Average Cost Of Renters Insurance Per Month

Friday, May 24, 2024

Edit

Average Cost Of Renters Insurance Per Month

What is Renters Insurance?

Renters insurance is a type of insurance policy designed to protect renters from unexpected events. This type of insurance covers personal belongings, liability, and additional living expenses if an insured event occurs such as fire, smoke, theft, vandalism, etc. It also provides coverage for medical expenses if someone is injured in the rental property. Renters insurance is typically very affordable, costing an average of only a few dollars a month.

Types of Coverage Offered

Renters insurance typically provides coverage for personal belongings, liability, and additional living expenses. Personal belongings coverage typically covers items such as clothing, furniture, electronics, and other personal items in the event of theft, fire, smoke, or vandalism. Liability coverage typically includes protection against lawsuits that may arise from an injury caused by the tenant in the rental property. Additional living expenses coverage typically pays the difference between the tenant’s current rent and the cost of temporary housing should the tenant’s rental unit become uninhabitable due to an insured event.

Who Needs Renters Insurance?

Renters insurance is recommended for all tenants, regardless of their living situation. Even if the tenant does not own many personal belongings or has a landlord who provides coverage for the rental property, the tenant is still at risk of being sued if someone is injured in the rental property. Renters insurance is an easy and affordable way to protect oneself from unexpected events and lawsuits.

