Cooperative Car Insurance Cancellation Fee

Guide to Cooperative Car Insurance Cancellation Fee

What is a Car Insurance Cancellation Fee?

A car insurance cancellation fee is a charge incurred when you choose to cancel your car insurance policy before the end of the term. The fee is usually a percentage of your total premium. Depending on the insurer, the fee can range from 50% to 100% of the total premium. In some cases, you may be allowed to cancel your policy without paying a fee. However, the cancellation fee will still apply if you cancel your policy early. In addition, some insurers may charge an administrative fee to cover the cost of processing the cancellation.

Cooperative Car Insurance Cancellation Fee

Cooperative car insurance is an insurance policy offered by the Cooperative Insurance Society. It is a type of multi-car insurance policy that covers all the vehicles in your household. The policy includes a cancellation fee that is a percentage of the total premium. Depending on the insurer, the fee can range from 50% to 100% of the total premium. If you decide to cancel your policy before the end of the term, the cancellation fee will be applied.

How to Avoid Paying a Car Insurance Cancellation Fee

If you need to cancel your car insurance policy, there are a few ways to avoid paying the cancellation fee. The first is to switch to another insurer that does not charge a cancellation fee. However, you should be aware that you may still have to pay any outstanding premiums before cancelling the policy. Additionally, if you switch to another insurer, you may also have to pay any additional fees associated with the new policy, such as the cost of any additional cover.

When Can I Cancel My Car Insurance Policy?

You can usually cancel your car insurance policy at any time. However, if you cancel your policy before the end of the term, you will be charged a cancellation fee. The fee will be a percentage of the total premium. If you have paid for the full term of your policy, you may be able to receive a refund for any unused premiums, minus any cancellation fees. It is important to read your policy documents carefully to understand your rights when it comes to cancelling your policy.

Do I Have to Pay a Cancellation Fee if I Switch Insurers?

No, you do not have to pay a cancellation fee if you switch to another insurer. However, you may still have to pay any outstanding premiums before cancelling the policy. Additionally, you may also have to pay any additional fees associated with the new policy. It is important to compare the policies of different insurers to ensure you are getting the best deal.

Conclusion

A car insurance cancellation fee is a charge incurred when you choose to cancel your car insurance policy before the end of the term. Depending on the insurer, the fee can range from 50% to 100% of the total premium. If you need to cancel your policy, there are a few ways to avoid paying the cancellation fee. You can usually cancel your policy at any time, but if you cancel before the end of the term, you will be charged a cancellation fee. Additionally, you may also have to pay any additional fees associated with the new policy.

