Liability Vs Full Coverage Car Insurance

What is the Difference Between Liability and Full Coverage Car Insurance?

When it comes to auto insurance, two of the most common policies are liability coverage and full coverage. Although they are both important and necessary, they are very different. Before selecting a policy, it’s important to understand the differences between these two policies.

What Is Liability Insurance?

Liability insurance is a type of car insurance that covers any damage or injuries that you may cause to others during an accident. This type of insurance covers medical bills and property damage if you are found to be at fault for an accident. It is a legal requirement in most states, so it’s important to have. Liability coverage typically only covers damage and injury to the other party. It does not cover your own medical bills or vehicle repairs.

What is Full Coverage Auto Insurance?

Full coverage auto insurance is a type of insurance that covers your car and provides additional protection beyond liability coverage. It typically includes comprehensive and collision coverage, which covers damage to your vehicle from fire, theft, vandalism, and other causes. It also covers medical bills, rental car fees, and other costs associated with an accident. Full coverage is not a legal requirement, but it is recommended for those who are looking for a more comprehensive level of protection.

What Are the Benefits of Liability Insurance?

The main benefit of liability insurance is that it is the most affordable type of car insurance. It meets the legal requirement for insurance, so it is often the best option for those on a tight budget. It also provides protection if you are found to be at fault in an accident. This means that you won’t be responsible for paying any damages or medical bills out of pocket.

What Are the Benefits of Full Coverage Car Insurance?

Full coverage auto insurance provides additional protection beyond what liability coverage offers. It can cover any damages to your own vehicle, as well as medical bills. It can also cover rental car fees, towing fees, and other costs associated with an accident. This type of insurance is more expensive than liability coverage, but it offers more comprehensive protection.

Which Type of Insurance Is Right for You?

When deciding between liability and full coverage auto insurance, it’s important to consider your budget, your vehicle, and the level of protection you need. Liability insurance is the most affordable option, but it does not provide protection for your own vehicle or medical bills. Full coverage is more expensive, but it offers a more comprehensive level of protection. Ultimately, it’s up to you to decide which type of policy is right for you.

Page for individual images - QuoteInspector.com

Liability vs. Full Coverage Car Insurance: Key Differences

Auto Liability Insurance - What It Is and How to Buy

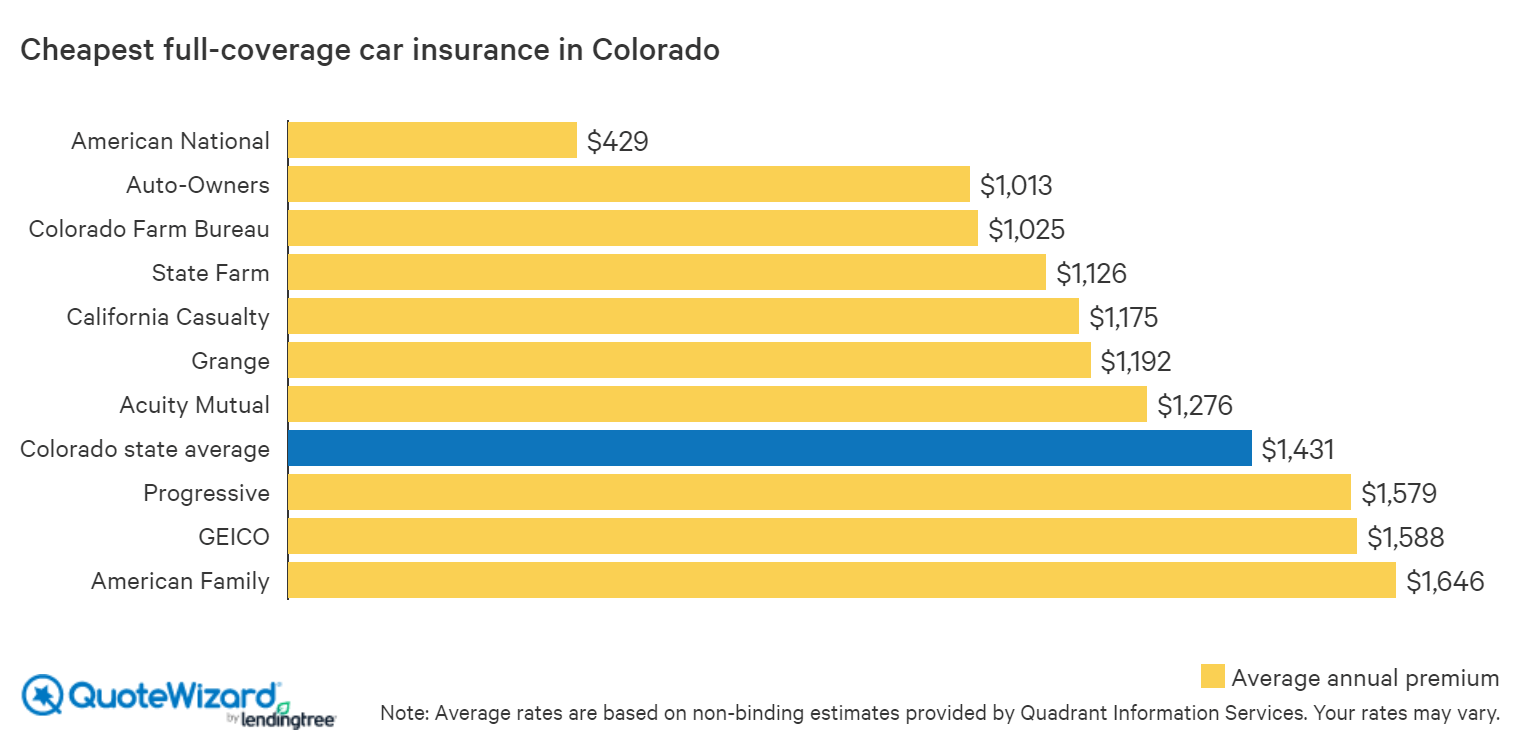

What Is The Average Price Of Full Coverage Car Insurance

does auto liability insurance cover my passengers - VEKTOR TOKTOK