Auto Insurance Providers In Texas

Wednesday, May 1, 2024

Edit

Auto Insurance Providers In Texas

What Is Auto Insurance?

Auto insurance is a policy you purchase to protect yourself financially should you be in an accident. It provides coverage for bodily injury liability, property damage liability, uninsured motorist, medical payments, and collision coverage. Depending on the type of coverage you choose and the deductible you select, the amount of your premium will vary. Auto insurance is required by law in most states, including Texas.

Where to Find Auto Insurance in Texas

In Texas, there are many auto insurance providers from which to choose. Most insurance companies offer a variety of plans with different coverage and deductibles. Some companies offer discounts for specific groups, such as students, seniors, military personnel, or those with good driving records. Additionally, many insurers have online tools that allow you to compare rates and coverage to find the best policy for your needs.

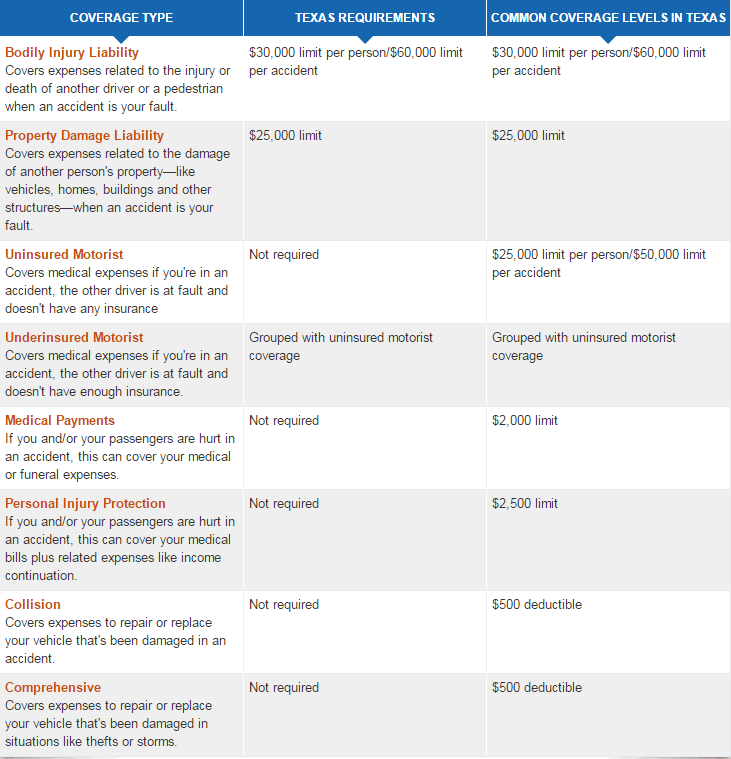

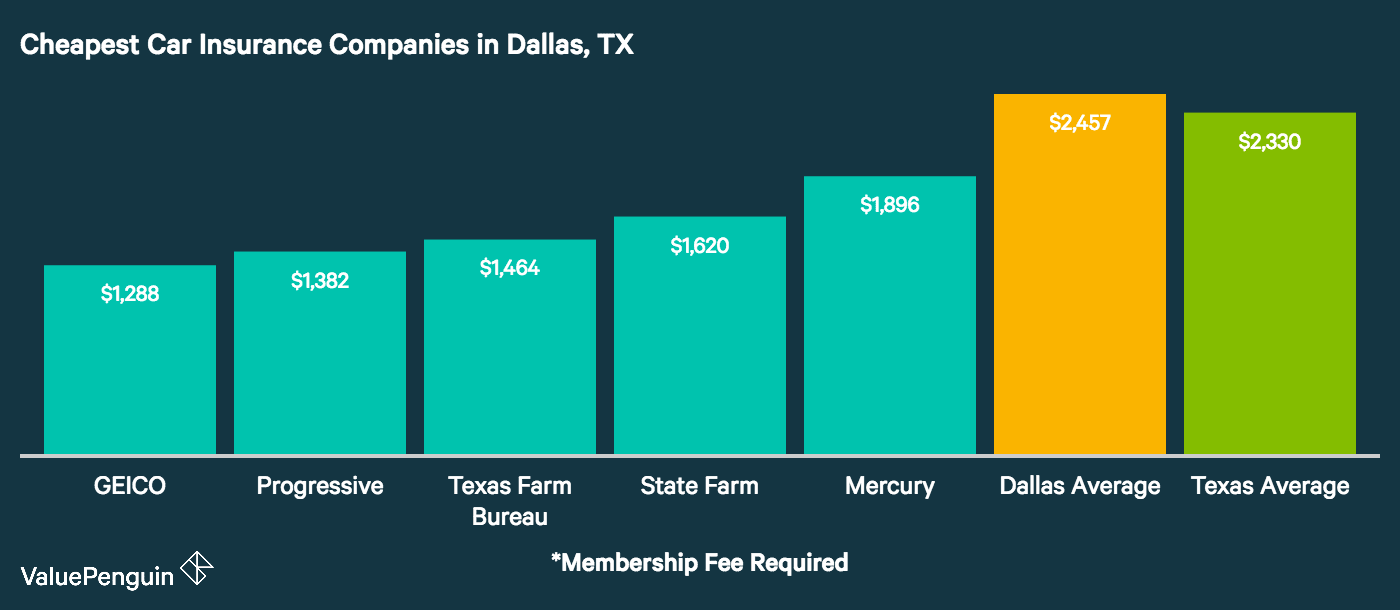

Types of Auto Insurance in Texas

In Texas, auto insurance policies are typically divided into two categories: liability coverage and comprehensive coverage. Liability insurance covers damages to another person or property if you are found to be at fault in an accident. Comprehensive coverage includes collision coverage, which pays for damages to your vehicle, as well as medical payments, uninsured motorist coverage, and roadside assistance. Depending on your needs, you can choose to purchase a policy that covers all of these types of coverage, or just the ones that are most important to you.

Cost of Auto Insurance in Texas

The cost of auto insurance in Texas varies depending on the type of coverage you select, the type of vehicle you are insuring, and your driving record. Generally speaking, the more coverage you select, the higher the premium you will pay. Additionally, some insurers offer discounts for certain groups, such as students, seniors, military personnel, or those with good driving records.

How to Find the Right Auto Insurance Provider in Texas

When looking for an auto insurance provider in Texas, it is important to shop around and compare rates. You should also make sure the provider you choose is licensed to do business in Texas and has a good reputation. Additionally, you should read the terms and conditions of the policy carefully to make sure it provides the coverage you need. Finally, you should ask any questions you have about the policy to make sure you fully understand the coverage.

Conclusion

Finding the right auto insurance provider in Texas can be a daunting task. It is important to compare rates and coverage from multiple providers to ensure you are getting the best policy for your needs. Additionally, you should make sure the provider you choose is licensed to do business in Texas and has a good reputation. Doing your research beforehand will help you make an informed decision and ensure you get the right coverage for your needs.

