Marks And Spencer Car Insurance Details

Marks And Spencer Car Insurance Details

What Is Marks And Spencer Car Insurance?

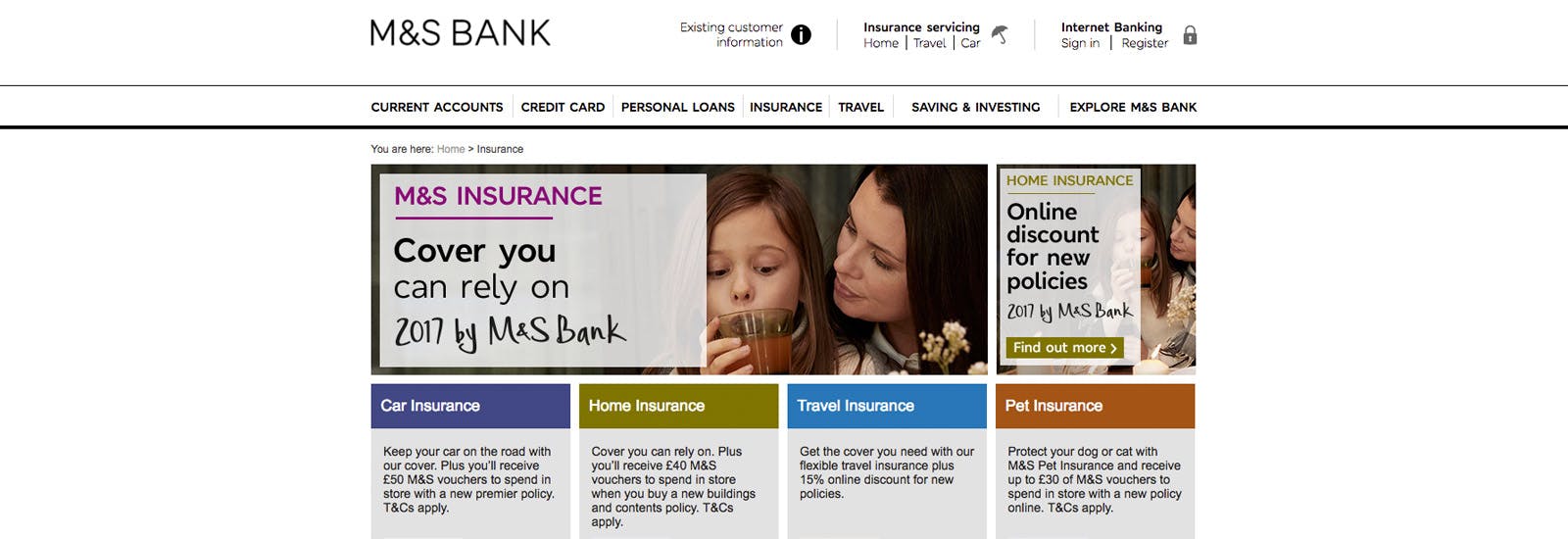

Marks And Spencer (M&S) Car Insurance is a comprehensive insurance policy that provides cover for a wide range of car-related costs. It is designed to protect drivers from the financial risks associated with owning a car. The policy covers the cost of repairs and replacements for damage caused to your car, as well as any medical expenses and legal fees that may arise from an accident. It also provides cover for third party damage and personal injury. Furthermore, the policy can be tailored to suit the individual needs of the policyholder, with optional extras such as breakdown cover, legal protection and courtesy car services.

What Does Marks And Spencer Car Insurance Cover?

M&S Car Insurance provides cover for a range of car-related costs, including: repair and replacement costs for damage caused to your car; medical costs and legal fees that result from an accident; third party damage and personal injury; breakdown cover; and legal protection. The policy also covers any personal belongings that are in the car at the time of an accident. In addition, the policy includes a courtesy car service, which allows the policyholder to use a replacement vehicle while their car is being repaired.

What Are The Benefits Of Marks And Spencer Car Insurance?

M&S Car Insurance offers a range of benefits, including: competitive rates; tailored policies to suit individual needs; comprehensive cover; and a range of optional extras. Furthermore, the policy offers a no-claims bonus, which rewards policyholders who do not make any claims during the policy term. Additionally, the policy includes a courtesy car service, which allows policyholders to use a replacement vehicle while their car is being repaired. Additionally, the policy provides cover for personal belongings in the car at the time of an accident.

What Are The Drawbacks Of Marks And Spencer Car Insurance?

M&S Car Insurance may not be the best option for everyone. The policy is only available to drivers over the age of 21 and those with a full UK driving license. Additionally, the policy does not cover any damage caused by uninsured drivers, which may be a drawback for some. Furthermore, the policy does not cover the cost of towing or recovery services, which may be an issue for those who drive long distances. Additionally, the policy does not cover the cost of modifications or upgrades to the car, which may be an issue for those who modify their vehicle.

How Do I Get The Best Deal On Marks And Spencer Car Insurance?

In order to get the best deal on M&S Car Insurance, it is important to shop around and compare policies from different providers. It is also important to consider the policy limits and excess amounts, as these can affect the overall cost of the policy. Additionally, it is important to consider any optional extras that may be included in the policy, such as breakdown cover and legal protection. Furthermore, it is advisable to take advantage of any discounts that may be available, such as no-claims bonuses and multi-car discounts.

Conclusion

Marks And Spencer Car Insurance provides comprehensive cover for a range of car-related costs, including repair and replacement costs, medical expenses and legal fees. The policy can be tailored to suit the individual needs of the policyholder, with optional extras such as breakdown cover and legal protection. Furthermore, the policy offers a no-claims bonus and a courtesy car service. In order to get the best deal on M&S Car Insurance, it is important to shop around and compare policies from different providers. It is also important to consider the policy limits and excess amounts, as well as any optional extras that may be included in the policy.

