Insurance Estimate For New Car

Everything You Need To Know About Insurance Estimate For A New Car

The Basics of Insurance Estimate for New Car

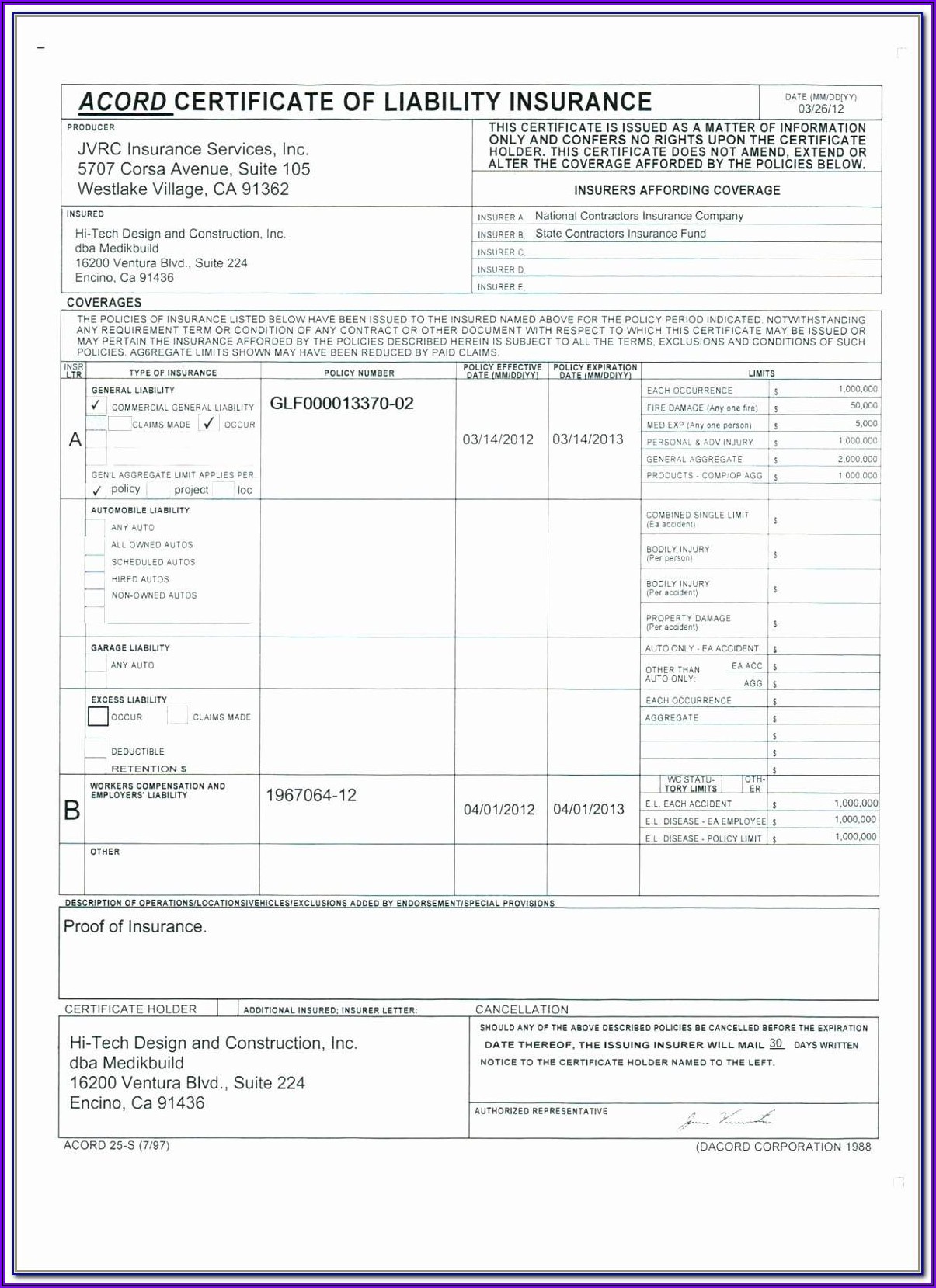

When purchasing a new car, there is a lot to consider. One critical factor that should not be overlooked is insurance. Before buying a new car, it’s important to get an insurance estimate so that you know the cost of coverage and can budget accordingly. To get an accurate insurance estimate, it’s important to have all of the necessary information about the car and the driver.

