Long Term Care Insurance Cost Aarp

Long Term Care Insurance Cost Aarp: The Basics

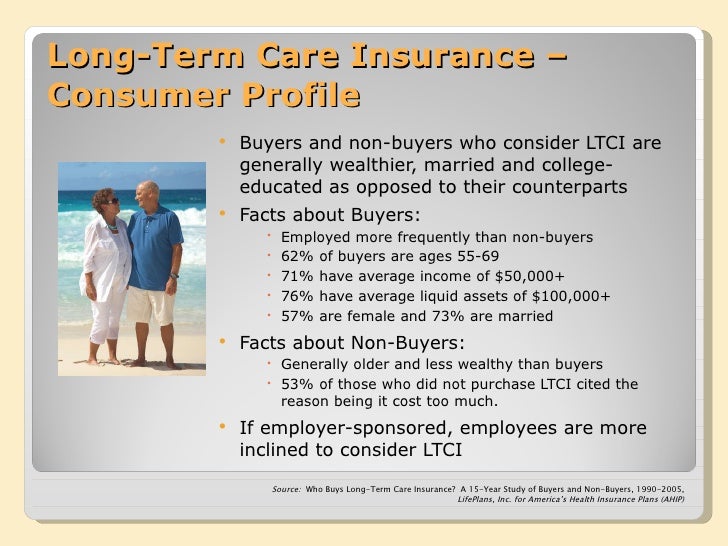

Long term care insurance is an important option for people to consider, especially if they are in the age range where they are prone to needing more medical assistance in the later stages of life. AARP is a well-known organization that provides a variety of services and products to help individuals and families prepare for the future. One of those products is long term care insurance, which can help defray the costs associated with long term care, such as nursing home stays, home health care, and assisted living. In this article, we will discuss the basics of long term care insurance cost AARP.

Long Term Care Insurance Cost AARP and What It Covers

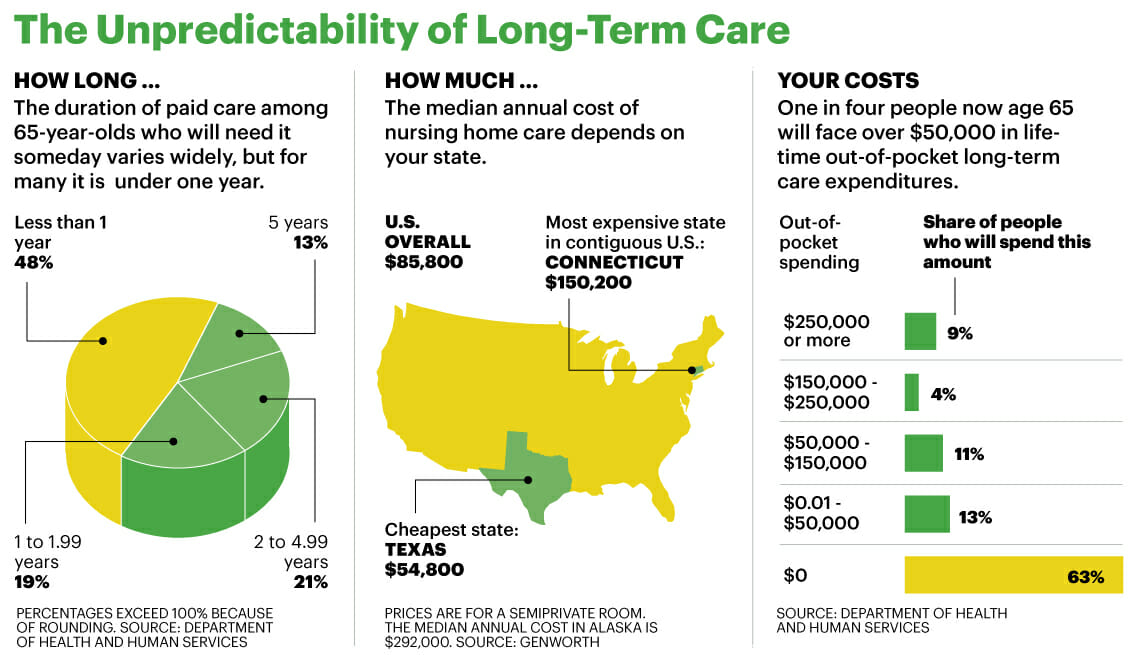

Long term care insurance cost AARP provides coverage for a variety of long term care situations, including nursing home stays and home health care. It also covers assisted living and day care services, as well as home and community-based services. The premiums for long term care insurance cost AARP vary greatly depending on the type of coverage chosen, the age of the person, and the level of coverage desired. Generally, the younger a person is when they purchase a policy, the lower the premiums will be.

What Does the Long Term Care Insurance Cost AARP Cover?

Long term care insurance cost AARP covers a variety of services, including nursing home care, home health care, and assisted living. It also covers home and community-based services, such as adult day care, home health aides, and home health aides. Additionally, it covers certain types of home modifications, such as grab bars, wheelchair ramps, and stair lifts. The level of coverage and the type of services covered depend on the policy chosen.

What Are the Benefits of Long Term Care Insurance Cost AARP?

One of the main benefits of long term care insurance cost AARP is the peace of mind it provides. Knowing that you have coverage in place can help you to relax and enjoy your retirement years. Additionally, long term care insurance cost AARP can help protect your retirement savings, as it can help to defray the costs of long term care. This can help you to maintain a higher level of financial security in retirement.

How Can I Get Long Term Care Insurance Cost AARP?

Long term care insurance cost AARP is available through AARP and can be purchased online or through a local agent. Before purchasing a policy, it is important to shop around and compare the different policies available in order to find the best coverage for your needs. Additionally, it is important to read the fine print of any policy you are considering to ensure that you understand the coverage and what is excluded.

Conclusion

Long term care insurance cost AARP can be a great way to protect your retirement savings and provide peace of mind. It is important to shop around and compare different policies in order to find the best coverage for your needs. Additionally, it is important to read the fine print of any policy you are considering to ensure that you understand the coverage and what is excluded. With the right policy, long term care insurance cost AARP can be a great way to protect your financial security in retirement.

Long term care insurance cost aarp - insurance

Cost of Long Term Care | Buffer Benefits

Aarp long term care insurance - insurance

AARP Long Term Care Insurance – Insurance Buzz #Classic #Car #House #

Long Term Care Insurance