Cheapest Full Coverage Auto Insurance Texas

Cheapest Full Coverage Auto Insurance in Texas

What is Full Coverage Auto Insurance?

Full coverage auto insurance is an insurance policy that combines both liability and physical damage coverage for a vehicle. It provides a wide range of protection for both the insured driver and others. Liability coverage pays for damages and injuries that the insured driver causes to others in an auto accident. Physical damage coverage pays for damages to the insured driver’s vehicle from a variety of sources, including theft, vandalism, natural disasters, and collisions. Full coverage auto insurance is essential for drivers who want to be prepared for the unexpected and protect their assets.

Why Do You Need Full Coverage Auto Insurance in Texas?

Full coverage auto insurance is required by law in Texas. It provides the driver with essential protection from the financial costs of an auto accident. Without full coverage auto insurance, the driver would be personally responsible for any damages or medical costs incurred in an auto accident. Additionally, Texas state law requires that each driver carry at least $30,000 in liability coverage and $25,000 in uninsured/underinsured motorist coverage. Without these coverages, the driver would not be in compliance with the law.

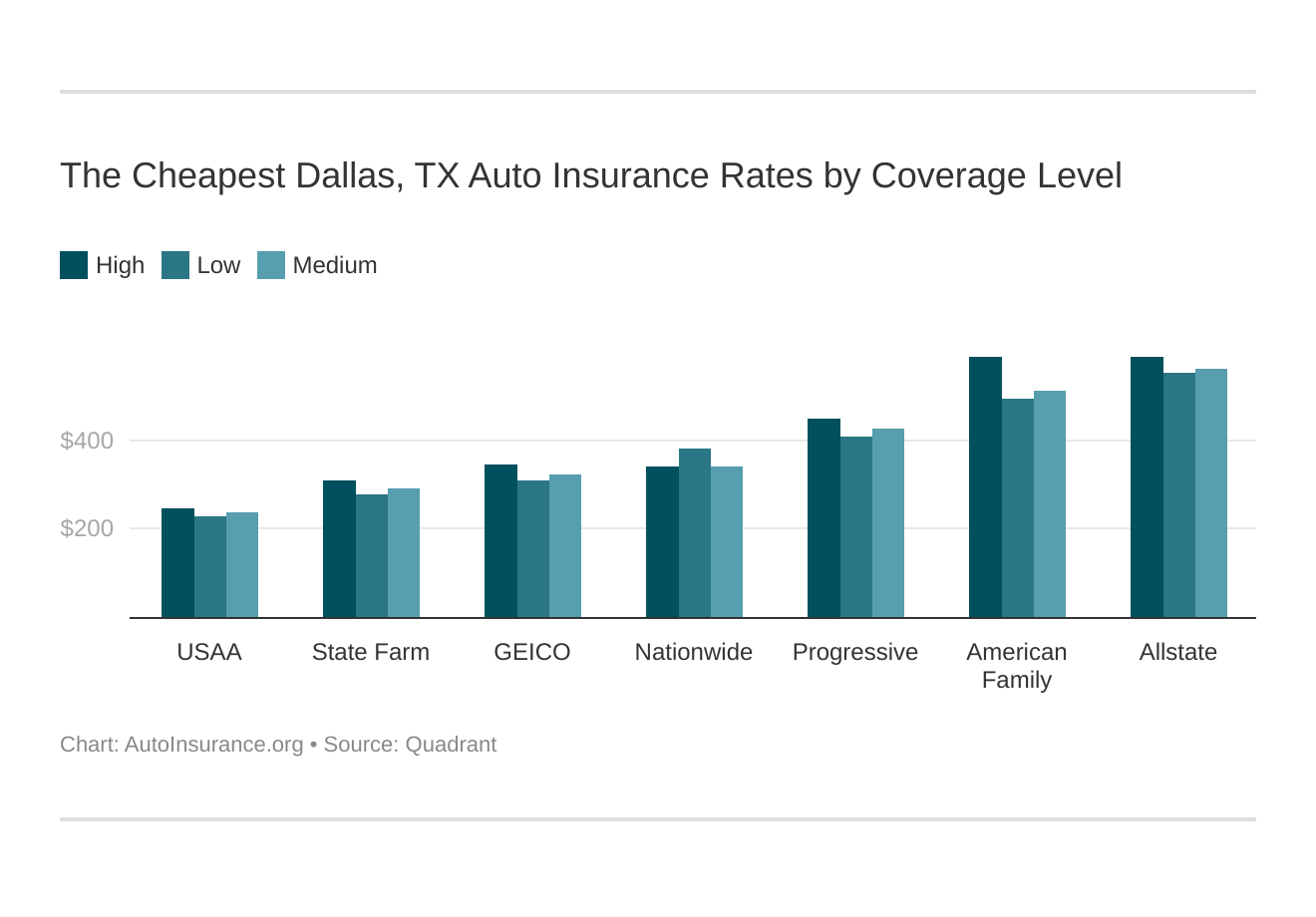

Finding the Cheapest Full Coverage Auto Insurance in Texas

The best way to find the cheapest full coverage auto insurance in Texas is to shop around and compare rates from different insurance companies. There are several factors that can affect the cost of a policy, such as the driver’s age, driving record, vehicle type, and location. Additionally, there are discounts available for certain types of drivers, such as those who have completed a defensive driving course, or those who have a good credit score. It is important to compare multiple policies and make sure you are getting the best coverage for the lowest cost.

Common Discounts for Full Coverage Auto Insurance in Texas

There are several different discounts available to drivers who purchase full coverage auto insurance in Texas. These include discounts for having a good driving record, completing a defensive driving course, having multiple vehicles on the policy, and having a good credit score. Additionally, some companies may offer discounts to drivers who are members of certain organizations, such as a credit union or alumni association. It is important to ask each insurance company about the discounts they offer in order to get the best deal.

Tips for Getting the Cheapest Full Coverage Auto Insurance in Texas

When looking for the cheapest full coverage auto insurance in Texas, it is important to shop around and compare rates from different companies. Additionally, it is important to ask about any discounts that may be available. Finally, it is important to make sure the policy meets the minimum requirements set forth by the state of Texas. By doing all of these things, drivers can find the best coverage at the lowest price.

Conclusion

Full coverage auto insurance is essential in Texas, and drivers should make sure they have the right coverage in place. The best way to find the cheapest full coverage auto insurance in Texas is to shop around and compare rates from different companies. Additionally, it is important to ask about any discounts that may be available. By doing all of these things, drivers can find the best coverage at the lowest price.

PPT - Texas Cheapest Car Insurance PowerPoint Presentation - ID:3863638

35+ Minimum Full Coverage Auto Insurance Texas - Hutomo Sungkar

Who Has the Cheapest Auto Insurance Quotes in Texas?

Cheap Auto Insurance Texas Online : Pin di Best Auto Insurance in Texas

Best Full Coverage Insurance Price – Insurance Auto Information