Auto Third Party Insurance Price

The Rising Cost of Auto Third Party Insurance

When it comes to car insurance, third party insurance is the most common type of coverage purchased by drivers. This type of insurance coverage pays for any damage to another person’s property, or for any bodily injury or death to another person, caused by the policyholder’s vehicle. Third party insurance also pays for any legal costs resulting from a claim made against the policyholder. Unfortunately, over the past few years, the cost of third party auto insurance has been steadily increasing, leaving many drivers wondering why.

The Reasons Behind the Price Increase

There are a few reasons why the cost of third party auto insurance has been steadily rising. The first reason is that the cost of medical care and repairs is increasing. As medical and repair costs go up, so do the costs associated with third party auto insurance. Higher repair costs are due to the increase in the cost of parts, labor, and other expenses associated with car repairs. Additionally, medical costs have also been on the rise due to the cost of medical treatments, medications, and the cost of medical supplies and equipment.

Another reason for the rising cost of third party auto insurance is the increasing number of accidents. With more people on the roads, and more cars on the road, the odds of an accident occurring are greater than ever before. As a result, insurance companies have to charge more for third party auto insurance in order to cover the increased costs associated with claims and repairs.

How to Reduce Your Auto Insurance Costs

Fortunately, there are several ways that you can reduce the cost of your auto insurance. The first way is to shop around and compare rates from different insurance companies. By comparing rates, you may be able to find a better rate than what you are currently paying. Additionally, you can also look into discount programs offered by your insurance company. Some companies offer discounts for drivers who are over a certain age, have a certain type of car, or who have a good driving record.

You can also reduce your auto insurance costs by increasing your deductible. A higher deductible means that you will have to pay more out of pocket if you are involved in an accident, but it can also lead to a lower monthly insurance premium. Lastly, if you are a safe driver, you may qualify for a safe driver discount. This type of discount can help you save money on your auto insurance.

Conclusion

The cost of third party auto insurance is on the rise, and there are several reasons behind it. However, there are ways to reduce your auto insurance costs, such as shopping around and comparing rates, looking into discount programs, increasing your deductible, and qualifying for a safe driver discount. By taking advantage of these options, you can help keep your auto insurance costs down.

Third Party Insurance Price Uae - akuapprovesing

Third Party Property Car Insurance | iSelect

Car owners to pay Rs 24,000 for third party insurance

What is Third Party Insurance Policy and its Protection

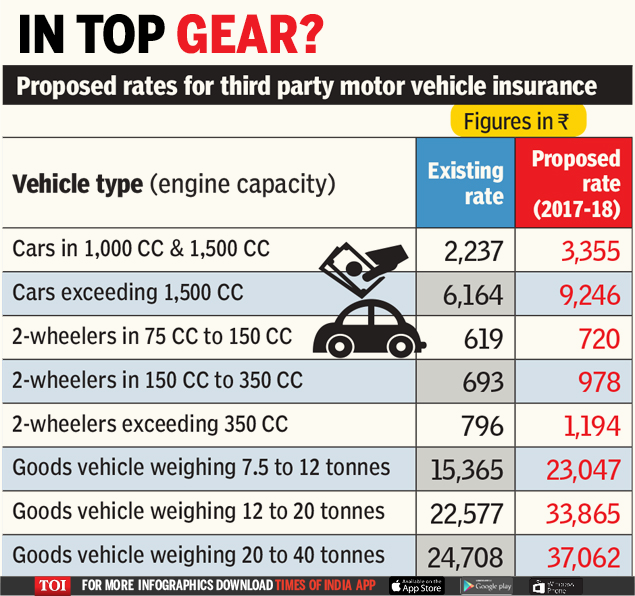

Infographic: Third party insurance to become more pricey | India News