Farmers Auto Insurance Quotes Georgia

Everything You Need to Know About Farmers Auto Insurance Quotes Georgia

Why Get Auto Insurance in Georgia?

Having auto insurance in the state of Georgia is a must, not just a good idea. It is a legal requirement that all drivers must have liability coverage in order to drive a vehicle that is registered in the state. This means that if an accident occurs, the insurance policy will pay for any damages to property or people, up to the limits of the policy. Without insurance, a driver can be held liable for any damages, which can be expensive. Additionally, uninsured drivers can face fines and suspension of their driver's license.

What Does Farmers Auto Insurance Quotes Georgia Cover?

When looking for auto insurance in Georgia, it is important to understand the different types of coverage available. The most common type of coverage is liability, which covers the cost of damages to another person or property in the event of an accident. Other types of coverage include collision and comprehensive, which cover damages to the insured's own vehicle; uninsured/underinsured motorist coverage, which covers the cost of injuries or property damage caused by an uninsured or underinsured driver; and personal injury protection, which covers medical expenses for the driver and passengers. Each of these coverages vary in cost and coverage amounts, so it is important to review each type in order to make an informed decision.

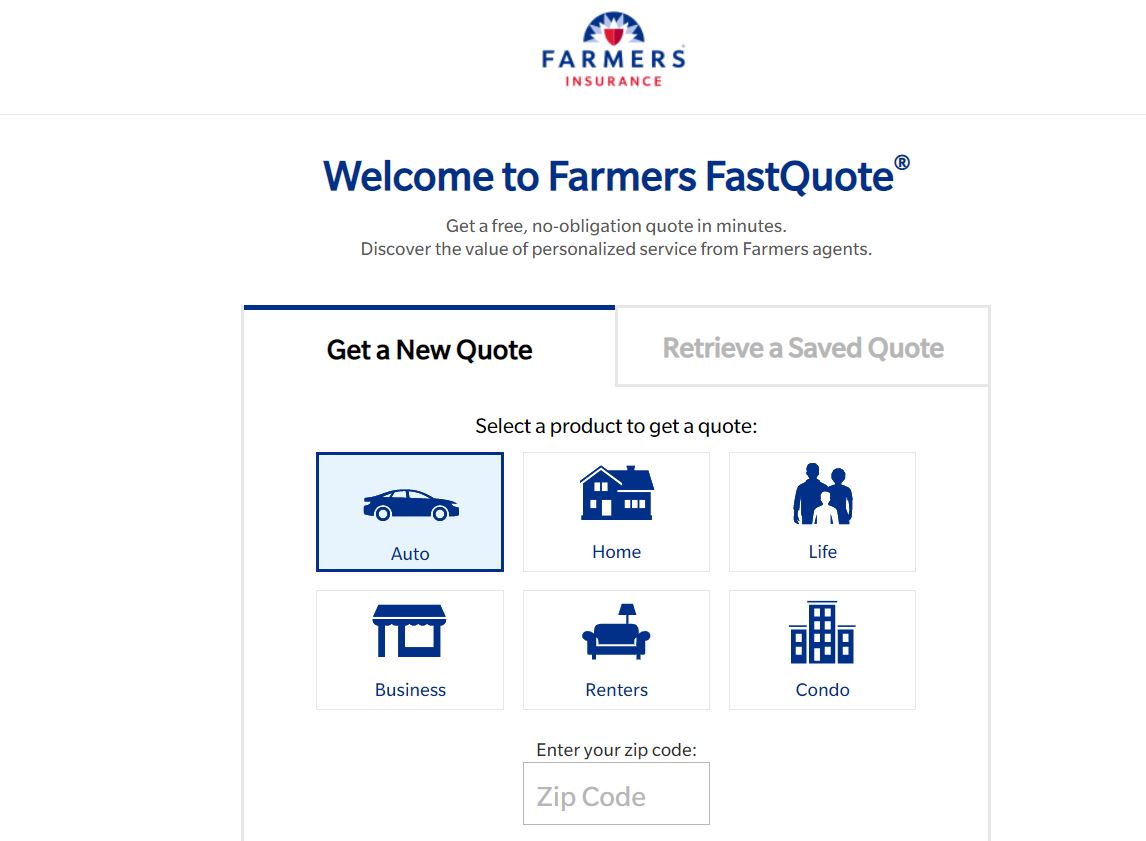

How to Get Farmers Auto Insurance Quotes Georgia?

Getting auto insurance quotes for Georgia is easy. The first step is to compare quotes from multiple insurance companies. Most companies offer online quotes, which can provide an estimate of the cost of a policy in minutes. Additionally, many companies offer discounts, such as multi-car, safe driver, and good student discounts, which can help reduce the cost of a policy. It is important to compare quotes from multiple companies in order to find the best coverage and the best price.

What Factors Impact Farmers Auto Insurance Quotes Georgia?

When getting auto insurance quotes for Georgia, it is important to understand the factors that can impact the cost of coverage. These factors include the type of vehicle being insured, the driver's age and driving history, the location of the vehicle, the vehicle's annual mileage, the driver's credit score, and the type and amount of coverage desired. Additionally, some companies may offer discounts for certain types of drivers, such as safe drivers, students, or members of certain organizations. It is important to understand these factors and how they can impact the cost of coverage.

Conclusion

Getting auto insurance quotes for Georgia is a vital part of owning a vehicle in the state. It is important to understand the different types of coverage available, as well as the factors that can impact the cost of coverage. Comparing quotes from multiple companies is the best way to find the right coverage at the best price. Additionally, understanding the discounts available can help reduce the cost of a policy. By taking the time to understand auto insurance in Georgia, drivers can ensure they have the right coverage at the right price.

Farmers Auto Insurance Review (Complete Guide for Drivers)

Everything You Need to Know About Farmers Insurance - Quote.com®

Farmers Auto Insurance Review | Top Ten Reviews

Farmers Auto Insurance Review (2021) | AutoInsurance.org

17 Best images about Farmers Insurance on Pinterest | Life insurance