Car Insurance Cost A Month

Car Insurance Cost A Month – The Real Cost of Car Insurance

When it comes to the cost of car insurance, many people are left wondering how much they should expect to pay each month. The cost of car insurance depends on several factors, including age, driving history, credit score, and type of vehicle. With so many variables, it can be difficult to determine how much car insurance will cost each month.

Factors in Determining Car Insurance Cost A Month

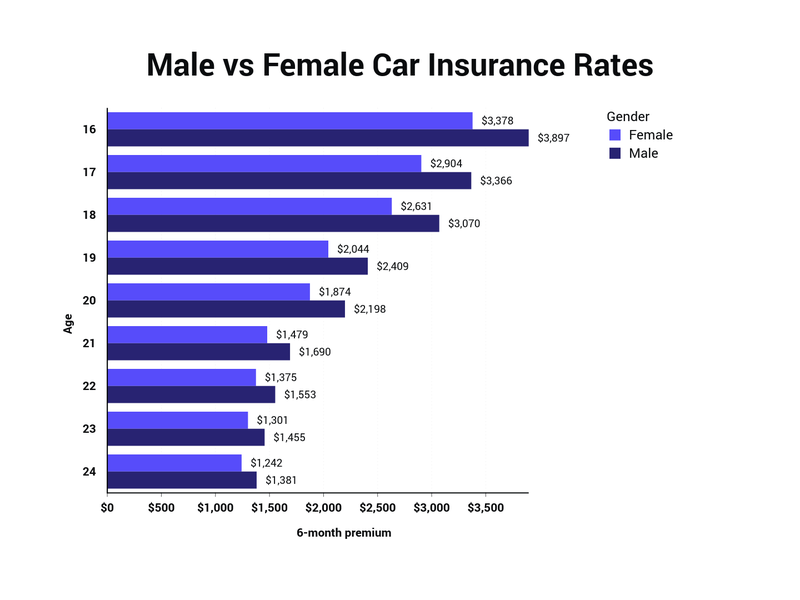

Age is one of the major factors in determining car insurance cost a month. Generally, the younger you are, the more expensive your car insurance will be. This is because younger drivers tend to be less experienced and more likely to get into an accident. Additionally, insurance companies may also consider the type of car you drive. Sports cars and luxury vehicles tend to have higher premiums than more economical cars.

Your driving record is also taken into consideration when calculating your car insurance cost a month. If you have a history of moving violations or accidents, you may be considered a higher risk and your premiums will reflect this. Additionally, your credit score may also be a factor in determining your car insurance cost a month. Insurance companies often use credit scores to determine how likely you are to make payments on time.

Ways to Lower Your Car Insurance Cost A Month

There are a few ways to lower your car insurance cost a month. One of the best ways to save money on car insurance is to shop around. Different insurance companies offer different rates, so it pays to shop around and compare quotes. Additionally, you can save money by increasing your deductible. A higher deductible means that you will be responsible for paying a larger portion of any claim, but it will also lower your monthly premiums.

You may also be able to save money on car insurance by taking defensive driving classes or taking advantage of discounts for good drivers. If you have a clean driving record, you may be able to get a discount from your insurer. Additionally, some insurers offer discounts for drivers who have taken defensive driving classes. Finally, bundling your car insurance with other policies may also help you save money. Many insurers offer discounts if you bundle your car insurance with other policies, such as homeowners or renters insurance.

The Bottom Line

Car insurance cost a month can vary greatly depending on your age, driving history, credit score, and type of vehicle. Shopping around and taking advantage of discounts can help you save money on your car insurance. Additionally, increasing your deductible and bundling your insurance with other policies can also help you save money. By taking the time to do your research, you can find the best car insurance policy for your needs and budget.

What's the Average Auto Insurance Cost Per Month? | The Lazy Site

The average cost of car insurance in the US, from coast to coast

The Average Auto Insurance Cost Per Month | The Lazy Site

Average Car Insurance Rates by Age and Gender Per Month