Geico Named Non Owner Policy

Geico Named Non Owner Policy

Introduction

Geico is one of the leading insurance companies in the United States. It is known for providing customers with comprehensive coverage options, from auto, renters, to life insurance. Geico recently announced a new policy called the Non Owner Policy. This policy is designed to provide coverage for those who do not own a vehicle, but may still need to drive for personal reasons.

What Is a Non Owner Policy?

A Non Owner Policy is a type of car insurance policy designed for people who do not have a car, but may need to drive for their own personal reasons. This policy covers the insured person in the event of an accident when they are driving a non-owned vehicle. The policy also provides coverage for rental cars, as well as borrowed or leased vehicles.

Benefits of Geico's Non Owner Policy

Geico's Non Owner Policy is designed with the customer in mind. The policy provides coverage for property damage and bodily injury, which is particularly attractive for those who do not own a vehicle. Additionally, the policy includes uninsured motorist coverage and personal injury protection. The policy also covers medical payments for the insured and any passengers in the event of an accident.

How to Get a Non Owner Policy from Geico

Getting a Non Owner Policy from Geico is fast and easy. All you need to do is contact a Geico representative and they will be able to help you get the coverage you need. You can also get a quote online, and then purchase the policy right away. The process is straightforward, and you can have the coverage you need in just minutes.

What is the Cost of a Non Owner Policy?

The cost of a Non Owner Policy from Geico will depend on a variety of factors, including the amount of coverage you choose and where you live. Geico offers competitive rates and discounts for eligible customers, so it is important to compare different policies to find the best coverage for your needs.

Conclusion

Geico's Non Owner Policy is a great option for those who do not own a vehicle but may still need to drive for personal reasons. The policy offers comprehensive coverage for property damage and personal injury, as well as uninsured motorist coverage and personal injury protection. While the cost of the policy will depend on the amount of coverage you choose and where you live, Geico offers competitive rates and discounts, so it is worth considering.

Geico non-owner car insurance - insurance

Geico Forms - Fill Out and Sign Printable PDF Template | signNow

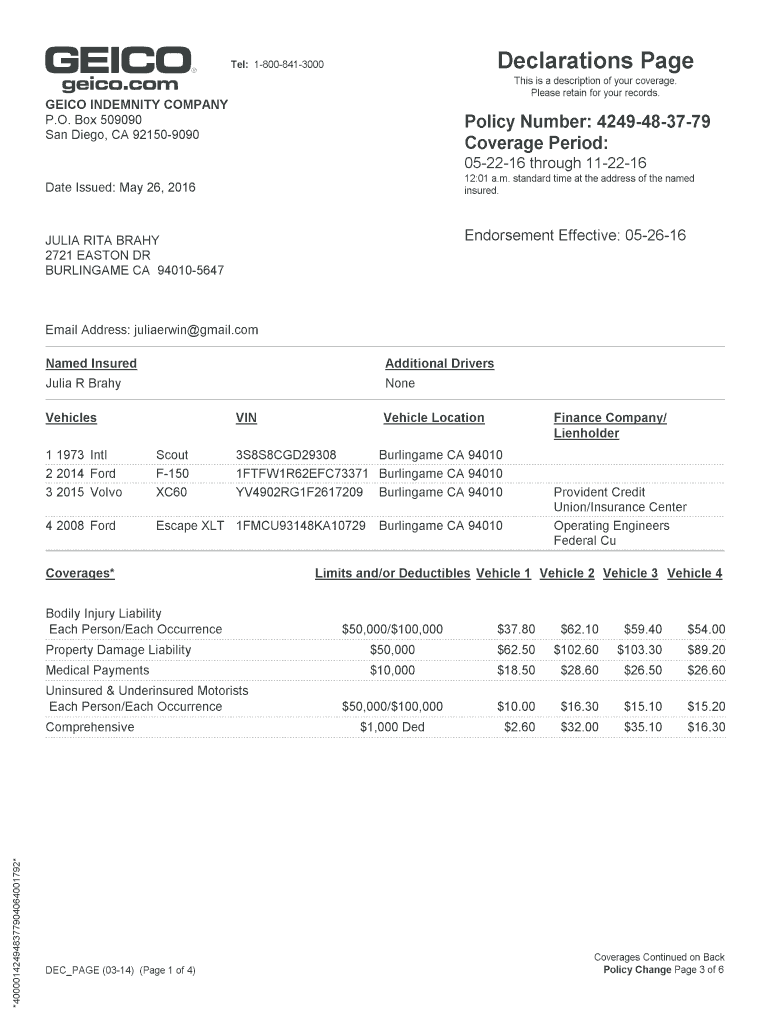

Declaration Page Geico 2020 - Fill and Sign Printable Template Online

Non Owner Car Insurance Geico Sr22 - Insurance Reference

Geico General Insurance Company Address - us.pricespin.net