First Party Coverage In Cyber Insurance

What Is First Party Cyber Insurance Coverage?

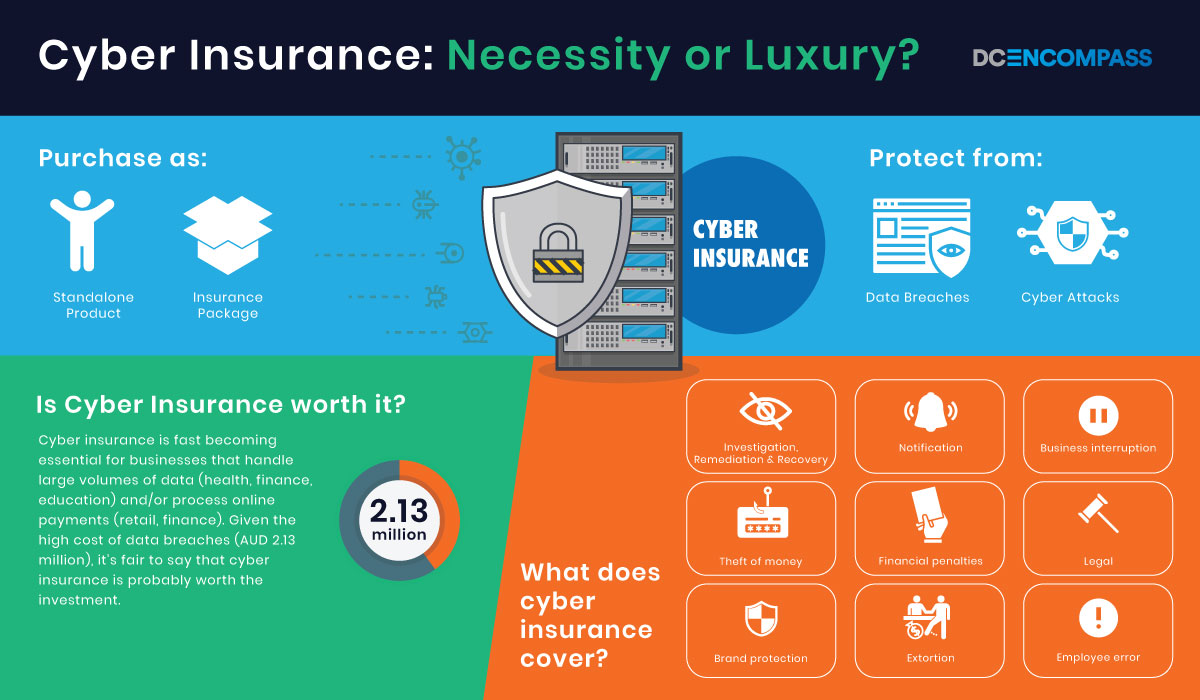

First Party Cyber Insurance Coverage is an insurance policy designed to protect businesses against cyber-related losses. It is a type of insurance coverage that businesses can purchase to provide financial protection against cyber-related losses and liabilities. It is also known as Cyber Liability Insurance (CLI).

First Party Cyber Insurance Coverage can provide protection against a wide range of cyber-risks. This includes the loss of data, theft of confidential customer or business information, or the damage caused by malicious activities such as hacking or virus attacks. It can also provide protection against losses resulting from lawsuits or other legal action taken against the business for a breach of data security.

What Does It Cover?

First Party Cyber Insurance Coverage typically covers the costs associated with responding to a data breach, such as investigating the breach, restoring the compromised data, and notifying customers of the breach. It may also cover the costs associated with repairing any damage caused by the breach. Additionally, First Party Cyber Insurance Coverage can provide coverage for the costs associated with legal action taken against the business for the breach. This includes coverage for settlements, judgments, and defense costs.

First Party Cyber Insurance Coverage may also provide coverage for the costs associated with data recovery, such as the cost of restoring lost or damaged data. This type of coverage is important, as data loss can be extremely costly and time-consuming to recover. Additionally, First Party Cyber Insurance Coverage may provide coverage for the costs associated with business interruption, such as lost revenue and additional expenses incurred while the business is unable to operate.

