Cheap Full Coverage Car Insurance For New Drivers

Thursday, July 25, 2024

Edit

Cheap Full Coverage Car Insurance For New Drivers

What is Full Coverage Car Insurance?

Car insurance is a type of policy that provides financial protection against physical damage and/or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Full coverage car insurance is a type of insurance policy that provides coverage for both bodily injury and liability, as well as damage to the vehicle itself. It is the most comprehensive type of policy available and is typically more expensive than other types of car insurance. It includes collision coverage, comprehensive coverage, and liability coverage. Collision coverage covers the cost of repairs or replacement of the insured vehicle if it is damaged in a collision with another vehicle or object. Comprehensive coverage protects against damage or loss of the insured vehicle from events other than a collision, such as theft or fire. Liability coverage pays for legal expenses and damages to the other party if the insured driver is found at fault in an accident.

Why is Full Coverage Insurance Important?

Full coverage car insurance is an important type of policy for any driver to have. It provides the most comprehensive protection against damage, theft, and liability that can occur when driving. It is particularly important for new drivers, as they are typically more likely to be involved in an accident and may not have the financial means to cover the costs of repairs or medical bills if the accident is their fault. Additionally, full coverage insurance policies typically include uninsured motorist coverage, which helps to protect a driver in the event they are hit by an uninsured or underinsured motorist.

How Can I Find Cheap Full Coverage Insurance?

Finding cheap full coverage car insurance can be a challenge, particularly for new drivers. Insurance companies assess the risk of insuring a driver based on factors such as age, driving record, and type of vehicle. New drivers are often considered a higher risk, and thus their premiums are typically higher than those of experienced drivers. However, there are several ways to save money on full coverage insurance for new drivers.

One of the best ways to save money on car insurance is to take advantage of available discounts. Some insurance companies offer discounts for bundling policies, taking a defensive driving course, or having more than one vehicle on the policy. Additionally, many insurers offer discounts for good driving records and for having a good credit score. New drivers should also shop around and compare quotes from different insurers in order to find the best rate.

What Other Factors Should I Consider?

In addition to shopping around for the best rates, there are several other factors to consider when purchasing full coverage car insurance. It is important to read the policy thoroughly and make sure that the coverage is sufficient to protect the driver and their vehicle. Some policies may include additional coverage such as towing and roadside assistance, rental car coverage, and uninsured motorist coverage. Additionally, new drivers should consider the deductibles associated with the policy. Higher deductibles can help to lower the premium, but will also mean that more money will have to be paid out of pocket in the event of an accident.

Conclusion

Full coverage car insurance is an important type of policy for any driver to have, particularly for new drivers. It provides the most comprehensive protection against damage, theft, and liability that can occur when driving. Shopping around for the best rates and taking advantage of available discounts can help to lower the cost of full coverage car insurance for new drivers. Additionally, it is important to read the policy thoroughly and make sure that the coverage is sufficient to protect the driver and their vehicle.

PPT - Cheap Full Coverage Car Insurance For All People PowerPoint

Car Insurance Florida For New Drivers - IAE NEWS SITE

How to Get Cheap Full Coverage Auto Insurance Plan by Helvin Hills - Issuu

Full coverage car insurance in california by Promax Insurance Agency

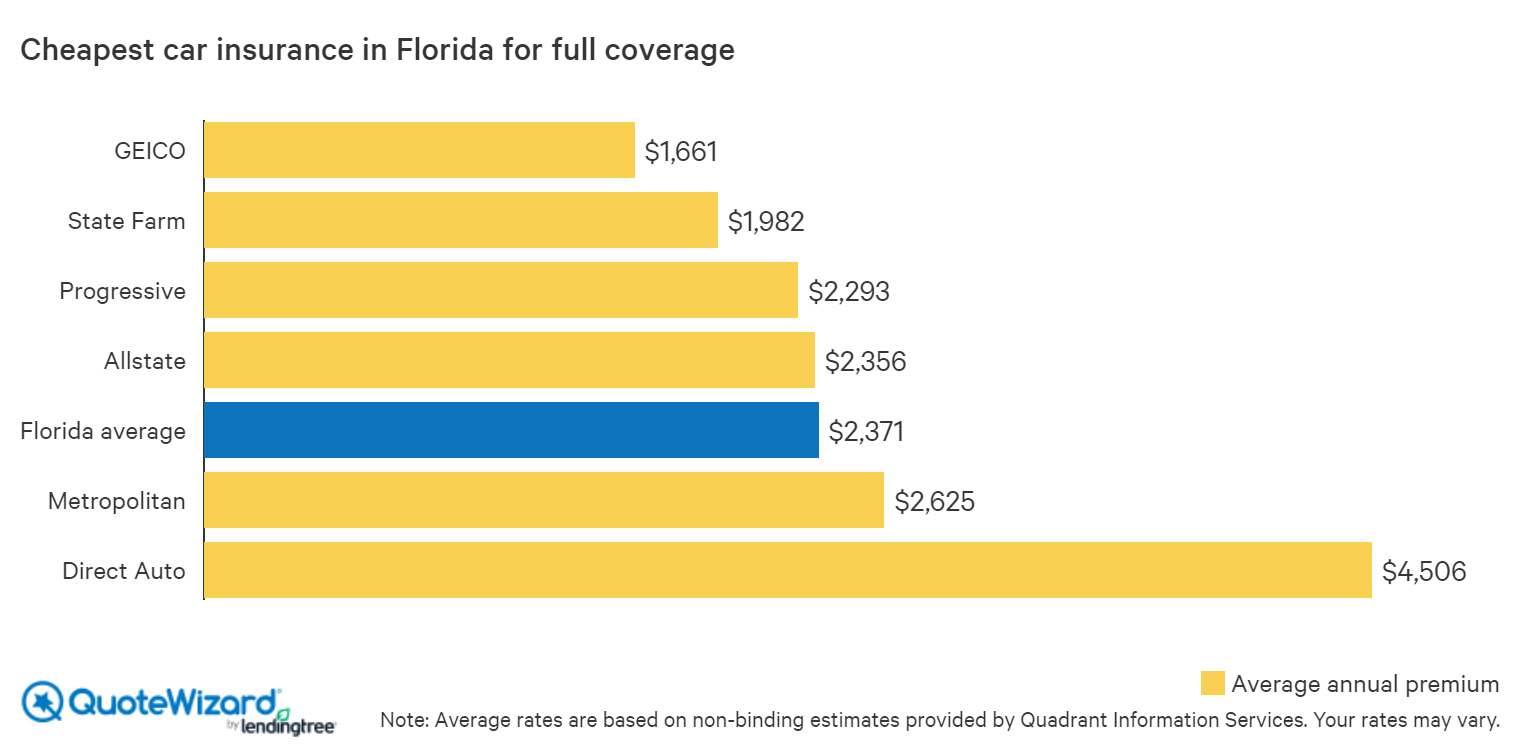

Cheap Car Insurance in Florida (2020) | QuoteWizard