California Damages Recovered From Your Own Insurance

Recover Damages From Your Insurance in California

Understanding Your Insurance Coverage

Having the right insurance coverage is an important part of ensuring that you are financially secure. Knowing what kind of coverage you have and what you are entitled to can help you recover damages more easily. In California, it is important to understand that there are different types of insurance that can be used to recover damages. Property damage, bodily injury, and death, as well as personal injury, are all covered by different types of insurance. Depending on the type of coverage that you have, you may be able to recover damages from your insurance.

The first step in the process of recovering damages is to determine what type of insurance coverage you have. Different types of coverage will provide different levels of coverage. For example, some policies will cover property damage, while others will provide coverage for bodily injury and death. Additionally, some policies may provide coverage for personal injury or for medical expenses incurred due to an accident. Knowing which type of coverage you have is important because it will determine how much money you can receive from your insurance.

How to File a Claim for Damages

Once you have determined what type of coverage you have, you can then file a claim for damages. The process for filing a claim for damages in California is fairly straightforward. First, you will need to contact your insurance company to provide them with the details of the incident. This includes any photos or other documents that can help prove the extent of the damage. Once your claim is accepted, you will need to provide the insurance company with an estimate of the cost of repairs or replacements.

Once the insurance company has determined what the cost of the repairs or replacements will be, they will provide you with an estimate of the damages that they are willing to cover. If you have additional expenses associated with the damages, such as the cost of a rental vehicle or medical bills, you may be able to receive additional coverage. It is important to note that the amount of damages that the insurance company is willing to cover is often less than the actual cost of repairs or replacements.

How to Recover Damages in California

Once the insurance company has provided an estimate of the damages that they are willing to cover, you can then file a claim for the amount of damages that you are requesting. In California, you will need to fill out a claim form and submit it to the insurance company. Once the claim is approved, you will receive the amount of damages that you are requesting. It is important to note that the amount of the claim may be lower than the amount of the repairs or replacements.

In some cases, you may be able to receive payment for additional expenses associated with the damages. These additional expenses may include the cost of a rental car, medical bills, or other expenses that were incurred due to the incident. Additionally, you may be able to receive compensation for pain and suffering. This can be done through a settlement or through the court system.

Conclusion

Recovering damages from your insurance in California is an important part of ensuring that you are financially secure. Knowing what type of coverage you have and how to file a claim can help you recover the damages that you are entitled to. By understanding how to recover damages in California, you can ensure that you are compensated for the costs associated with the incident.

