Lowest Price For Car Insurance

Lowest Price For Car Insurance

Finding the Right Car Insurance for You

Finding the right car insurance can be a difficult and confusing process. There are many different options available, and each one has its own set of benefits and drawbacks. It is important to find the right fit for your particular situation and budget. With so many different factors to consider, it can be hard to know where to start. The good news is that there are a few tips and tricks that can help you get the best deal on car insurance.

Comparison Shopping

One of the best ways to find the lowest price for car insurance is to do some comparison shopping. Take some time to research different companies and compare the rates they offer. This will allow you to find the best deal for your situation. Be sure to check out both local and national insurance companies, as well as any discounts they may offer. Don’t forget to check out online quotes as well, as these can often be cheaper than what you can find in person.

Know Your Coverage Needs

Before you start shopping around for car insurance, it is important to understand your coverage needs. Different types of insurance will offer different levels of protection, so it is important to know what you need before you start looking. This will help you narrow down your search and find the coverage that is right for you. Be sure to consider the type of car you drive, as some companies may offer discounts for certain makes and models.

Ask for Discounts

Many insurance companies offer discounts for a variety of things. From bundling policies to having good credit, there are lots of ways to save on car insurance. Be sure to ask about any discounts that may be available to you. You may be surprised at how much you can save by taking advantage of these discounts.

Choose the Right Deductible

The deductible is the amount of money that you have to pay out-of-pocket before your car insurance will kick in. Choosing the right deductible can have a big impact on the cost of your insurance. A higher deductible will result in lower premiums, but it also means that you will have to pay more out-of-pocket in the event of an accident. If you are a safe driver and rarely get into accidents, then a higher deductible may be a good choice. However, if you are more likely to get into accidents, then a lower deductible may be the better option.

Shop Around Regularly

It is important to shop around for car insurance regularly. Insurance companies are constantly changing their rates and policies, so it is important to keep up with the latest changes. Additionally, you may find that another company is offering a better deal than the one you are currently with. Shopping around regularly will ensure that you are always getting the best deal on car insurance.

Page for individual images - QuoteInspector.com

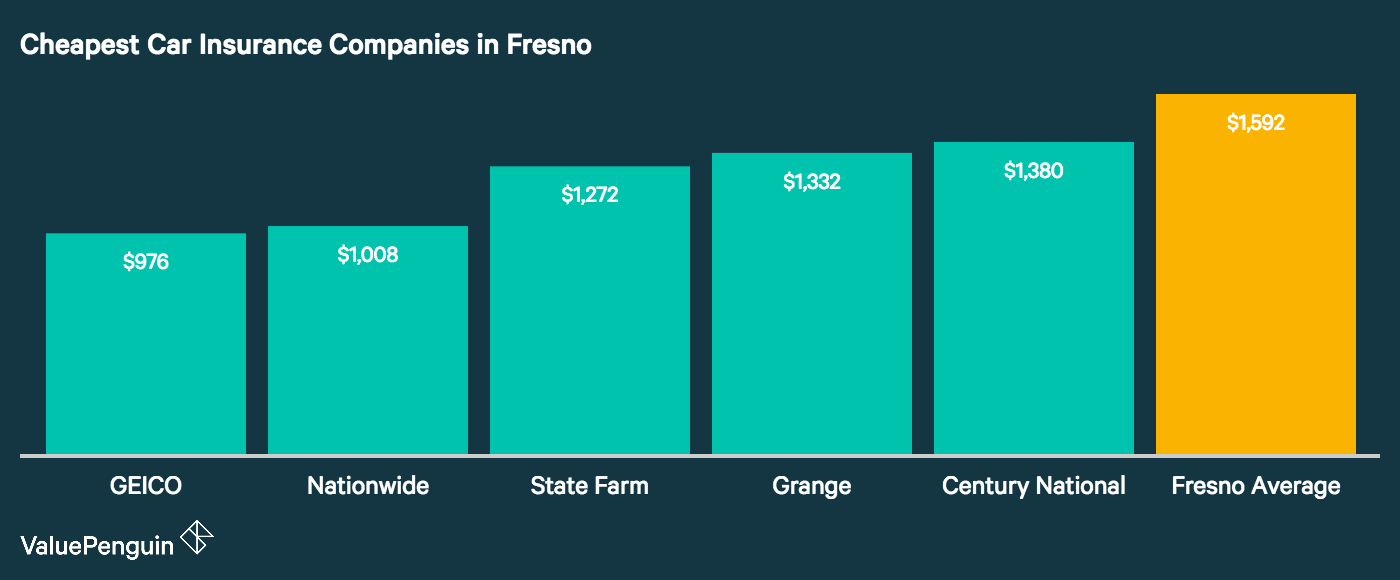

Who Has The Cheapest Auto Insurance Quotes in California? (2018

Page for individual images - QuoteInspector.com

Pin by Hurul comiccostum on comiccostum | Compare car insurance, Car