Average 6 Month Premium Car Insurance

Average 6 Month Car Insurance: An Overview

Are you looking for a car insurance policy that covers you for 6 months? 6 month car insurance policies are a great choice if you're looking to save money and time. With an average 6 month car insurance policy, you'll pay a one-time premium and have coverage for the entire 6 month period.

There are a few different types of 6 month car insurance policies available. The most popular is a full coverage policy, which covers you for all types of accidents, including liability, collision, and comprehensive. This type of policy is typically more expensive than a basic liability policy, but it can provide peace of mind knowing you're covered for almost any type of accident.

Another option is a liability-only policy. This type of policy will only cover you for any damages you cause to someone else's property. This is a great option if you don't drive very often or if you're looking to save some money on your premiums. However, it won't cover any of your own expenses if you're in an accident.

No matter which type of 6 month car insurance policy you choose, it's important to shop around and compare rates. Every insurer has different rates, so it's important to compare them in order to get the best deal. It's also important to read the fine print and make sure you understand what is and isn't covered.

Understanding Your Car Insurance Premiums

When you're shopping for 6 month car insurance, it's important to understand how your premiums are determined. Most insurers use a variety of factors to calculate your premiums, including your driving record, the type of car you drive, and the amount of coverage you choose.

Your driving record is an important factor when it comes to determining your premiums. Insurers will look at the number of tickets and accidents you've had in the past, as well as your driving history. The better your driving record, the lower your premiums will be.

The type of car you drive is also important. If you drive an older car, you'll likely pay less in premiums. The amount of coverage you choose will also affect your premiums. The more coverage you choose, the higher your premiums will be.

Tips for Lowering Your Car Insurance Premiums

If you're looking to save money on your 6 month car insurance premiums, there are a few things you can do. First, you should shop around and compare rates from different insurers. You may also be able to get a discount if you choose a higher deductible or if you pay your premiums in full.

Another way to save money on your premiums is to take a defensive driving course. This can help you become a better driver and, in turn, can lead to lower premiums. Additionally, you should make sure to keep your car in good condition and keep up with regular maintenance. This can help you avoid expensive repairs and reduce the risk of an accident.

Finally, you should make sure to read the fine print of any policy you're considering. This will help you understand what is and isn't covered and can help you make an informed decision. Taking the time to do your research can help you find the best 6 month car insurance policy for your needs.

ALL You Need to Know About the Average Car Insurance Cost

ALL You Need to Know About the Average Car Insurance Cost

How Much Is Car Insurance Per Month For A 18 Year Old ~ news word

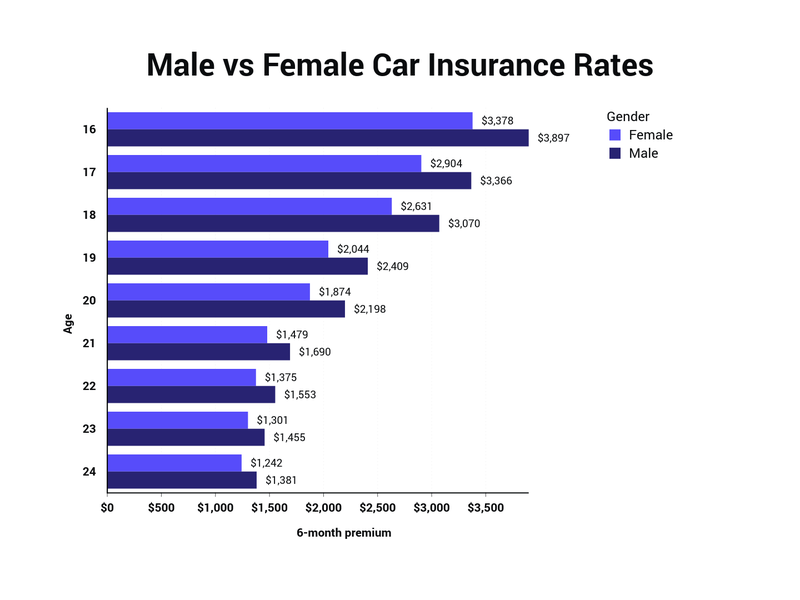

Average Car Insurance Rates by Age and Gender Per Month

Auto-Owners Insurance Review - ValuePenguin