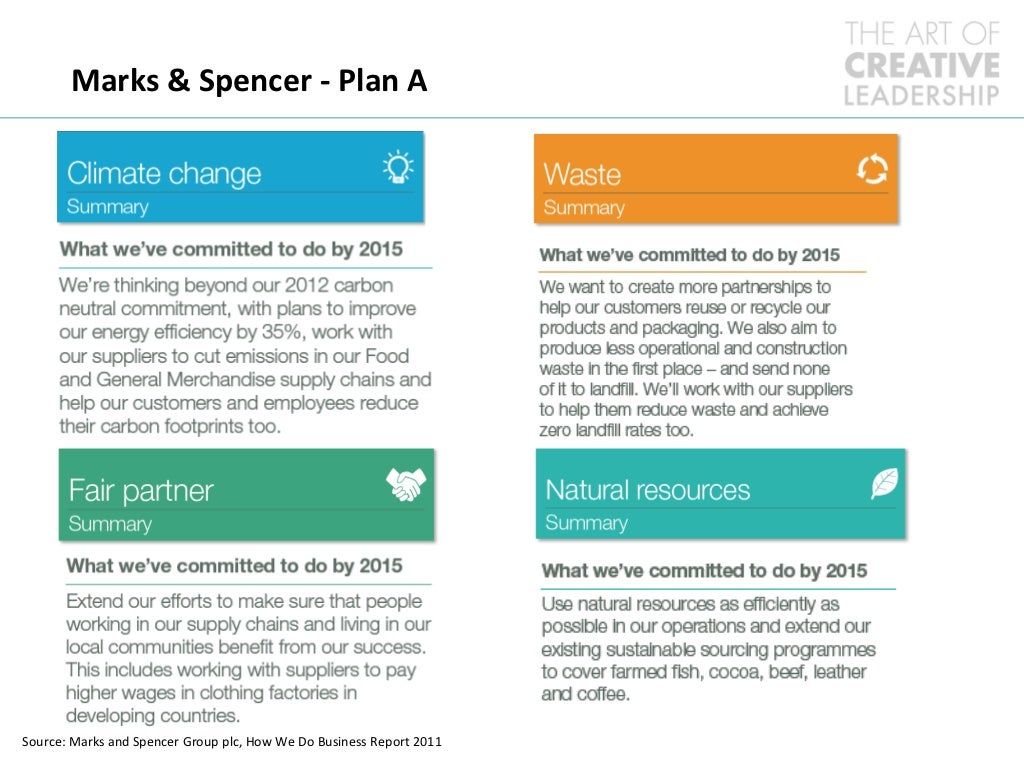

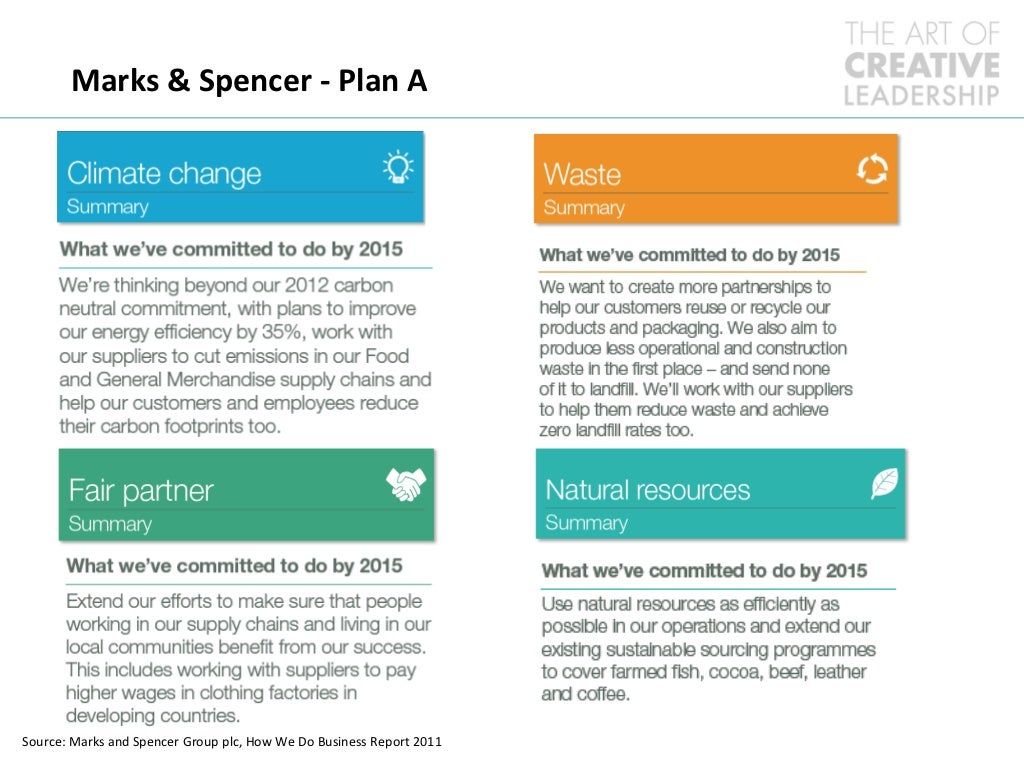

Marks & Spencer - Plan

What are the best car insurance companies? | carwow

33 jobs at risk as Marks & Spencer announces plans to close

Marks & Spencer expected to set out post-coronavirus future