What Is Full Coverage For Car Insurance

What Is Full Coverage For Car Insurance?

What Does Full Coverage Car Insurance Cover?

Full coverage car insurance is a type of insurance policy that provides comprehensive protection against both physical and financial damages. It typically includes liability coverage, personal injury protection, and comprehensive and collision coverage. Liability coverage is the most basic type of car insurance and is required by law in most states. Liability coverage pays for damage to other people and their property if you are found at fault in an accident. Personal injury protection is also required in some states, and it covers medical expenses for you and your passengers in the event of an accident.

What Are The Benefits Of Full Coverage Car Insurance?

Full coverage car insurance is beneficial because it can help protect you in the event of an accident. It can also provide financial protection if you are found at fault in an accident. Comprehensive and collision coverage can help pay for repair costs in the event that your vehicle is damaged or totaled in an accident. Full coverage car insurance can also provide extra peace of mind, knowing that you are covered in the event of an accident.

What Are The Different Types Of Full Coverage?

Full coverage car insurance typically includes liability coverage, personal injury protection, and comprehensive and collision coverage. Liability coverage provides financial protection if you are found at fault in an accident. Personal injury protection covers medical expenses for you and your passengers in the event of an accident. Comprehensive and collision coverage pays for repairs or replacement costs of your vehicle in the event of an accident.

How Much Does Full Coverage Car Insurance Cost?

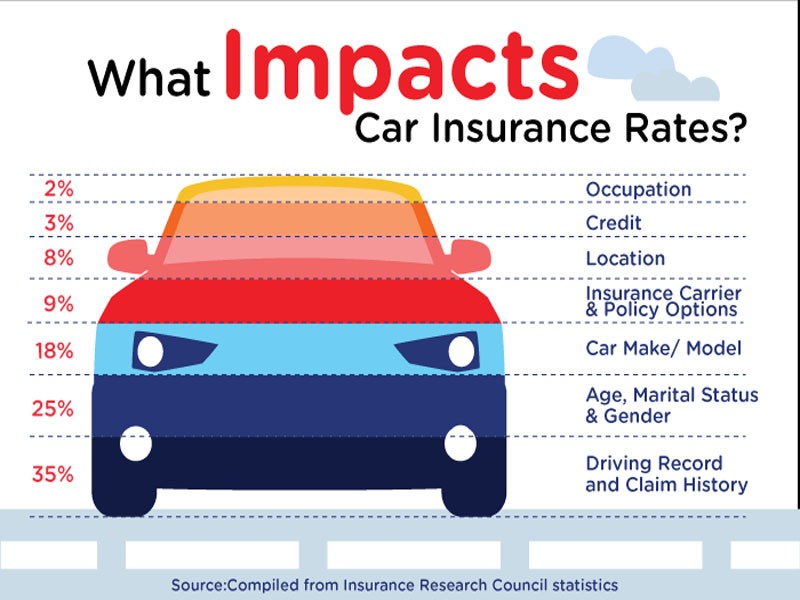

The cost of full coverage car insurance varies depending on a variety of factors, including the age and model of your vehicle, your driving record, and the type of coverage you select. Generally, full coverage car insurance is more expensive than basic liability coverage, but it can provide additional protection in the event of an accident. It is important to shop around and compare quotes from different insurance companies to find the best rate for your needs.

Should I Get Full Coverage Car Insurance?

Full coverage car insurance can provide additional protection in the event of an accident. It is important to consider your individual needs when deciding whether or not to purchase full coverage. If you are an experienced driver with a clean driving record, you may not need full coverage. However, if you are a new driver or have a history of accidents, full coverage may be the best option for you.

Full coverage car insurance in california by Promax Insurance Agency

What is Full Coverage Car Insurance? - eTrustedAdvisor

18+ Full Coverage Car Insurance Quotes - Best Day Quotes

How to Get Cheap Full Coverage Auto Insurance Plan by Helvin Hills - Issuu