What Does Car Insurance Cost On Turo

What Does Car Insurance Cost On Turo?

Are you looking for an alternative to traditional car rental services? Turo is an online car rental marketplace that allows private car owners to rent their vehicles to travelers. As a peer-to-peer car rental service, Turo provides a unique experience for travelers that is often cheaper and more flexible than traditional car rental companies. But what about car insurance? Does Turo provide car insurance coverage, and if so, how much does it cost?

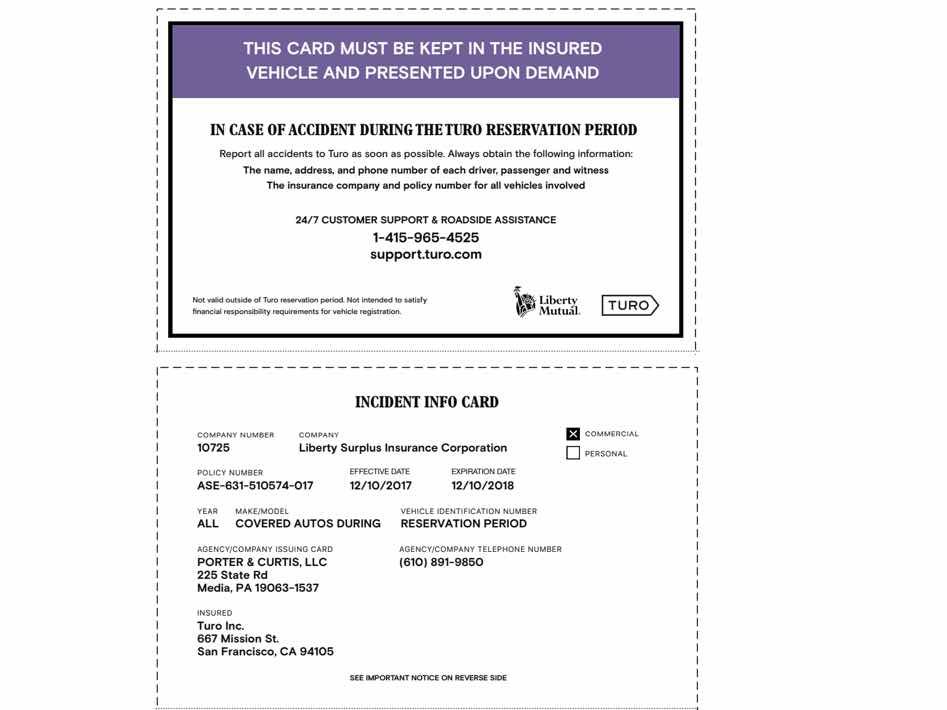

Turo's Insurance Coverage

Turo provides insurance coverage for all cars listed on its platform. The company offers two types of insurance coverage—basic and premium. Basic coverage includes a combination of liability and physical damage coverage, and is included in the price of the rental. However, it does not cover personal items left in the car, or any other losses or damages caused by the renter. Premium coverage includes all of the basic coverage, plus additional coverage for personal items left in the car, towing and roadside assistance, and loss of use.

Cost of Basic Coverage

The cost of basic coverage varies depending on the type of car being rented and the length of the rental. For example, a compact car rental for a week may cost as little as $10, while a luxury car rental for the same period of time may cost up to $40. The cost of basic coverage is always included in the price of the rental, so there is no need to purchase additional insurance.

Cost of Premium Coverage

Premium coverage is optional and can be purchased for an additional fee. The cost of premium coverage also varies depending on the type of car and the length of the rental. For example, a compact car rental for a week may cost as little as $20 for premium coverage, while a luxury car rental for the same period of time may cost up to $60. Premium coverage is optional, so you can decide whether or not you want to purchase it.

Benefits of Turo Insurance

The biggest benefit of Turo's insurance is that it provides peace of mind. Knowing that you are covered in the event of an accident can make the entire car rental experience more enjoyable. Additionally, Turo's insurance is often cheaper than what is offered by traditional car rental companies, so you can save money while still getting the coverage you need.

Conclusion

Turo is a great alternative to traditional car rental companies, offering a unique peer-to-peer experience that is often cheaper and more flexible. The company provides both basic and premium insurance coverage for all cars listed on its platform, with the cost of basic coverage included in the price of the rental. Premium coverage is optional and can be purchased for an additional fee. Turo's insurance provides peace of mind and is often cheaper than what is offered by traditional car rental companies, so you can save money while still getting the coverage you need.

Turo Review: How Renting Out Our Cars on Turo Turned Into a Free Tesla

I Don’t Have Car Insurance. What Do I Do When I Book a Car Share?

Pros and Cons of Turo Car Rental for Travellers – Sling Adventures

Reddit - Dive into anything

Everything You Need to Know About Using Turo - Part 2 - ECI Insurance