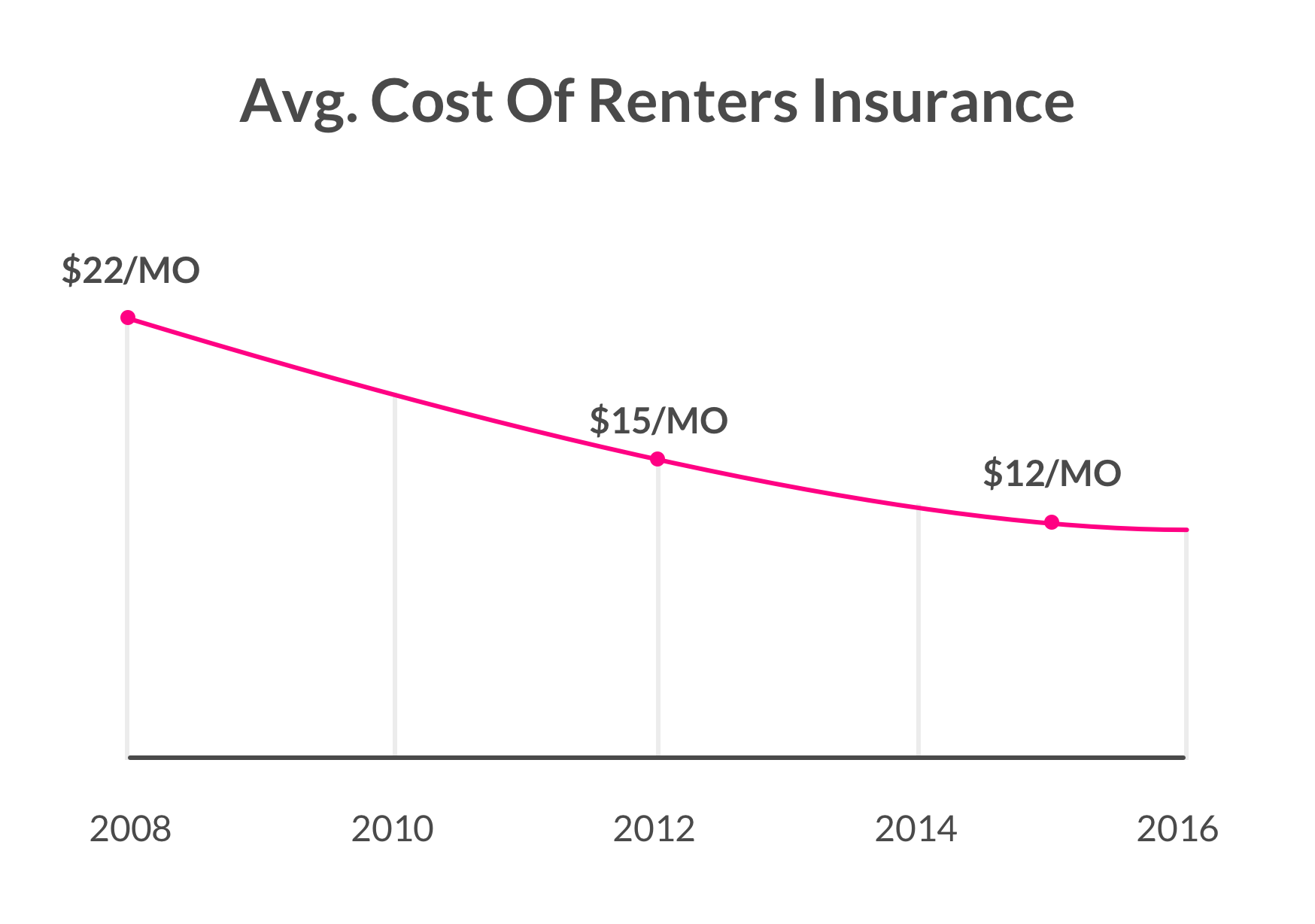

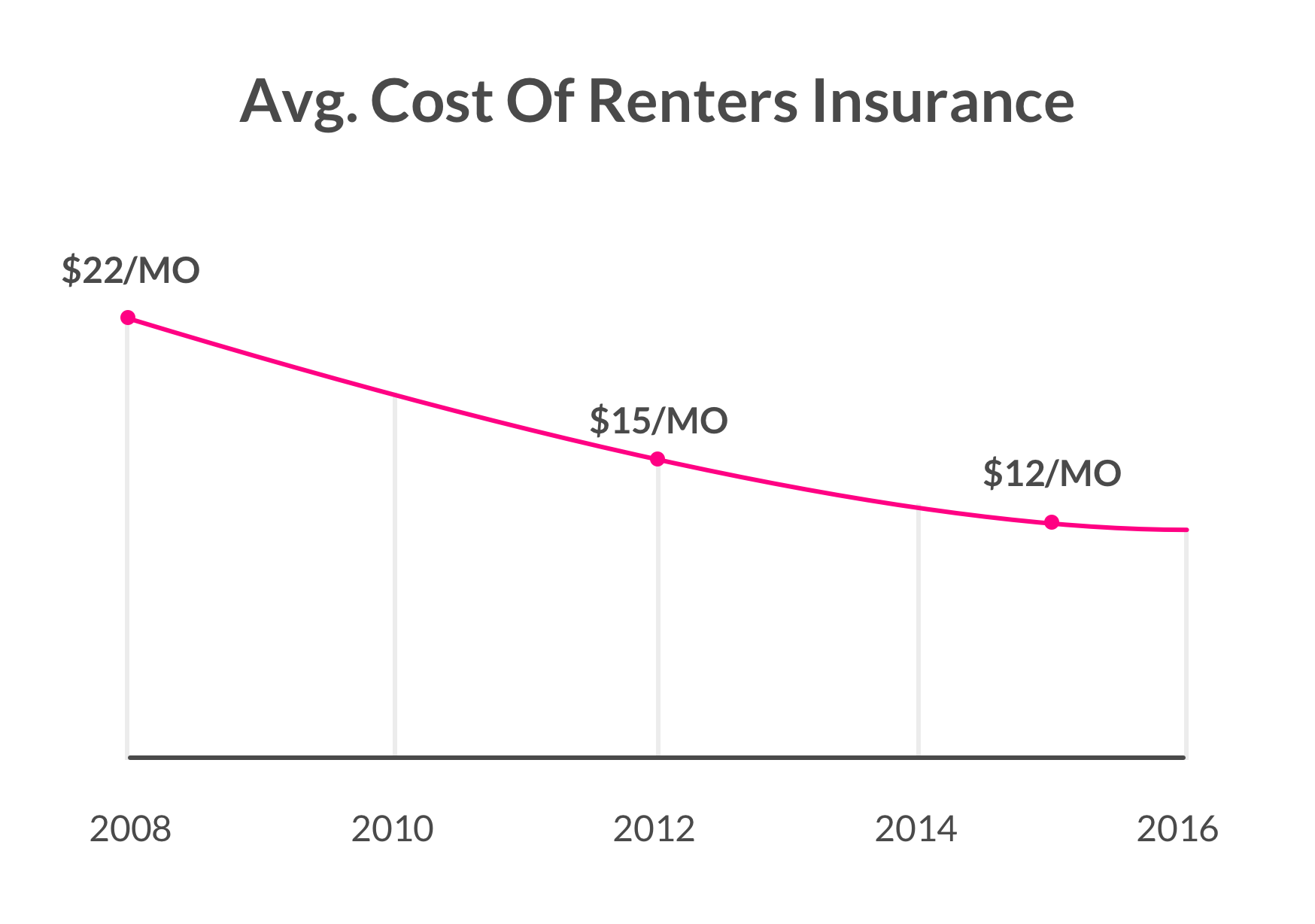

How Much Does Renters Insurance Cost?

Renters insurance typically costs anywhere from a few dollars per month to several hundred dollars per year, depending on the amount of coverage needed and the type of coverage. Generally, renters insurance policies with more coverage will cost more per month. It is important to research different policies and compare rates in order to find the most affordable renters insurance policy that meets the tenant’s needs.

