3rd Party Liability Insurance Switzerland

The Benefits of 3rd Party Liability Insurance in Switzerland

Switzerland is a country known for its strong economic base, strict regulations, and its modern infrastructure. This is why businesses around the world consider it to be an attractive place to operate. But despite all of these advantages, companies operating in Switzerland must pay close attention to their legal obligations, including the need to have 3rd party liability insurance.

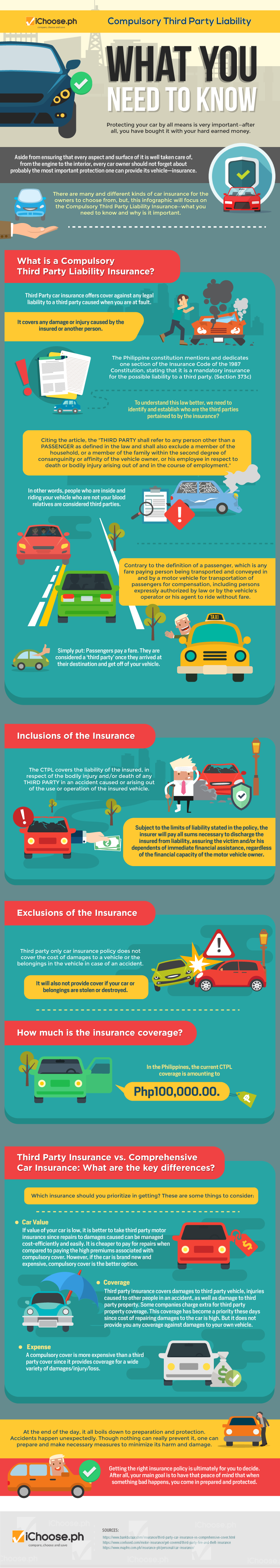

What is 3rd Party Liability Insurance?

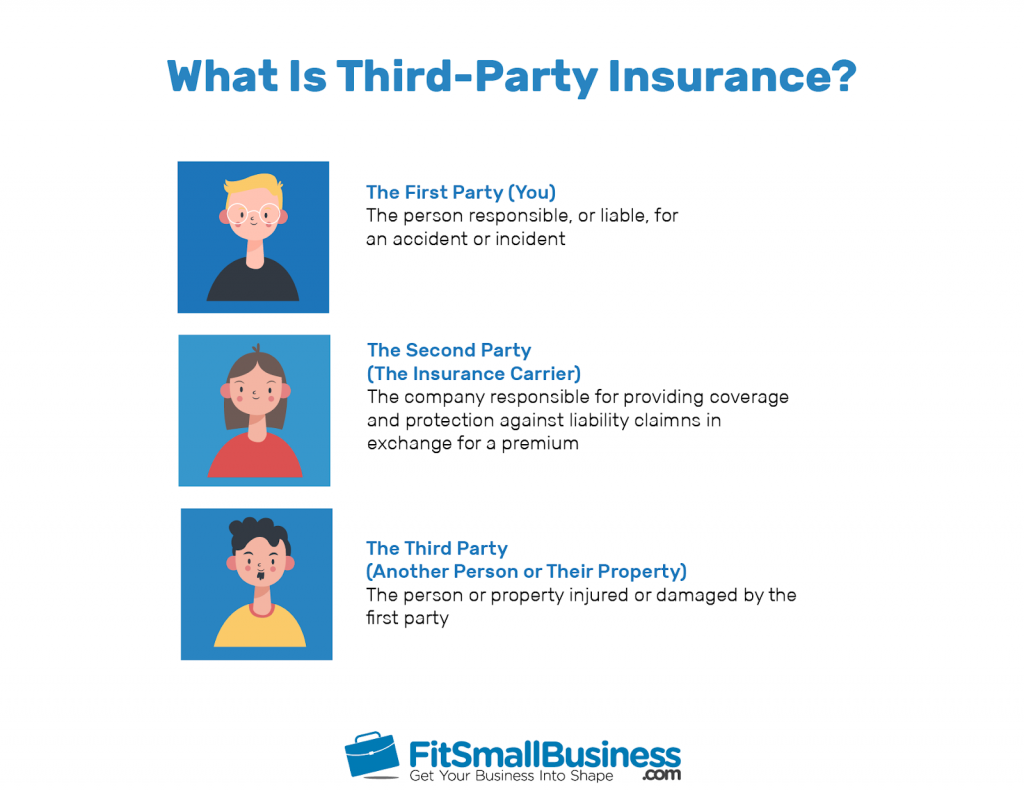

3rd party liability insurance is a type of insurance policy that provides coverage for any legal liabilities arising from damage or injury to a third party. This type of insurance is typically required for businesses operating in Switzerland, as it can be used to protect the business from financial losses resulting from legal claims. This type of insurance is also known as public liability insurance, as it covers claims from the public as well as from other businesses.