What is the cancellation fee for Progressive auto insurance if I

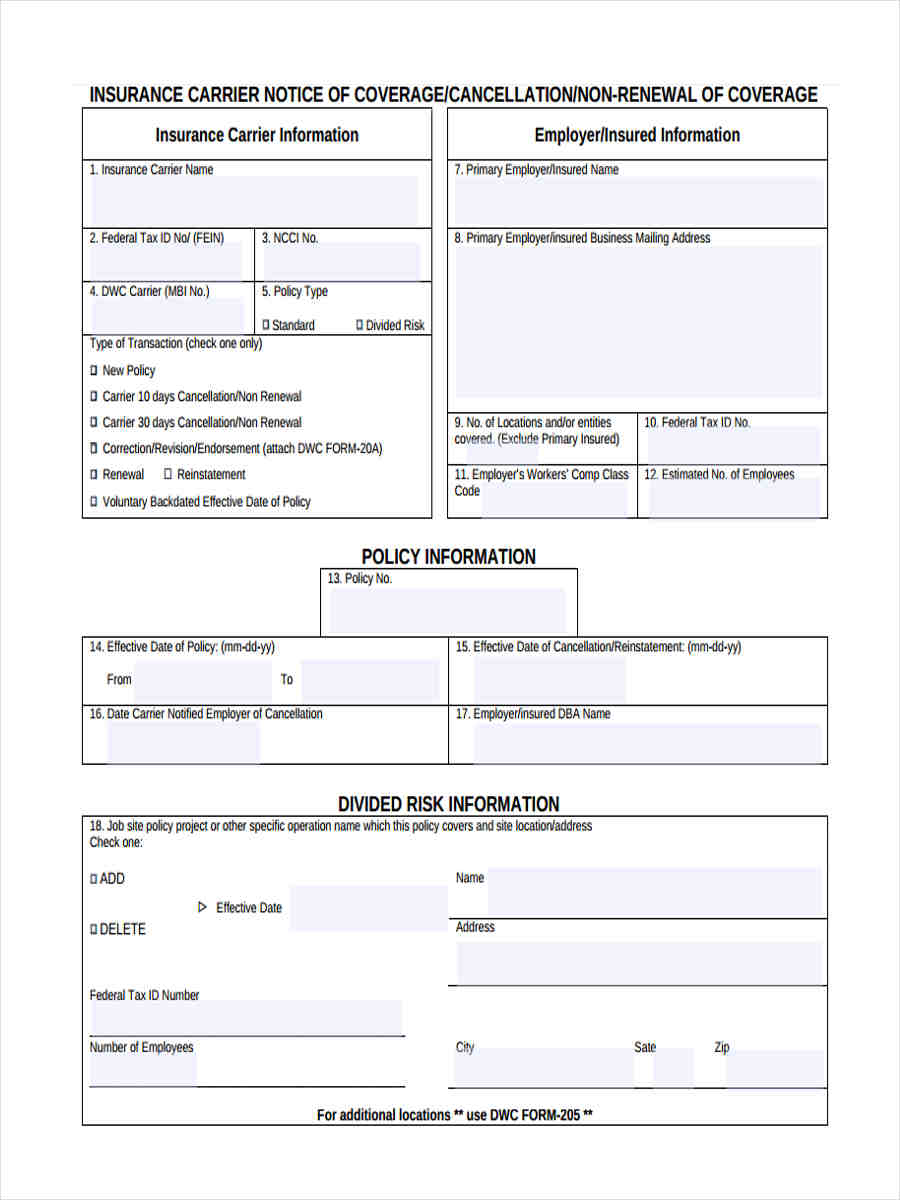

FREE 8+ Sample Notice of Cancellation Forms in MS Word | PDF

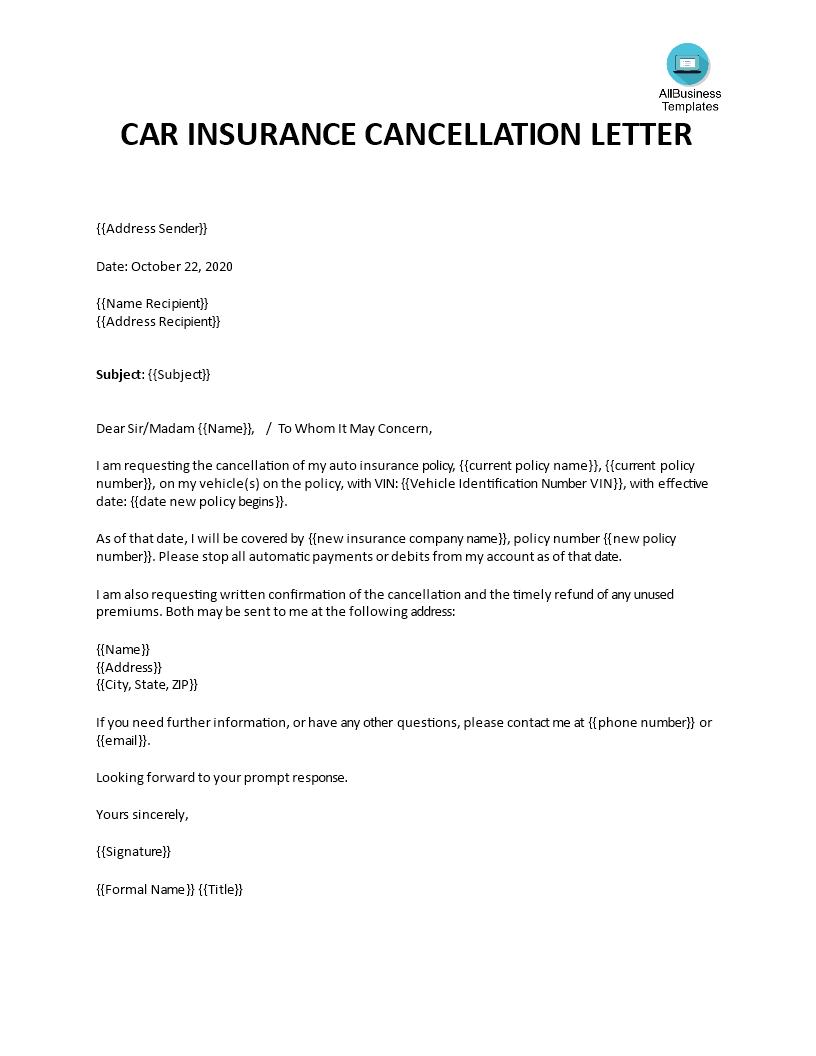

Car Insurance Cancellation Letter | Templates at allbusinesstemplates.com

Our cancellation policy | Car hire, Car rental, Policies

Cancellation Letter Template - 5+ Free Word, PDF Documents Download