Auto Insurance By The Miles Driven

Sunday, July 14, 2024

Edit

Auto Insurance By The Miles Driven: All You Need To Know

What is Pay-Per-Mile Auto Insurance?

Pay-Per-Mile Auto Insurance is an insurance product designed to benefit drivers who don’t drive much. The idea is that you only pay for the miles you drive. You simply download an app or plug a device into your car to track your miles. Then, you’ll be charged a base rate plus a per-mile rate for the miles you drive. This type of insurance is ideal for people who only use their car occasionally, such as city dwellers who rely on public transportation most of the time.

How Does Pay-Per-Mile Auto Insurance Work?

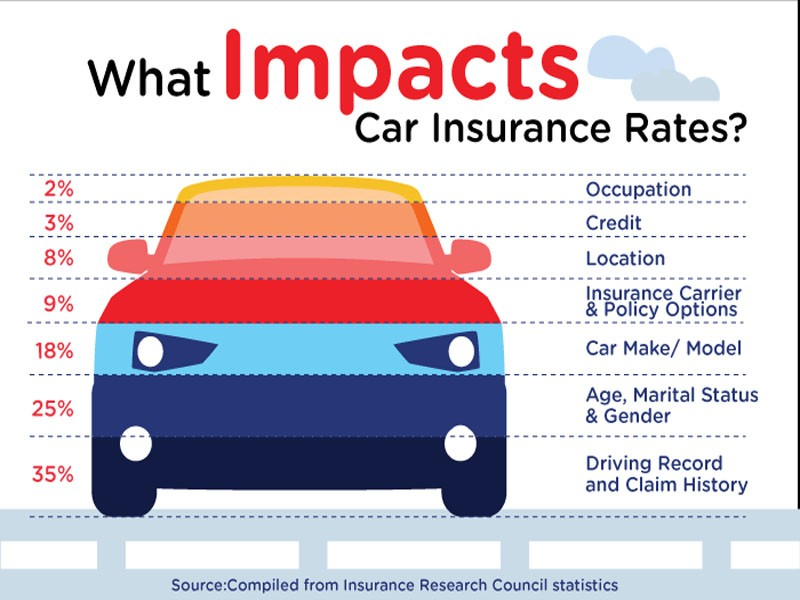

Pay-Per-Mile Auto Insurance works by charging a base rate plus a per-mile rate for the miles you drive. The base rate is a fixed rate that you pay regardless of how many miles you drive. The per-mile rate is the rate you pay for each mile you drive. This rate depends on your driving habits and the type of car you drive. You can usually get a lower rate if you drive an older car or a car with a good safety record. Depending on the insurer, you may also be able to get a lower rate if you drive fewer miles.

What Are The Benefits Of Pay-Per-Mile Auto Insurance?

The primary benefit of Pay-Per-Mile Auto Insurance is that it can save you money. If you only drive a few miles each month, you’ll pay less for your insurance than if you had a traditional policy. This is especially true if you live in an area where car insurance rates are high. Additionally, this type of insurance can help you save on gas and wear and tear on your car.

Another benefit of Pay-Per-Mile Auto Insurance is that it encourages safe driving. Since you’ll be paying for each mile you drive, you’ll be more likely to avoid reckless driving and other risky behaviors. This can help you avoid getting tickets or being involved in accidents.

What Are The Drawbacks Of Pay-Per-Mile Auto Insurance?

The biggest drawback of Pay-Per-Mile Auto Insurance is that it’s not available everywhere. Most insurance companies only offer this type of coverage in select states. Additionally, it may not be available for all types of vehicles.

Another potential drawback is that you may have to pay for the device or app used to track your miles. Depending on the insurer, this could be an added expense. Additionally, you may have to pay a fee if you want to change your coverage or cancel your policy.

Should You Get Pay-Per-Mile Auto Insurance?

Pay-Per-Mile Auto Insurance can be a great option for people who only drive occasionally. If you live in an area where car insurance rates are high, this could be a great way to save money. Additionally, it can help you save on gas and wear and tear on your car.

However, this type of insurance is not available everywhere and may not be available for all types of vehicles. Additionally, you may have to pay a fee if you want to change your coverage or cancel your policy. Ultimately, it’s up to you to decide if Pay-Per-Mile Auto Insurance is the right option for you.

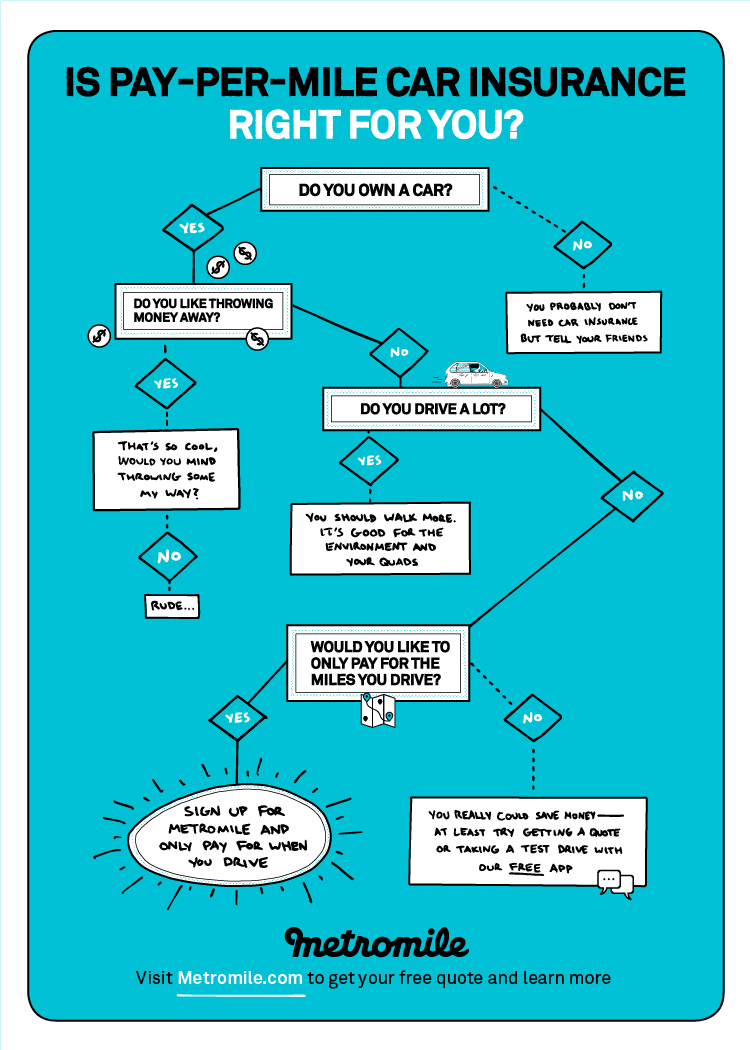

Quiz: Is Pay-per-mile Car Insurance Right for You?

Top 10 Auto Insurance Infographics

Top 10 Auto Insurance Infographics

Car Insurance Policy - All You Need to Know About It ~ General

How Car Insurance Can Increase Your Car’s Life - Odd Culture