Sbi Motor Insurance Claim Form Pdf

SBI Motor Insurance Claim Form – A Comprehensive Guide

What is SBI Motor Insurance Claim Form?

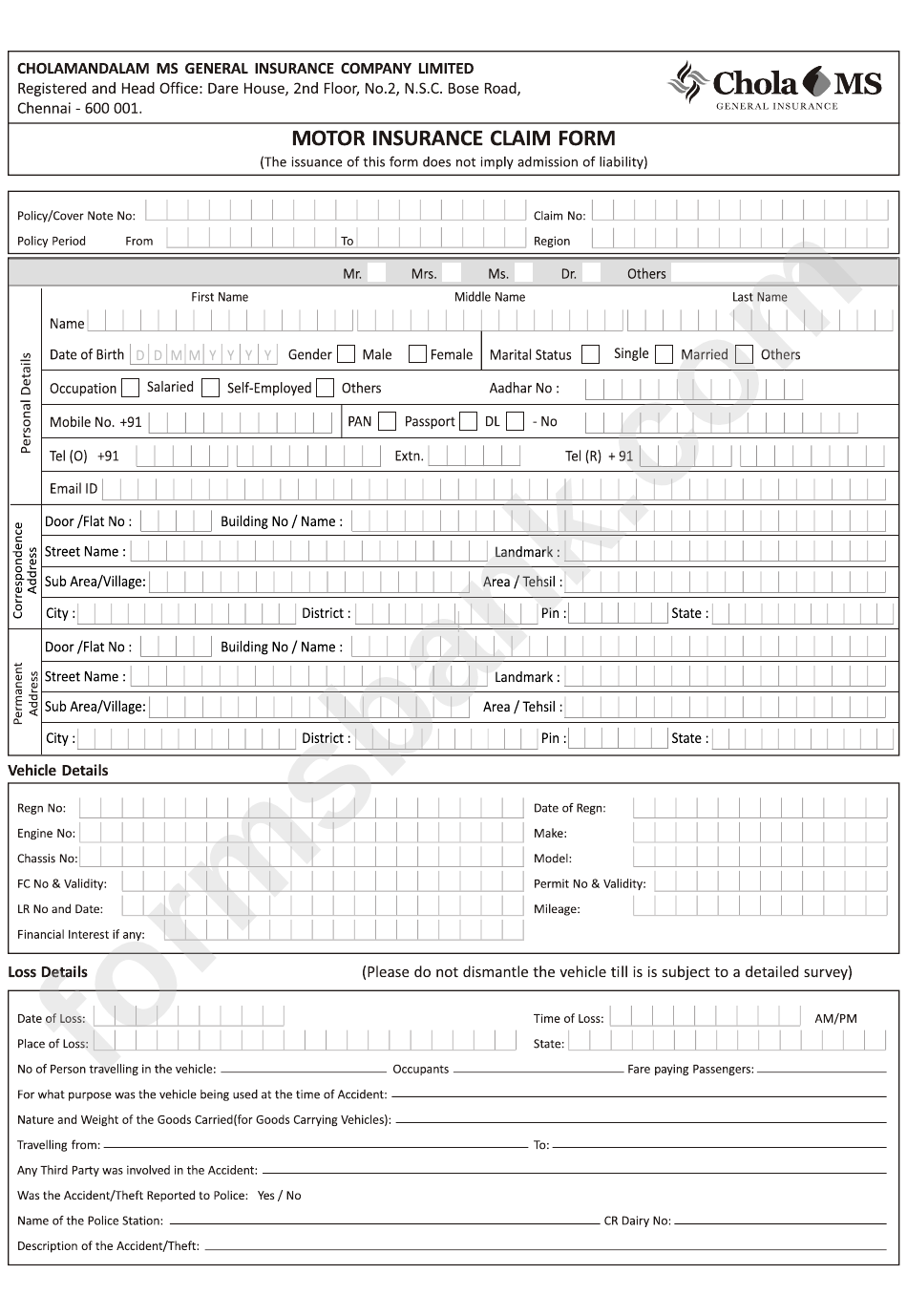

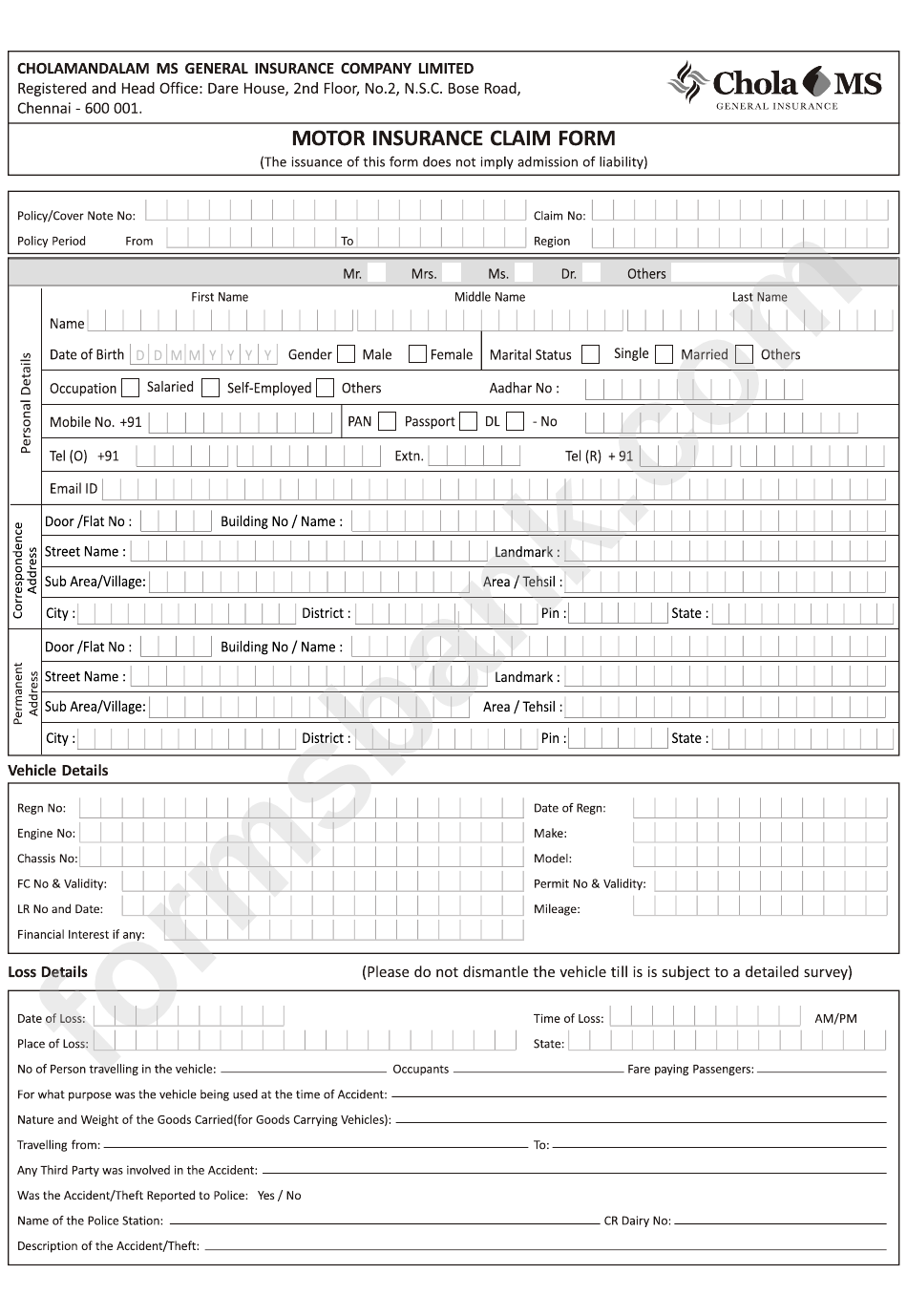

SBI motor insurance claim form is a comprehensive document which is used for filing an insurance claim in the event of any accident or damage to the insured vehicle. The form is typically filled out by the insured party, who provides details of the accident, the type of vehicle, the damage done and the estimate of the monetary value of the claim. The form also includes a list of documents that are required to be submitted along with it. These documents include the registration documents, photographs of the vehicle, a copy of the insurance policy, and any other relevant documents that are needed to substantiate the claim.

What Information is Needed to Fill Out the SBI Motor Insurance Claim Form?

In order to fill out the SBI motor insurance claim form, the insured party must provide the following information: the name of the insured party, the registration number of the vehicle, the date and time of the accident, the location of the accident, the type of damage incurred, the estimated cost of the repairs, and photographs of the vehicle. The insured party must also provide details of the policy, including the policy number, the cover period and the sum insured. In addition, information about any other drivers involved in the accident must also be provided.

What Documents Should Accompany the SBI Motor Insurance Claim Form?

The documents that should accompany the SBI motor insurance claim form include the registration documents, the original insurance policy, photographs of the vehicle, and any other relevant documents that are needed to substantiate the claim. The insured party must also provide a signed copy of the claim form, as well as an estimate of the monetary value of the claim.

What is the Procedure for Submitting the SBI Motor Insurance Claim Form?

