Cheap Insurance Sr 22 Ga

Saturday, May 25, 2024

Edit

Cheap Insurance SR 22 GA: All You Need to Know

What is SR 22 Insurance?

SR 22 is a type of car insurance filing that proves you carry the minimum liability coverage required by your state. It is most commonly required when a driver has been convicted of a DUI or other serious traffic violations. SR 22 is not an insurance policy, but rather an endorsement. It is issued either by the insurance company you purchased your auto policy from, or by another company that specializes in SR 22 filings.

How Much Does SR 22 Insurance Cost in GA?

The cost of SR 22 insurance varies from state to state and even from provider to provider. Generally speaking, the average cost of SR 22 insurance in GA is around $25 to $50 per month. This cost is in addition to your existing car insurance policy and will be added to your premium. To get an exact cost, it is best to contact a car insurance provider in your area.

What Types of Insurance Companies Offer SR 22 Insurance in GA?

The most common type of insurance provider that offers SR 22 insurance in GA is a non-standard auto insurance company. These companies specialize in providing coverage for drivers with high-risk records, such as those with DUI convictions. Examples of companies that offer SR 22 insurance in GA include Progressive, GEICO, The General, and Nationwide.

What Factors Determine the Cost of SR 22 Insurance?

The cost of SR 22 insurance is based on several factors, including your age, driving record, vehicle type, and coverage limits. The insurer will also take into consideration your credit score, as this can affect premium rates. Additionally, the cost of SR 22 insurance can vary depending on the provider you choose.

What Other Types of Insurance Can I Get with SR 22 Insurance?

In addition to the basic liability coverage, you can also get additional insurance coverage with SR 22 insurance. This includes uninsured/underinsured motorist coverage, collision coverage, comprehensive coverage, and rental car reimbursement. Depending on your needs and budget, you can choose the coverage that best meets your needs.

How Long Do I Have to Keep SR 22 Insurance?

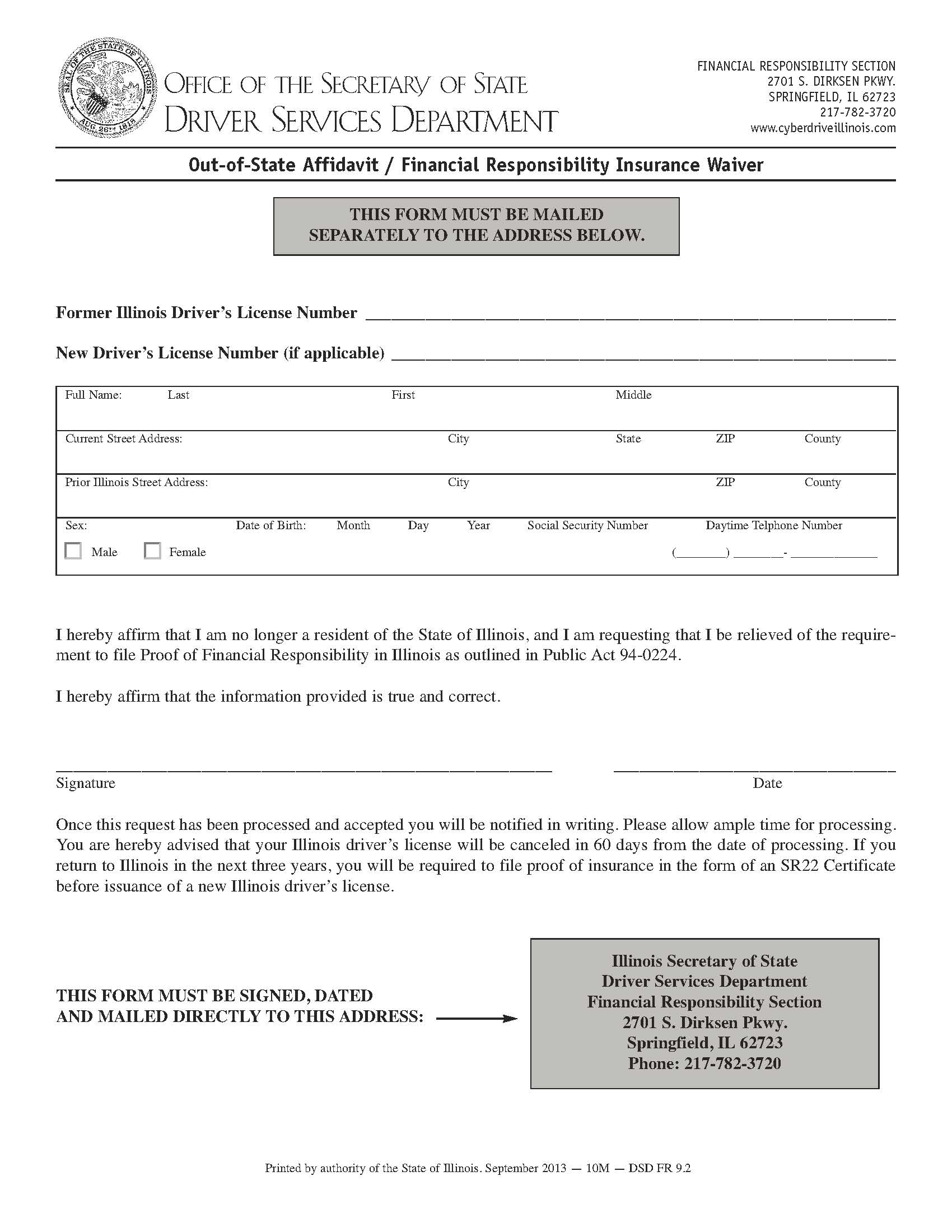

The length of time you need to keep SR 22 insurance depends on your state and on the severity of the offense that requires you to have it. Generally, you will need to keep SR 22 insurance for at least three years. During this time, it is important to maintain your policy and keep your payments up to date. If you fail to do so, your insurance company may cancel your policy and you will need to file another SR 22.

Cheap SR22 & SR22A Georgia Insurance

Cheap SR22 & SR22A Georgia Insurance

SR22 Insurance: What Does It Cover? | EINSURANCE

SR22 Auto Insurance Illinois, Cheap Chicago SR22 Insurance | American Auto

SR22 Insurance - Affordable DUI Insurance Quotes - YouTube