Electric Vehicle Insurance Policy Wording

Electric Vehicle Insurance Policy Wording

What Is Electric Vehicle Insurance?

Electric vehicle insurance is a specific type of auto insurance policy designed to cover the unique risks associated with owning and operating an electric vehicle. This type of insurance typically provides coverage for damage to the vehicle, theft, personal injury, and liability. Additionally, electric vehicle insurance policies may cover the cost of repairs to the vehicle and its components, as well as the cost of replacing the vehicle if it is damaged beyond repair. Electric vehicle insurance policies can also be tailored to meet the individual needs of the policyholder.

What Is Covered By Electric Vehicle Insurance?

Electric vehicle insurance policies typically provide coverage for the following: physical damage to the vehicle, theft, personal injury, and liability. Additionally, some policies may provide coverage for repairs to the vehicle and its components, as well as the cost of replacing the vehicle if it is damaged beyond repair. Electric vehicle insurance policies can also be customized to meet the individual needs of the policyholder.

Who Is Eligible For Electric Vehicle Insurance?

Electric vehicle insurance policies are available to individuals who own and operate an electric vehicle. In order to qualify for coverage, the vehicle must be registered in the policyholder’s name, and the policyholder must be the primary driver of the vehicle. Some insurance companies may also require that the policyholder have a valid driver’s license and a good driving record.

What Are The Benefits Of Electric Vehicle Insurance?

Electric vehicle insurance can provide peace of mind for electric vehicle owners. It can provide coverage for damage to the vehicle, theft, personal injury, and liability, as well as the cost of repairs to the vehicle and its components, and the cost of replacing the vehicle if it is damaged beyond repair. Electric vehicle insurance policies can also be tailored to meet the individual needs of the policyholder.

How Is Electric Vehicle Insurance Priced?

Electric vehicle insurance policies are typically priced based on a variety of factors including the type of vehicle, the age of the vehicle, the driver’s driving record, and the insurance company’s risk assessment. Additionally, some insurance companies may offer discounts for electric vehicle owners who have taken steps to reduce the risk of an accident, such as installing an anti-theft device or taking a driver safety course.

What Is The Electric Vehicle Insurance Policy Wording?

The wording of an electric vehicle insurance policy can vary from one insurance company to another, so it is important to read and understand the policy before signing. Generally, the policy will specify the types of coverage provided, as well as the limits of coverage and the deductible. Additionally, the policy will outline the policyholder’s responsibilities in the event of a claim, as well as the insurance company’s rights and obligations. It is important to read and understand the policy in order to make sure that it meets the individual needs of the policyholder.

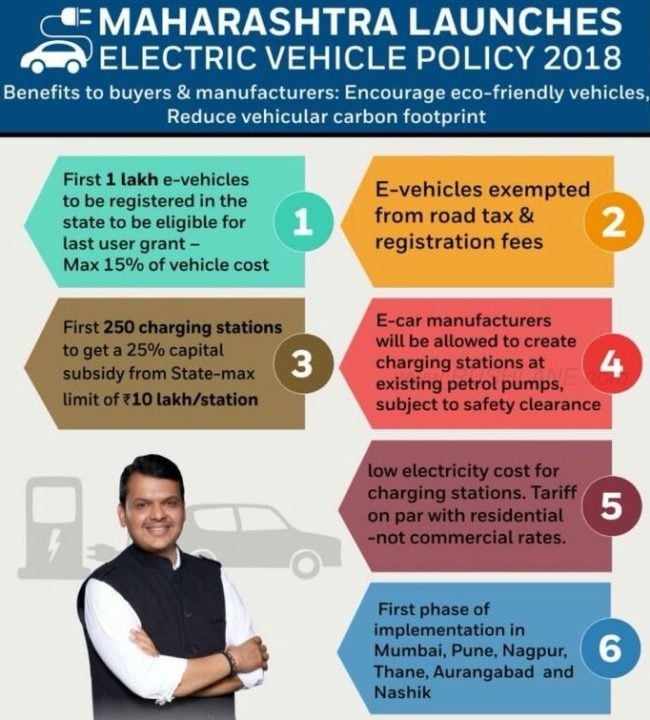

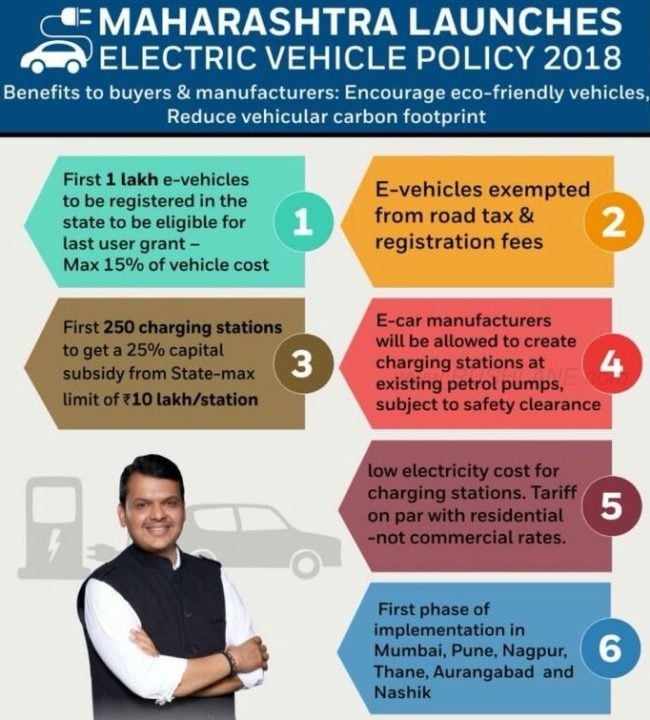

Maharashtra Government Promotes Use of Electric Vehicles

[PDF] Bharti AXA Smart Drive Private Car Insurance Policy PDF Download

![Electric Vehicle Insurance Policy Wording [PDF] Bharti AXA Smart Drive Private Car Insurance Policy PDF Download](https://instapdf.in/wp-content/uploads/pdf-thumbnails/bharti-axa-private-car-insurance-policy-2436.jpg)

Understanding Your Car Insurance Declarations Page | Policygenius

Best Free Auto Insurance Images and Photos

Car Insurance Policy Pdf - me2idesign