Bajaj Allianz Vs Icici Lombard Car Insurance

Bajaj Allianz vs ICICI Lombard Car Insurance: Which is the Best Choice?

Introduction

If you’re considering purchasing a car insurance policy, you may be wondering which company you should go with. Two of the most popular car insurance providers in India are Bajaj Allianz and ICICI Lombard. Both companies offer a variety of products and services, so it can be difficult to choose between them. In this article, we’ll take a look at the features and benefits of each provider to help you decide which one is the best choice for you.

Bajaj Allianz Car Insurance

Bajaj Allianz is one of the leading insurers in India and offers a range of car insurance policies. They offer several types of coverage, including liability, third party, and comprehensive policies. With Bajaj Allianz, customers can also opt for add-on covers, such as zero depreciation, roadside assistance, and engine protection. The company also provides 24/7 customer support and an online claims process that makes it easy to file a claim in case of an accident.

ICICI Lombard Car Insurance

ICICI Lombard is another well-known car insurance provider in India. Like Bajaj Allianz, they offer comprehensive and third-party policies, as well as add-on covers. ICICI Lombard also provides 24/7 customer service, an online claims process, and a host of other features, such as cashless repair, coverage for accessories, and discounts on premium. In addition, they have a mobile app that makes it easy to manage your policy.

Comparison of Bajaj Allianz and ICICI Lombard

When it comes to car insurance, both Bajaj Allianz and ICICI Lombard offer a range of products and services. However, there are some differences between the two providers. For example, Bajaj Allianz offers a higher coverage limit, while ICICI Lombard provides a longer list of add-on covers. Additionally, Bajaj Allianz offers a loyalty program, while ICICI Lombard provides discounts on premiums.

Which is the Best Choice?

When deciding between Bajaj Allianz and ICICI Lombard car insurance, it is important to consider your needs and budget. If you’re looking for a comprehensive policy with a higher coverage limit, then Bajaj Allianz may be the best choice for you. On the other hand, if you’re looking for a more affordable policy with a wider variety of add-on covers, then ICICI Lombard may be the better option.

Conclusion

When it comes to car insurance, Bajaj Allianz and ICICI Lombard are two of the top providers in India. Both companies offer a range of products and services, so it’s important to compare the features and benefits of each provider in order to find the one that best suits your needs and budget. No matter which one you choose, you can be sure that you’ll be getting a quality car insurance policy.

Bajaj Allianz vs ICICI Lombard Car Insurance Comparison - PolicyBachat

Buy Online Insurance and Renew: Two Wheeler Insurance | Four Wheeler

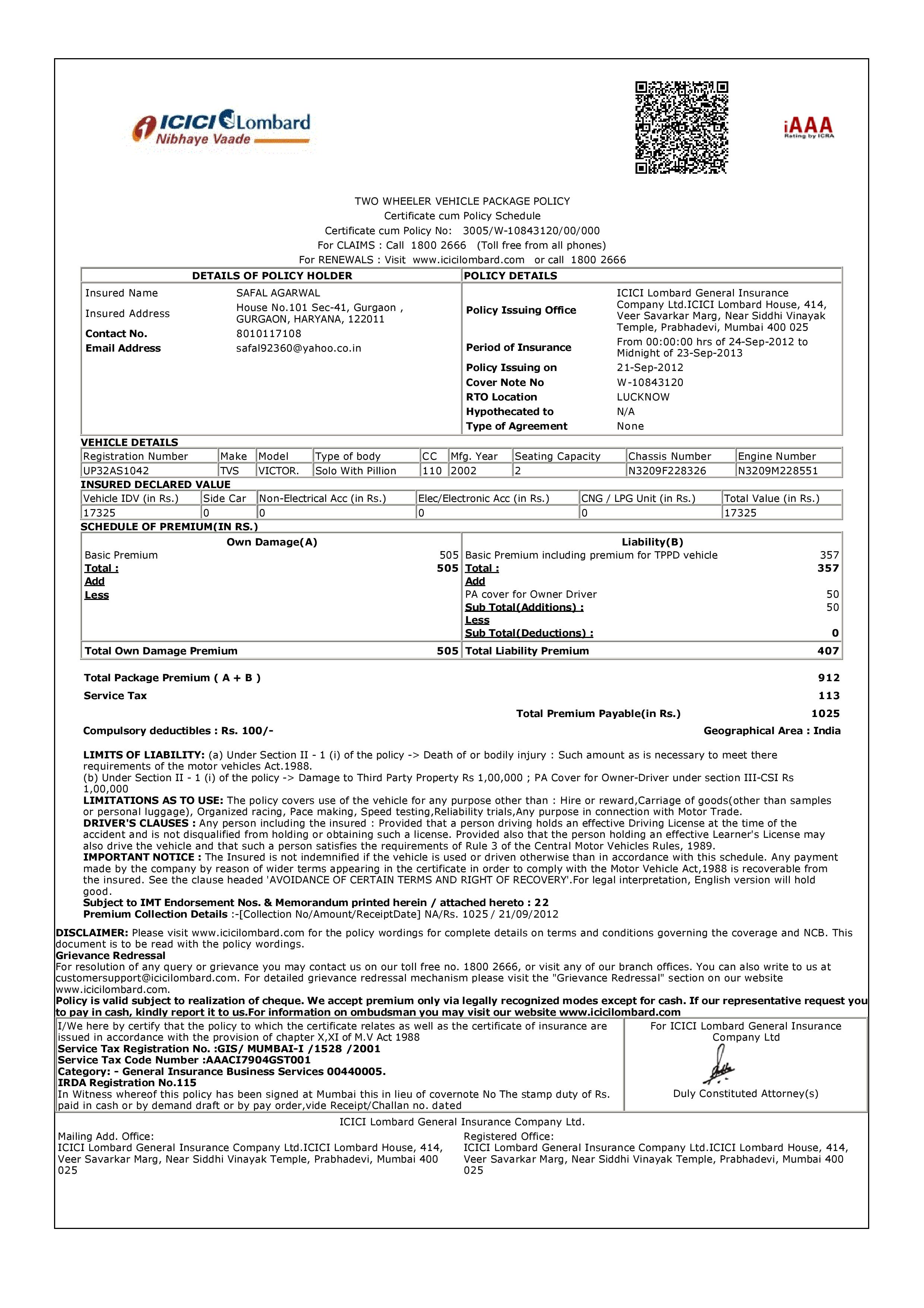

Vehicle Insurance for 3 years in 15 minutes - ICICI LOMBARD AUTO

BAJAJ ALLIANZ TWO WHEELER INSURANCE DUPLICATE COPY PDF

Bharti AXA's general insurance business to merge with ICICI Lombard