What Is Considered Full Coverage Auto Insurance In Florida

What Is Considered Full Coverage Auto Insurance In Florida?

Full coverage auto insurance is something that many drivers in Florida want to have. But what exactly does it mean? Full coverage auto insurance is a policy that provides financial protection for you, your vehicle, and other drivers involved in an accident. It includes liability coverage, uninsured/underinsured motorist coverage, and medical coverage. In Florida, it is legally required to have at least a minimum amount of auto insurance coverage.

Liability Coverage

Liability coverage is the most basic form of auto insurance coverage. It provides financial protection for you if you are found to be at fault in an accident. It covers bodily injury and property damage to the other driver and/or their vehicle. It also covers legal fees if you are sued for damages. In Florida, the minimum liability coverage is $10,000 per person and $20,000 per accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is an optional coverage that provides financial protection for you if you are hit by a driver who does not have auto insurance or does not have enough insurance. This coverage can help to pay for your medical bills and property damage if the other driver does not have enough insurance to cover the cost. In Florida, the minimum uninsured/underinsured motorist coverage is $10,000 per person and $20,000 per accident.

Medical Coverage

Medical coverage is an optional coverage that pays for medical bills for you, your passengers, and other drivers involved in an accident. It can also pay for lost wages, funeral expenses, and other related expenses. In Florida, the minimum medical coverage is $10,000 per person and $20,000 per accident.

Full Coverage Auto Insurance

Full coverage auto insurance is a policy that combines liability coverage, uninsured/underinsured motorist coverage, and medical coverage. It provides financial protection for you, your vehicle, and other drivers involved in an accident. In Florida, it is legally required to have at least a minimum amount of auto insurance coverage. However, you may choose to purchase additional coverage for added financial protection.

Conclusion

Full coverage auto insurance is an important part of driving in Florida. It provides financial protection for you, your vehicle, and other drivers involved in an accident. It is important to understand the different types of coverage and to make sure you have the right coverage for your needs. Be sure to shop around and compare different policies to make sure you are getting the best coverage for your money.

+11 What Is Considered Full Coverage Auto Insurance In Florida 2022 - SPB

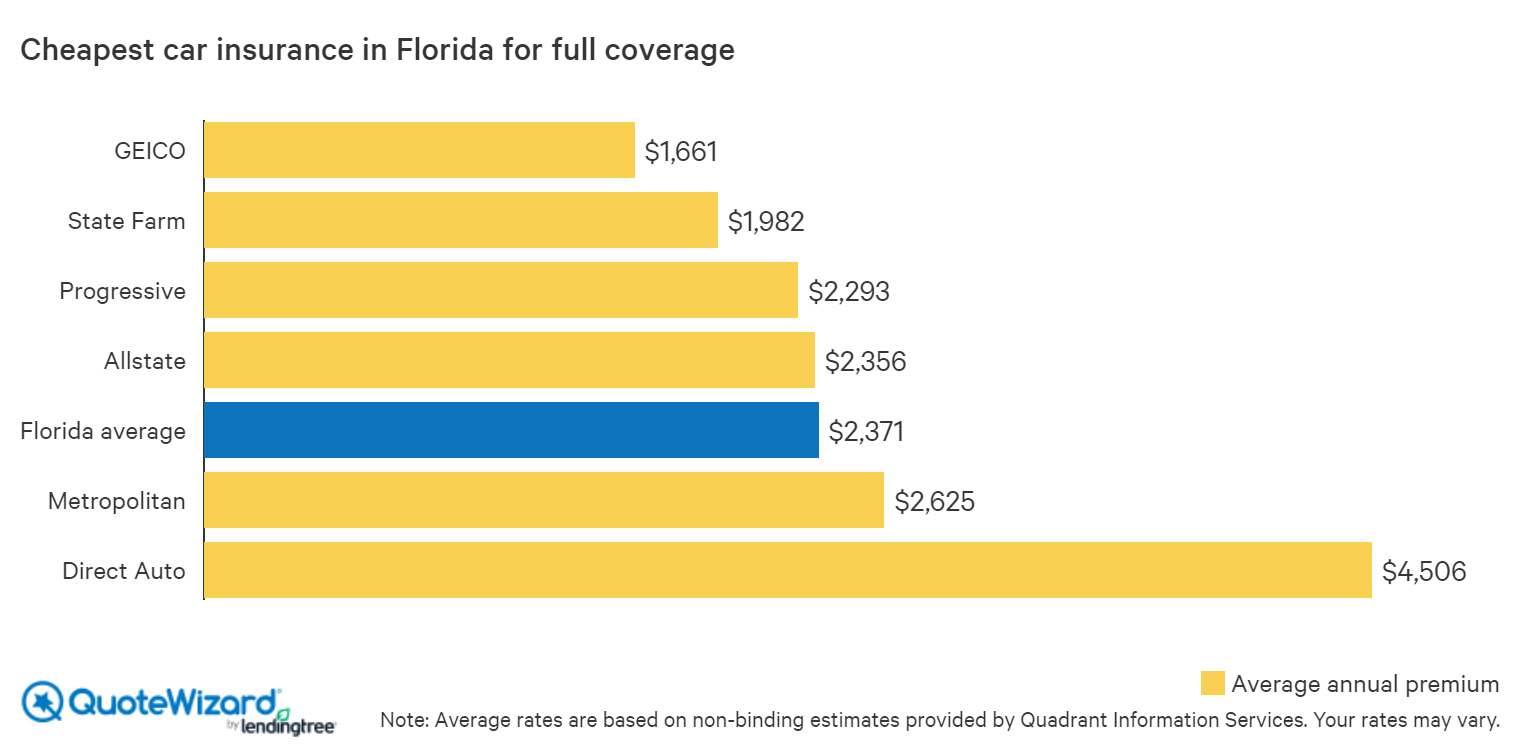

Cheap Car Insurance in Florida (2020) | QuoteWizard

Excellent Advice Regarding Auto Insurance in Florida - Brett M

√ What Is Considered Full Coverage Auto Insurance in Nation? - Tempat

Average Full Coverage Car Insurance For 20 Year Old