What Factors Affect the Cost of Renters Insurance?

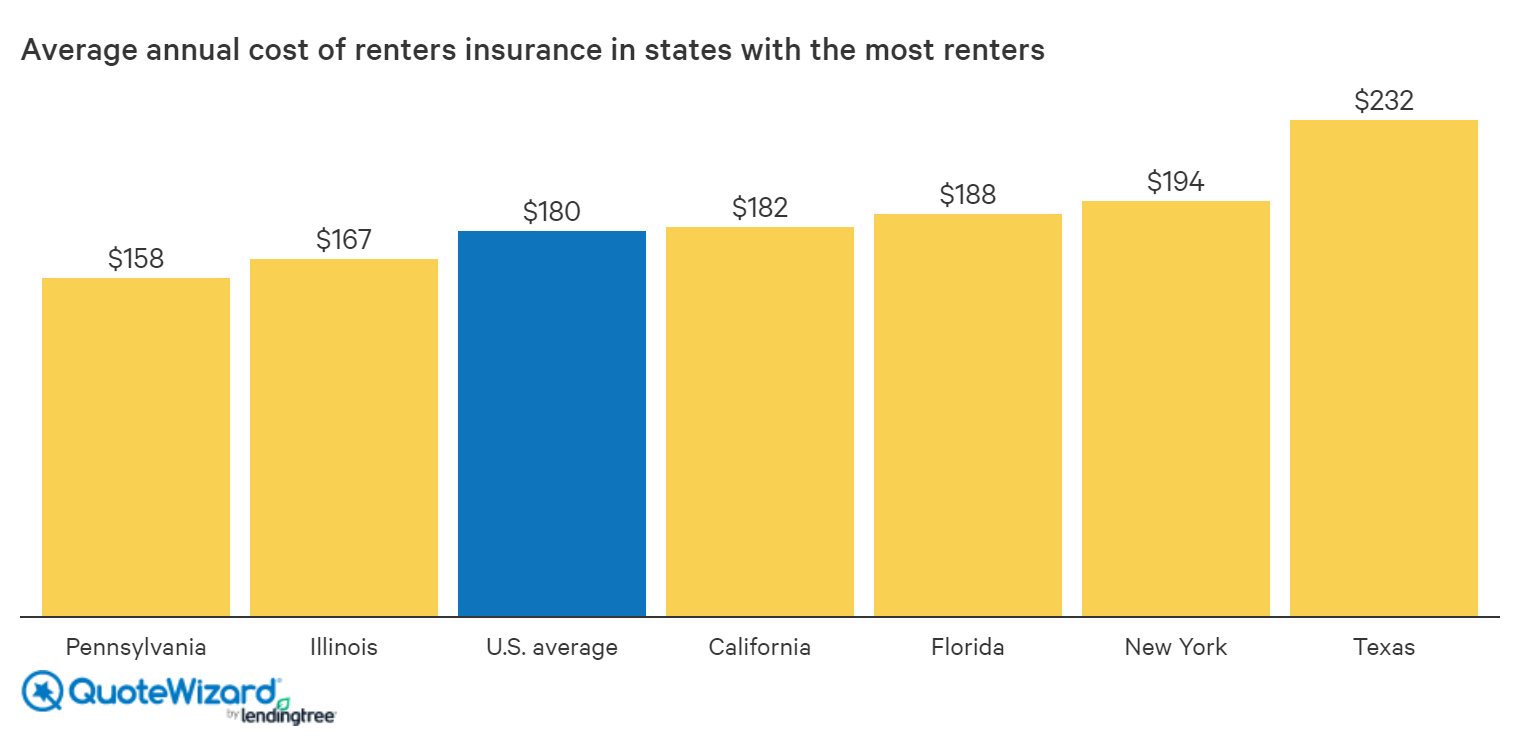

There are several factors that can affect the cost of renters insurance. The location of the rental property, the type and amount of coverage, and the tenant’s credit score are all factors that can influence the cost of the policy. In addition, some insurance companies offer discounts to tenants who bundle their renters insurance with other types of insurance policies, such as auto insurance.

Where Can I Find Cheap Renters Insurance?

The best way to find cheap renters insurance is to compare rates from different insurance companies. Many insurance companies offer online quotes, so it is easy to compare rates and find the most affordable policy. It is also important to research the company to make sure that they are reputable and offer quality coverage. Additionally, some insurance companies may offer discounts for bundling renters insurance with other types of insurance policies.

When’s The Best Time To Get Renters Insurance? | Lemonade Blog

How Much Does Renters Insurance Cost? | QuoteWizard

The Best Cheap Renters Insurance in North Carolina - ValuePenguin

Renters Insurance Cost Per Month / Erwin Insurance Hershey Pa: Average