Estimated Annual Home Insurance Woolworths

Estimated Annual Home Insurance Woolworths

What is Home Insurance Woolworths?

Home Insurance Woolworths is a type of insurance policy that provides cover for the structure of your home and its contents. It offers protection against loss or damage to your property, whether it's caused by natural disasters, theft, vandalism or other events. Home Insurance Woolworths is a type of insurance you can take out to cover your home and belongings for a set period of time. It typically covers the cost of repairing or replacing damaged items, as well as any legal costs that may arise from disputes or lawsuits. It also provides cover for any additional living expenses if your home becomes uninhabitable due to an insured event.

What Does Home Insurance Woolworths Cover?

Home Insurance Woolworths typically covers the following:

- Structural damage caused by natural disasters, such as floods, storms, and earthquakes.

- Theft or vandalism.

- Accidental damage.

- Loss or damage to personal items, such as furniture, clothing, appliances, and electronics.

- Liability insurance. This covers you if someone is injured on your property or if you are found liable for damage or injury caused by you, your family, or your pets.

- Additional living expenses if your home becomes uninhabitable due to an insured event.

What Does Home Insurance Woolworths Not Cover?

Home Insurance Woolworths does not typically cover the following:

- Property that has been left unoccupied for an extended period of time.

- Damage caused by normal wear and tear.

- Damage caused by pests or vermin.

- Damage caused by intentional acts.

- Damage caused by not following the manufacturer's instructions.

- Damage caused by not taking reasonable steps to prevent damage.

How Much Does Home Insurance Woolworths Cost?

The cost of Home Insurance Woolworths depends on a number of factors, including the value of your home and its contents, your location, the type of coverage you select, and the deductible you choose. Generally, the higher the value of your home and its contents, the higher your premiums will be. Additionally, the higher deductible you choose, the lower your premiums will be.

How To Get Home Insurance Woolworths?

To get Home Insurance Woolworths, you will need to contact an insurance provider. There are a number of providers that offer Home Insurance Woolworths, including Woolworths. You will need to provide information about your home and its contents, as well as the location of your property. Once you have provided this information, the insurance provider will be able to provide you with a quote for the cost of your policy. You can then decide if you would like to take out the policy.

Conclusion

Home Insurance Woolworths is an important type of insurance to have if you own a home. It provides cover for the structure of your property and its contents, as well as any additional living expenses if your home becomes uninhabitable due to an insured event. The cost of Home Insurance Woolworths will depend on a number of factors, including the value of your home and its contents, your location, the type of coverage you select, and the deductible you choose. To get Home Insurance Woolworths, you will need to contact an insurance provider.

Woolworths Landlords Insurance | ProductReview.com.au

Woolworths Home and Contents Insurance Reviews - ProductReview.com.au

How Much Does Homeowners Insurance Cost? [November 2021]

![Estimated Annual Home Insurance Woolworths How Much Does Homeowners Insurance Cost? [November 2021]](https://cdn.thezebra.com/zfront/media/production/images/Annual_Home_Insurance_Cost_by_Insurance_Company.original.png)

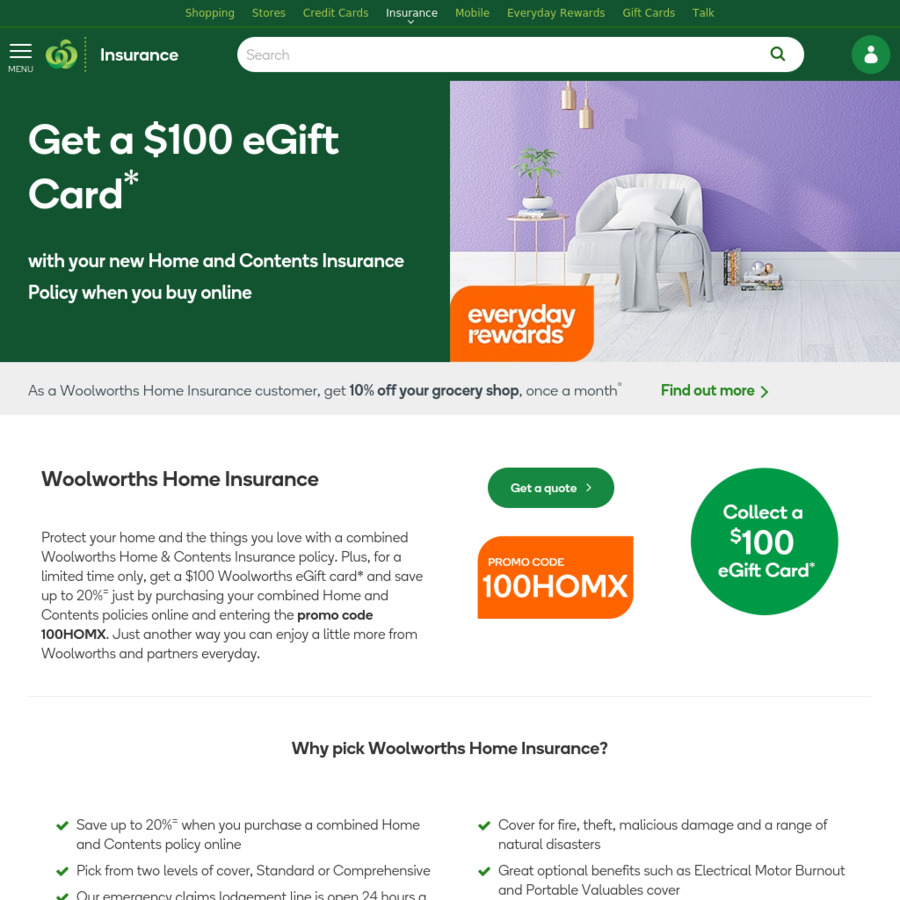

Bonus $100 eGift Card + up to 20% off When You Take up New Home and

Woolworths Car Insurance: Get a $100 Gift Card with Every New Policy