Once the SBI motor insurance claim form is filled out and all the required documents are submitted, the insured party must submit the form to the insurance company. The insurance company will then review the form and all the documents and provide an estimate of the amount that the insured party is eligible to receive. The insurance company will then issue the payment to the insured party. Depending on the policy, the insured party may also be required to pay a deductible before receiving payment.

What are Some Tips for Filling Out the SBI Motor Insurance Claim Form?

When filling out the SBI motor insurance claim form, it is important to provide accurate information. The form should be filled out in its entirety and all the relevant documents should be submitted along with it. The insured party should also make sure to read the terms and conditions of the policy before submitting the form. Additionally, the insured party should contact the insurance company for any queries related to the claim form.

Conclusion

The SBI motor insurance claim form is an important document that must be filled out accurately and submitted along with all the required documents. The insured party should make sure to read the terms and conditions of the policy before submitting the form and contact the insurance company for any queries. By following these tips, the insured party can ensure that their claim is processed quickly and smoothly.

Sbi Car Insurance Claim Form

[PDF] PMFBY Claim Form SBI PDF Download – InstaPDF

![Sbi Motor Insurance Claim Form Pdf [PDF] PMFBY Claim Form SBI PDF Download – InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/pmfby-claim-form-sbi-775.jpg)

General Insurance Claim Form ~ designbyafi

[PDF] SBI Deceased Claim Form Affidavit PDF Download – InstaPDF

![Sbi Motor Insurance Claim Form Pdf [PDF] SBI Deceased Claim Form Affidavit PDF Download – InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/sbi-deceased-claim-form-affidavit-3085.jpg)

Sbi General Insurance Form Pdf - Fadia Arsadila 2022