Property Damage Liability Pays For

What Does Property Damage Liability Pay For?

Property damage liability is an important part of any auto insurance policy. It pays for repairs to other people’s property if you’re at fault in an accident. Your policy covers damage to other vehicles, buildings, fences, telephone poles, and other structures. It also covers the replacement of items such as mailboxes and street signs.

What is Covered?

Your property damage liability coverage helps pay for repairs to other people’s property if you’re responsible for an accident. It includes repairing or replacing the damaged property. The type of property covered by this coverage includes vehicles, buildings, fences, telephone poles, and other structures. It also pays for the replacement of items such as mailboxes and street signs.

Who Does Property Damage Liability Protect?

Property damage liability is designed to protect you, the policyholder. It can help protect you from financial losses if you cause damage to someone else’s property in an accident. In most states, it is required by law that you carry this coverage on your auto insurance policy. Even if you’re not legally required to carry it, it’s still a good idea to add it to your policy.

How Much Does Property Damage Liability Pay?

The amount of property damage liability coverage you need depends on the value of the property you’re driving. If you’re driving a luxury vehicle or an expensive car, you’ll need more coverage. Most states require you to carry a minimum amount of property damage liability coverage. Check with your insurance agent to find out how much coverage you need.

What is Not Covered by Property Damage Liability?

Property damage liability coverage does not pay for repairs to your own vehicle or property. It also does not cover any damage caused by intentional or criminal acts. Additionally, property damage liability coverage doesn’t usually pay for any damage caused by animals, such as deer or other wildlife. It’s important to understand what is and is not covered by your policy.

Property Damage Liability is an Important Part of Any Auto Insurance Policy

Property damage liability is an important part of any auto insurance policy. It pays for repairs to other people’s property if you’re at fault in an accident. It’s designed to protect you from financial losses if you cause damage to someone else’s property. Most states require you to carry a minimum amount of property damage liability coverage. Make sure you understand what is and is not covered by your policy so you’re prepared in case of an accident.