Wrongful Death in California: Learn Who Can Be Liable and What Damages

California Appellate Court Affirms Large Punitive Damages Award Against

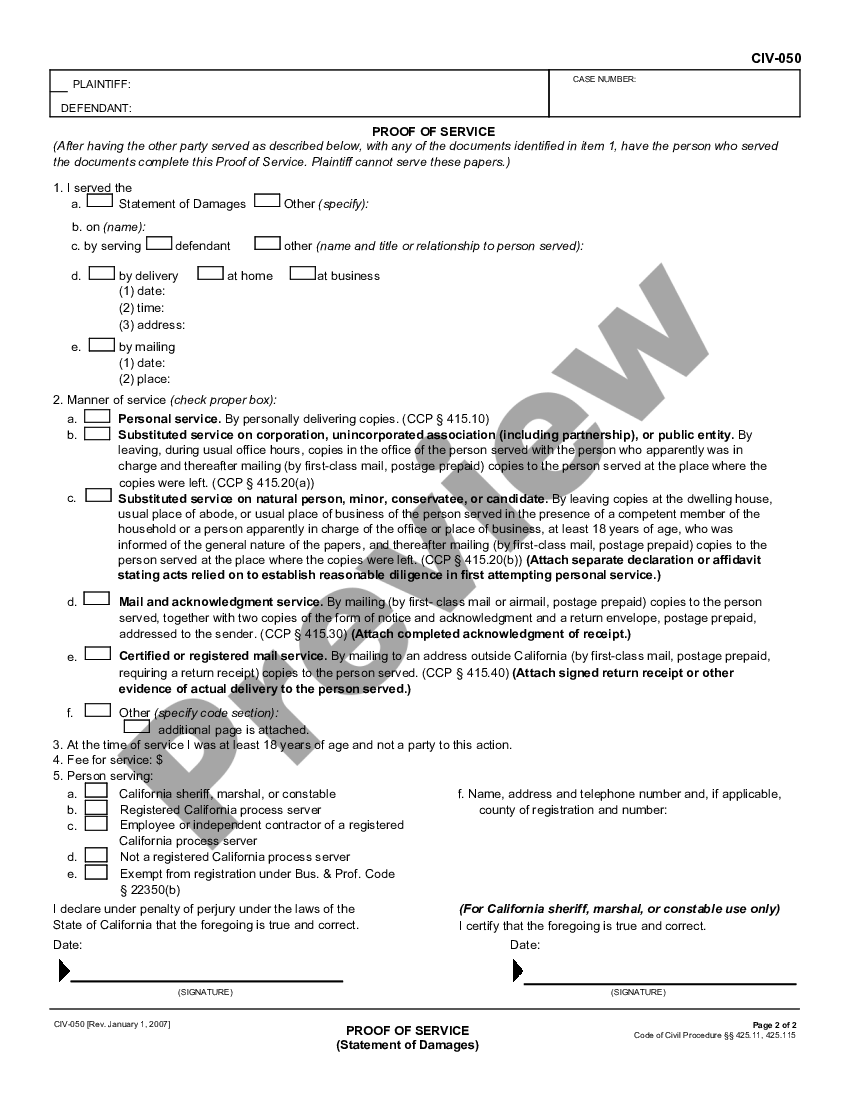

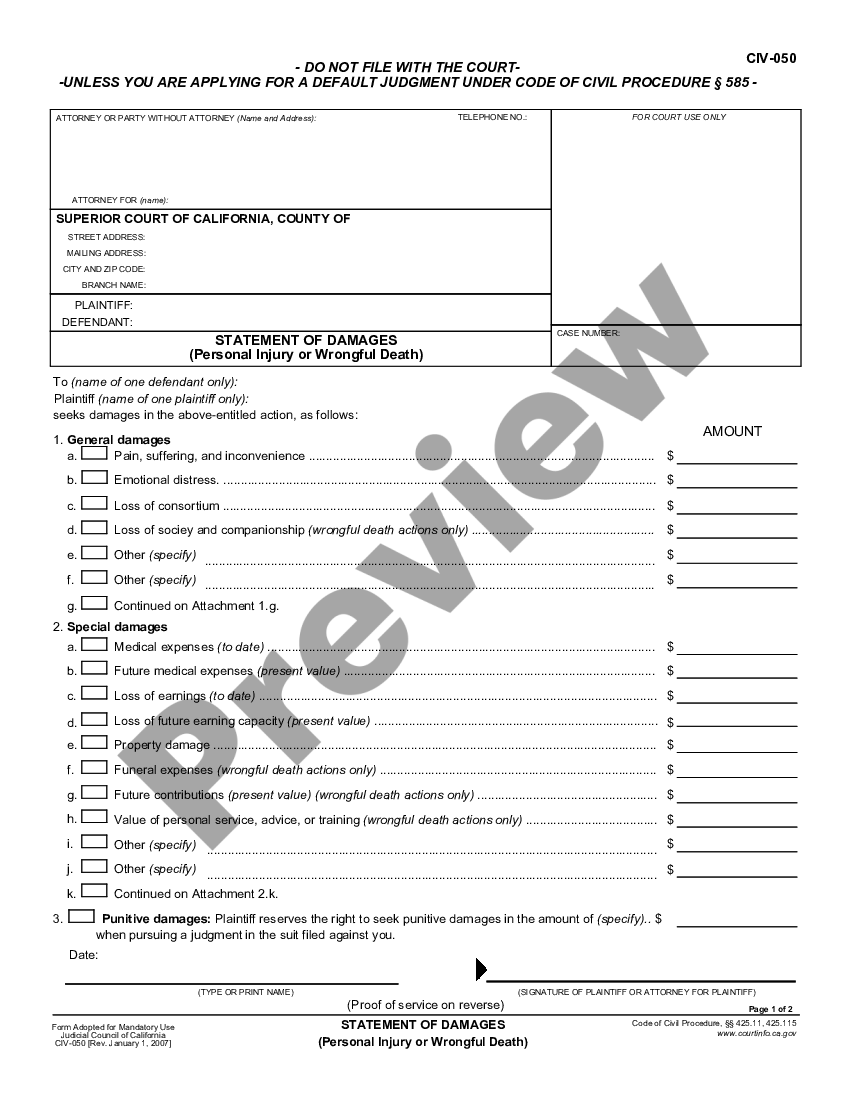

California Statement of Damages for Personal Injury or Wrongful Death

California Statement of Damages for Personal Injury or Wrongful Death

Free Car Accident Release of Liability Form (Settlement Agreement