Who Needs It?

First Party Cyber Insurance Coverage is essential for any business that stores or processes sensitive customer or business data. This includes any business that collects, stores, or processes credit card information, social security numbers, healthcare information, or other personal or confidential information. It is also important for businesses that rely heavily on technology, such as those that conduct business through e-commerce websites or mobile applications.

First Party Cyber Insurance Coverage is an important part of a comprehensive risk management plan. It can provide financial protection against cyber-related losses, and can help businesses recover from a data breach or other cyber-attack. It is important for businesses to understand their cyber-risks and to purchase the right coverage to protect their business.

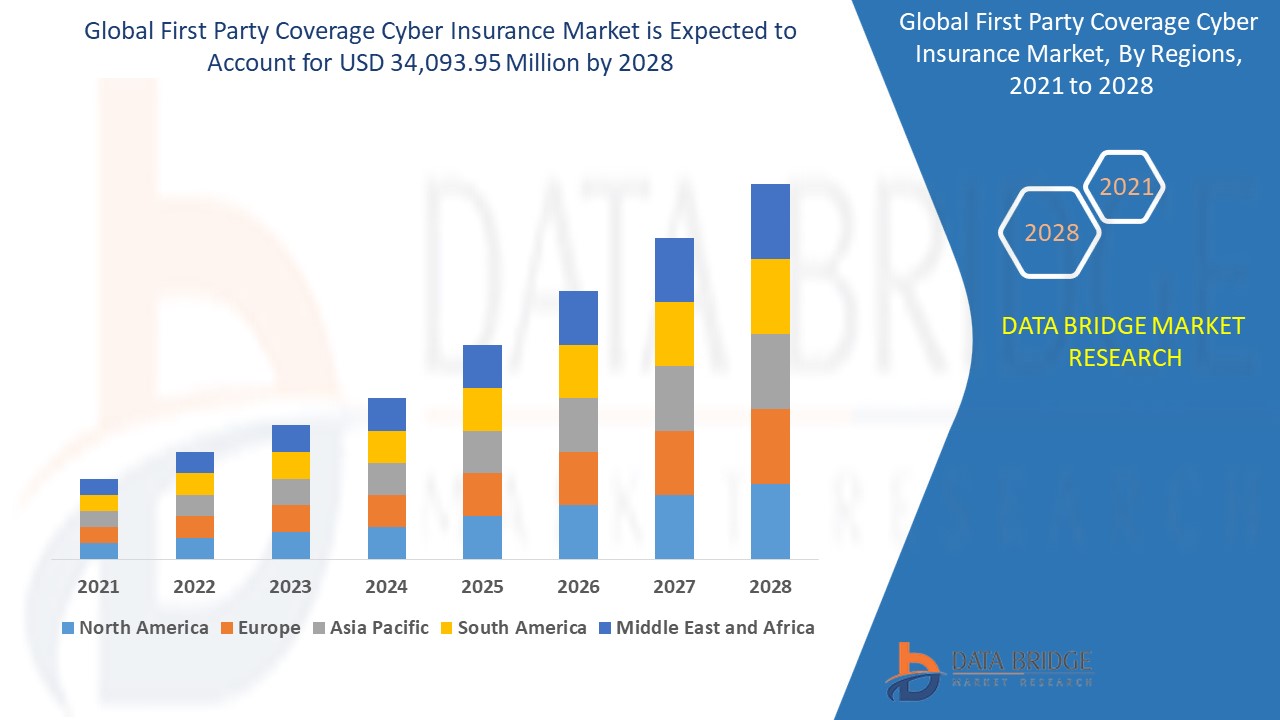

First Party Coverage Cyber Insurance Market – Global Industry Trends

PPT - First Party Coverage Cyber Insurance Market Opportunity, Trend

First-Party Insurance for Cyber Risks | Expert Commentary | IRMI.com

3 things agents should learn about cyber insurance and 4 steps to

Cyber Liability Insurance Cost : Cyber Insurance - Core-Infosec - Cyber