Definition Of Property Damage Auto Insurance - STAETI

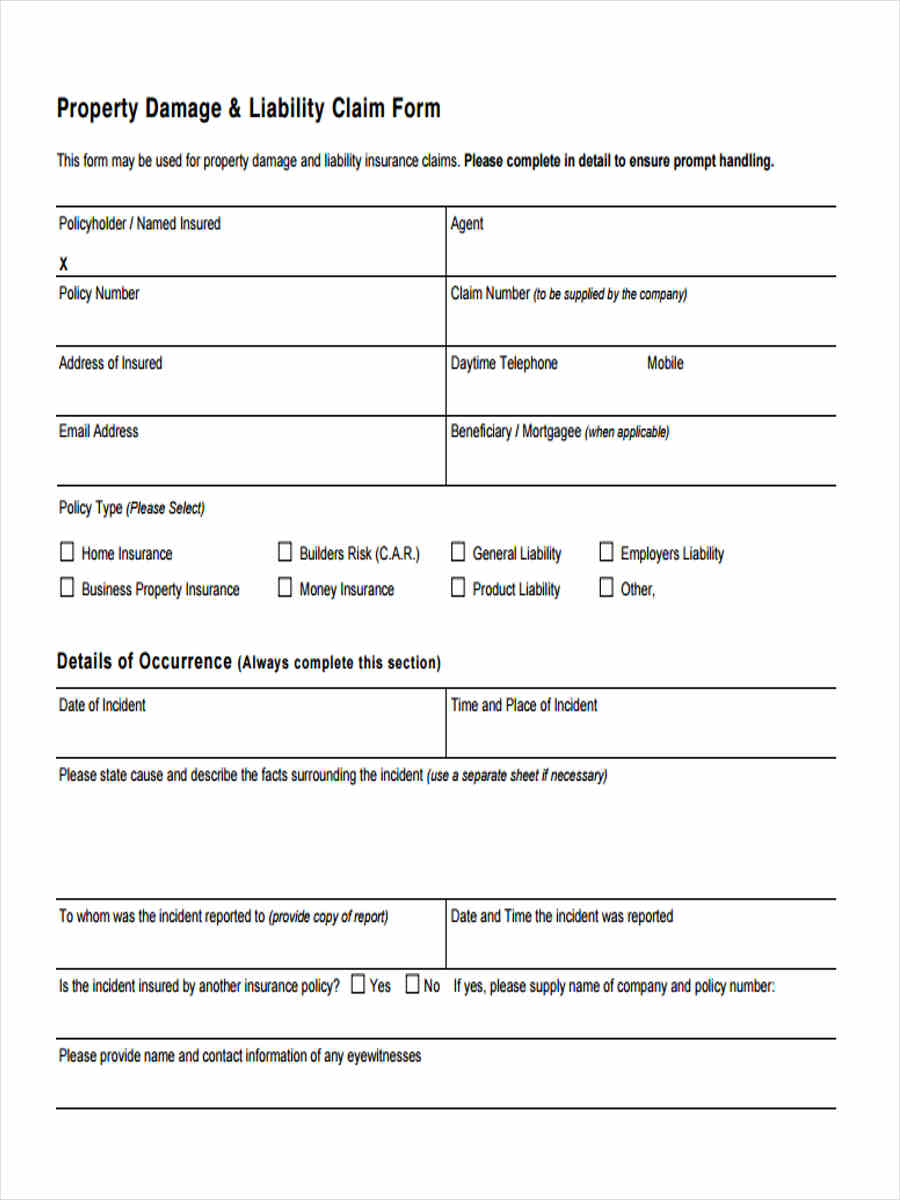

FREE 26+ Liability Forms in PDF | Ms Word | Excel

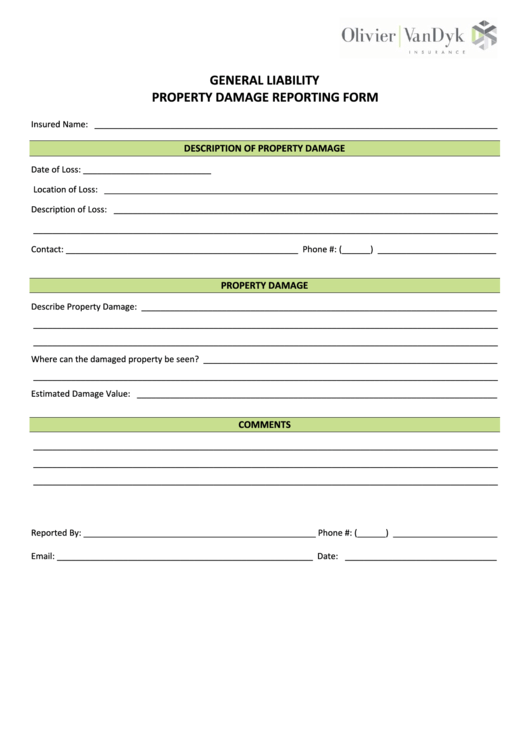

Top Property Damage Release Form Templates free to download in PDF format

FREE 9+ Sample Property Damage Release Forms in MS Word | PDF

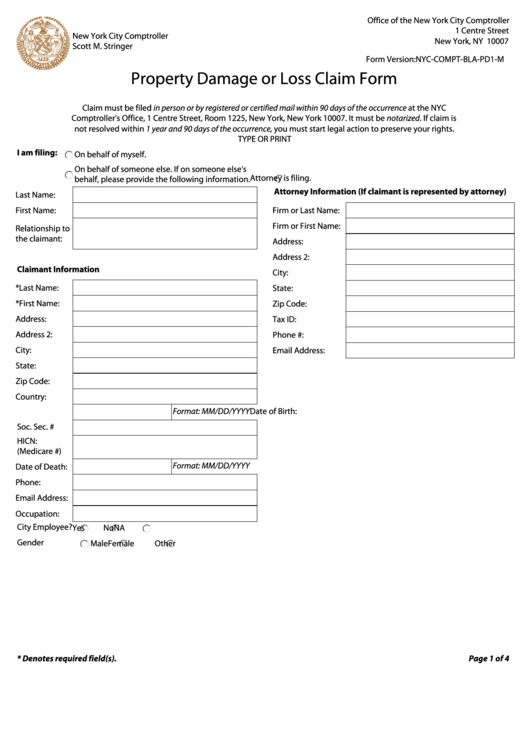

Fillable Property Damage Or Loss Claim Form - New York City printable