Does Personal Auto Insurance Cover Turo

Does Personal Auto Insurance Cover Turo?

What is Turo?

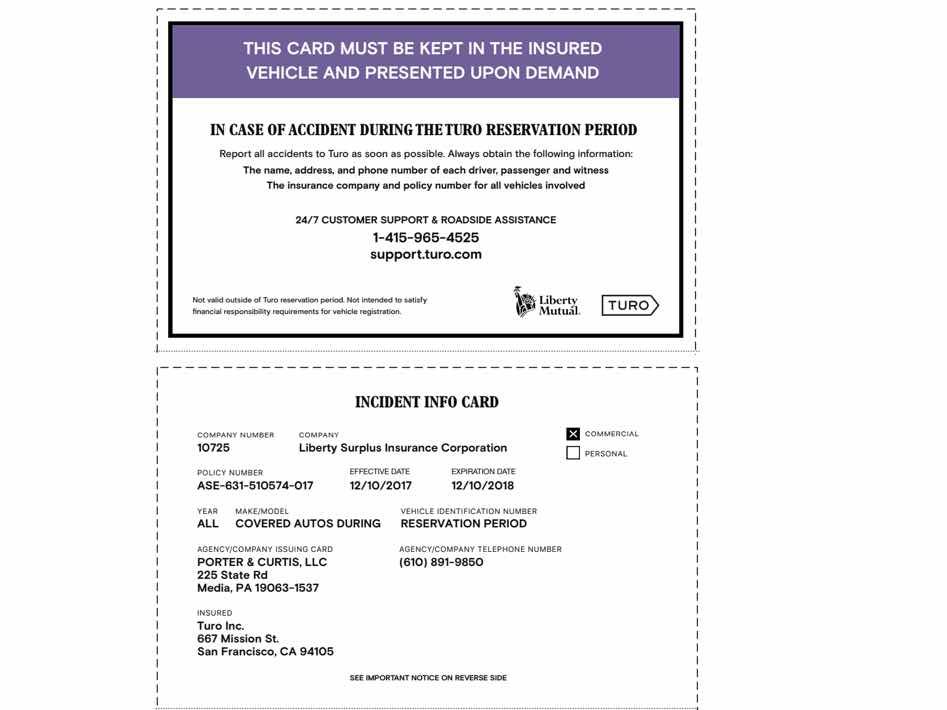

Turo is a car sharing service that allows individuals to rent their own personal vehicles to other people. Much like a traditional rental car company, customers can use the Turo website or app to find a car that meets their needs. Once they find the car they want to rent, they can pay the owner directly and pick up the car. The main difference between Turo and traditional car rental companies is that Turo does not own the vehicles, so it does not have its own insurance policies in place. Therefore, it is important for customers to understand their auto insurance coverage when renting a car on Turo.

Does Personal Auto Insurance Cover Turo?

The short answer is that it depends on your individual auto insurance policy. Most personal auto insurance policies will cover you when you are renting a car through Turo. However, there are some policies that may not cover the rental, so it is important to check your policy to make sure. Additionally, some policies may require you to purchase additional coverage for the rental. It is important to understand the specifics of your policy before renting a car on Turo.

What Types of Coverage Does Turo Offer?

Turo offers two types of coverage: physical damage coverage and liability coverage. Physical damage coverage covers damage to the car that you are renting, while liability coverage covers damage to other cars and people if you are involved in an accident while driving the rental. Turo offers both of these coverage options to customers, and you can purchase additional coverage if you wish. You can choose the coverage that best fits your needs, and the cost of coverage will vary depending on the type of car you are renting.

What if My Personal Auto Insurance Does Not Cover Turo?

If your personal auto insurance does not cover Turo, you still have options. You can purchase additional coverage through Turo, or you can purchase a short-term policy from a third-party provider. Third-party providers offer policies that are specifically designed for car sharing services like Turo, and they are often more affordable than Turo's coverage options. You can also opt to take an insurance waiver, which waives your right to sue the owner of the car in the event of an accident.

Conclusion

Personal auto insurance may or may not cover you when you are renting a car through Turo. It is important to check your policy to make sure, and you may need to purchase additional coverage. Turo offers two types of coverage: physical damage coverage and liability coverage. If your personal auto insurance does not cover Turo, you can purchase additional coverage through Turo or a third-party provider, or you can opt to take an insurance waiver. Understanding your coverage and the coverage options available through Turo will help you make sure you are adequately protected when renting a car.

Turo Third-Party Automobile Liability Insurance - KAASS LAW

Pros and Cons of Turo Car Rental for Travellers – Sling Adventures

How Does Turo Insurance Work : Host Tips How Insurance Works On Turo

Car Insurance That Pays For Your Injuries Weegy – Cars Insurance