The General Auto Insurance Lienholder Verification

Lienholder Verification: What You Need To Know About The General Auto Insurance

What Is a Lienholder?

When you purchase a vehicle, whether it is new or used, you typically need to finance the purchase. This means that you enter into a contract with a lender, who will provide the loan for you to buy the vehicle. The lender is known as the lienholder, and the lienholder has the legal right to keep the vehicle until the loan is paid off in full. This is why it is important to make sure that the lienholder is verified by The General Auto Insurance before you purchase a vehicle.

Why Do You Need To Verify The Lienholder?

When you purchase a vehicle, you need to make sure that the lienholder is verified by The General Auto Insurance. This is important because it ensures that the lienholder has a legitimate claim to the vehicle. If the lienholder is not verified, then there could be legal issues surrounding the purchase of the vehicle. Additionally, if the lienholder is not verified, you may not have the coverage you need in the event of an accident.

How Does The General Auto Insurance Verify The Lienholder?

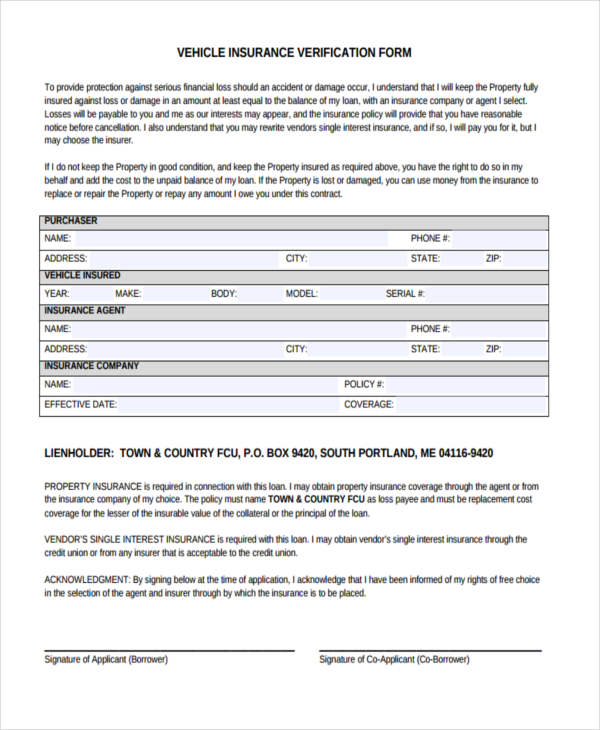

The General Auto Insurance will verify the lienholder by obtaining a copy of the lienholder’s policy. This policy will include information about the lienholder and the vehicle, including the make, model, and year. This information is then compared with the information that is provided by the lender. If the information matches, then the lienholder is verified.

What Happens If The Lienholder Is Not Verified By The General Auto Insurance?

If the lienholder is not verified by The General Auto Insurance, then you may not have the coverage you need in the event of an accident. Additionally, you may not be able to legally purchase the vehicle. In this case, it is important to contact the lender and the lienholder to ensure that the lienholder is verified by The General Auto Insurance.

What Are The Benefits Of Verifying The Lienholder With The General Auto Insurance?

The benefits of verifying the lienholder with The General Auto Insurance include protection in the event of an accident, as well as the assurance that the vehicle is legally purchased. Additionally, verifying the lienholder with The General Auto Insurance helps to protect you from any potential legal issues that could arise from the purchase of the vehicle.

In Summary

Verifying the lienholder with The General Auto Insurance is important for ensuring that the vehicle is legally purchased and that you are protected in the event of an accident. Additionally, verifying the lienholder helps to protect you from any potential legal issues that could arise from the purchase of the vehicle. It is important to make sure that the lienholder is verified before you purchase a vehicle.

Free Auto Insurance Verification Letters | 5-Steps Guide

FREE 17+ Sample Insurance Verification Forms in PDF | MS Word

Automobile Insurance: Auto Insurance Verification

www.thegeneral.com/mypolicy: The General Auto Insurance Login

Free Auto Insurance Verification Letters | 5-Steps Guide