The cost of insurance depends on several factors, such as the make and model of the car, its age, the driver’s age, and the driver’s driving record. Additionally, insurers consider the driver’s credit history and residence location when determining the cost of coverage. Insurance rates also vary by state and by insurer, so it’s important to shop around to get the best deal.

Getting an Insurance Estimate Before Buying a New Car

It’s wise to get an insurance estimate before you purchase a new car. You can contact your existing insurer for a quote or shop around for other insurers. When getting a quote, you’ll need to provide information about the car, such as the make and model, and information about the driver, such as their age and driving record. It’s also important to provide accurate contact information so the insurer can get in touch with you if necessary. If you’re in the process of purchasing a car, you can provide the vehicle identification number (VIN) and other details about the car.

Once you have an estimate, you can decide if the cost of insurance is within your budget. It’s important to remember that the cost of insurance is only one factor to consider when buying a car. You should also consider the cost of the car itself, as well as any other expenses associated with owning a car, such as registration, taxes and maintenance.

Other Factors That May Affect Insurance Costs

When getting an insurance estimate, it’s important to consider all of the factors that may affect the cost of coverage. For example, in some states, insurers offer discounts for drivers who are over the age of 55. Additionally, some insurers offer discounts for safe drivers, so it’s important to maintain a clean driving record.

Insurers also offer discounts for certain vehicle safety features, such as airbags, anti-lock brakes and other safety features. Additionally, some insurers offer discounts for taking a defensive driving course or a driver education course. It’s important to ask your insurer about these discounts and be sure to mention any safety features that the car you’re considering has.

Getting the Best Rate for Your New Car Insurance

It’s important to shop around to get the best rate for your new car insurance. You should contact several insurers to get quotes and compare rates. Additionally, you should also consider any discounts that may be available. Be sure to ask questions, such as what the deductible is, what the coverage limits are, and if there are any additional fees associated with the coverage.

Finally, be sure to read the policy to make sure that you understand the terms and conditions of the coverage. In some cases, insurers may require that you take certain steps to keep your coverage current, such as having the car inspected or taking a defensive driving course. Understanding the terms and conditions of your policy can help you make sure that your coverage remains up-to-date and that you won’t be caught off guard if you need to make a claim.