Low Cost Car Insurance In Houston Texas - lorek2design

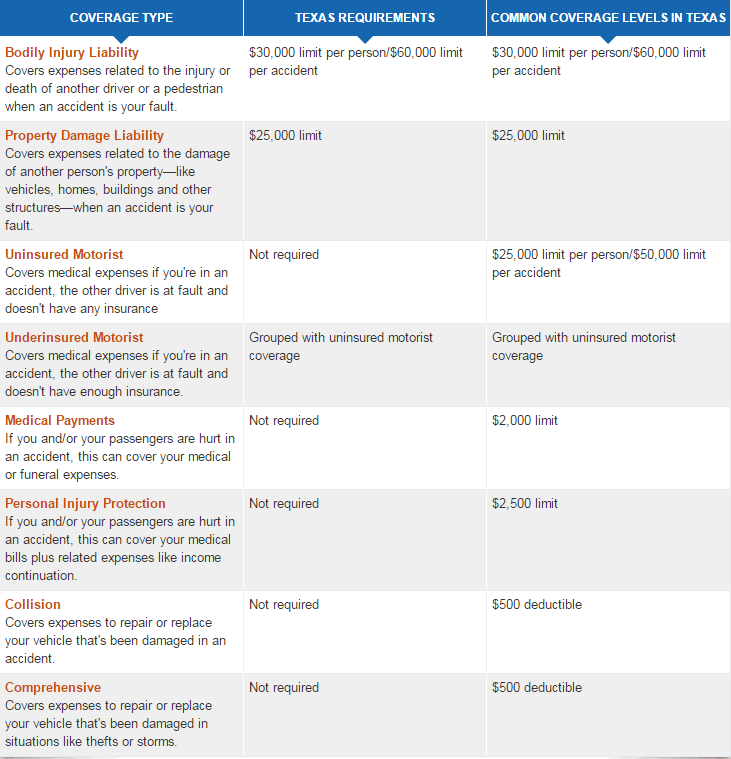

Full Coverage Auto Texas Insurance Form - Fill Online, Printable

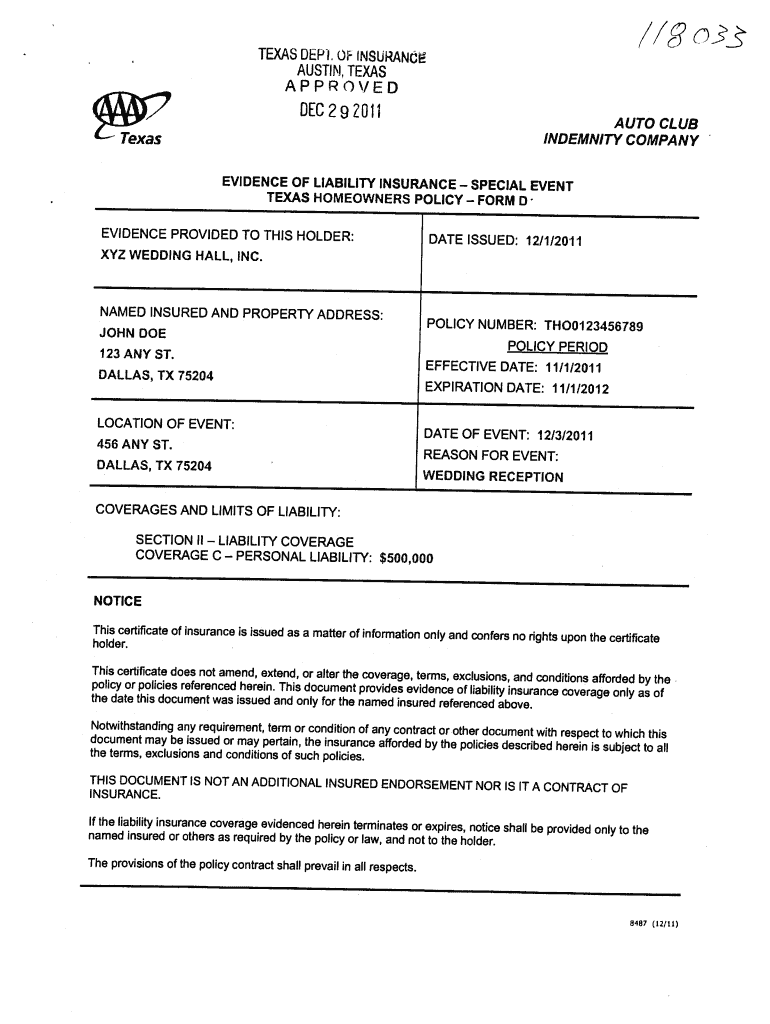

Who Has The Cheapest Auto Insurance Quotes in Dallas, TX? - ValuePenguin

A Close Look at What ACA Navigators Do to Help People Get Covered

Car Insurance Providers Australia