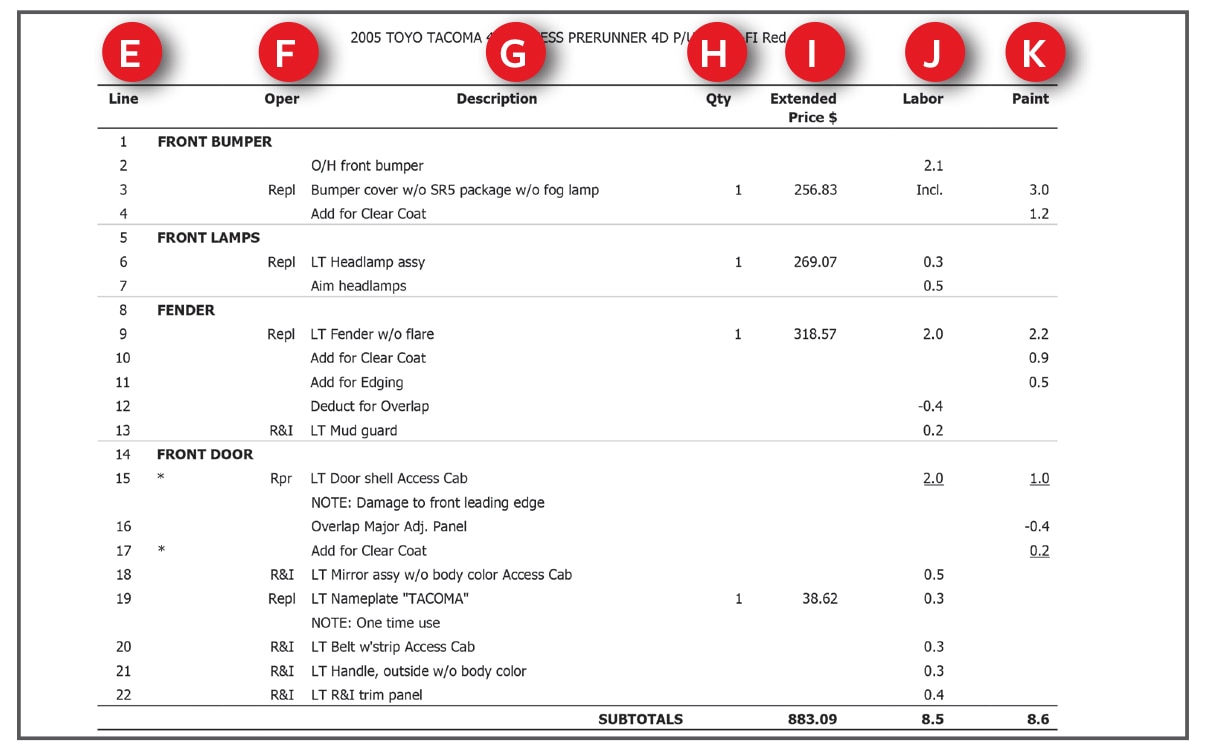

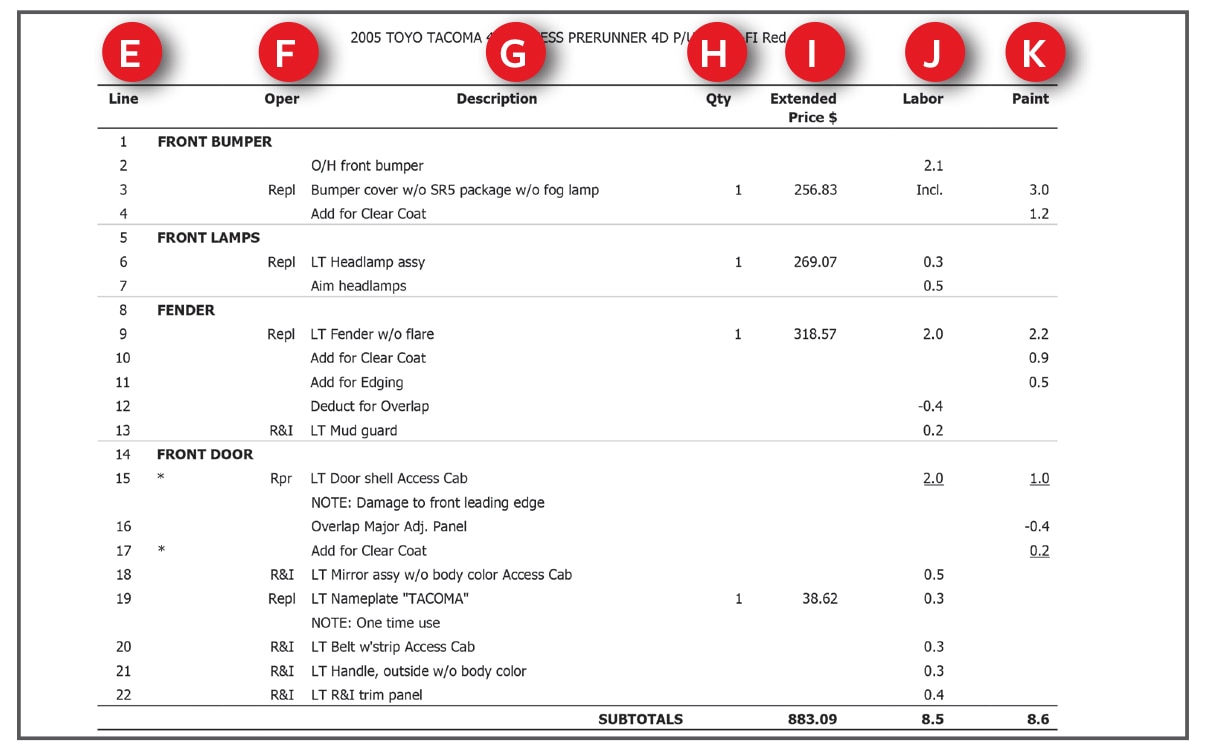

Understanding Auto Estimates | Travelers Insurance

Understanding Auto Estimates | Travelers Insurance

Pin by Hurul comiccostum on comiccostum | Auto insurance quotes

Progressive Auto Insurance Quotes Form. QuotesGram

Car Insurance Quote Form Template - Template 2 : Resume Examples #