What Does 3rd Party Liability Insurance Cover?

3rd party liability insurance covers a variety of different types of liability. These include: employee injury, property damage, product liability, advertising liability, and professional liability. This type of insurance also covers the legal costs associated with defending the business against these types of claims. In addition, 3rd party liability insurance can provide coverage for any medical expenses incurred by a third party due to an injury or illness caused by the business.

Why Do Businesses Need 3rd Party Liability Insurance?

Having 3rd party liability insurance is essential for businesses operating in Switzerland, as it provides protection from financial losses resulting from legal claims. Without this type of insurance, businesses would be exposed to a significant amount of financial risk. This is why it is essential for businesses to have this type of insurance in place.

How Much Does 3rd Party Liability Insurance Cost?

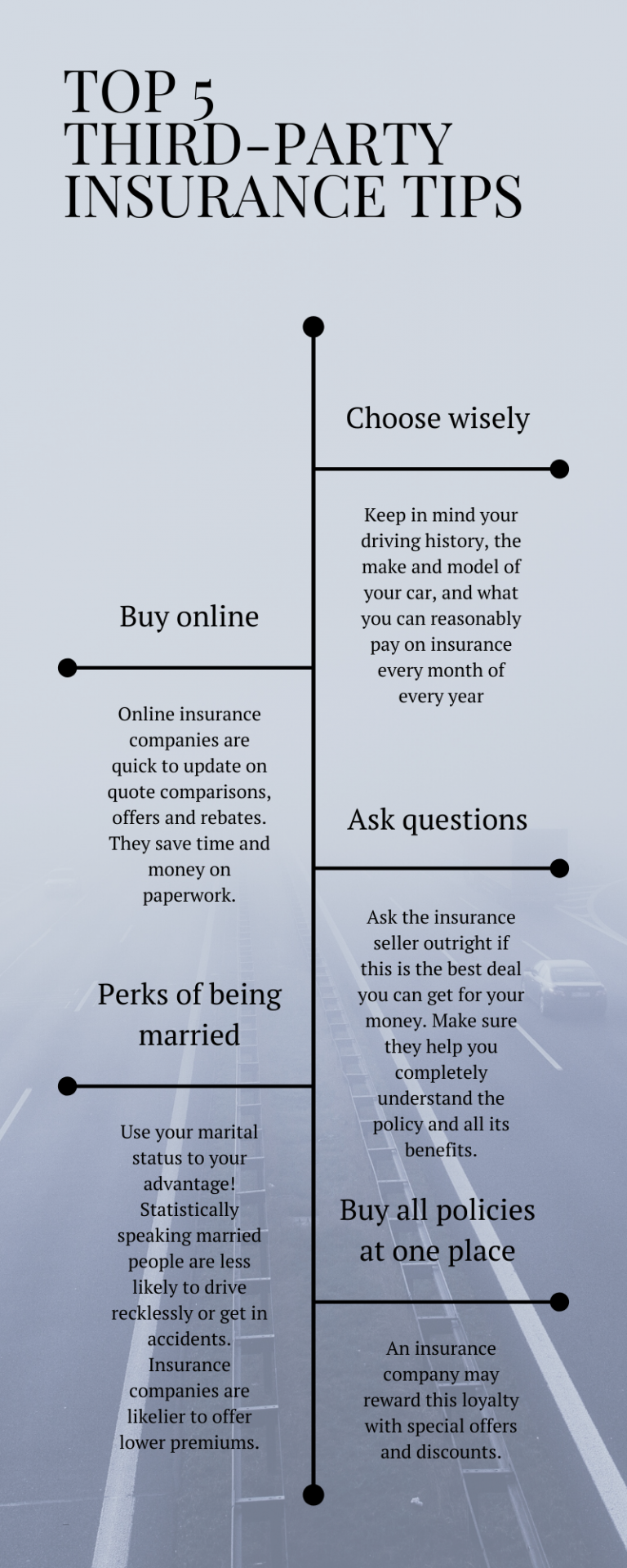

The cost of 3rd party liability insurance will vary depending on the risk associated with the business. Factors such as the size of the business, the type of goods or services offered, and the number of employees will all impact the cost of the policy. Generally, the higher the risk associated with the business, the more expensive the policy will be.

Where Can I Find More Information on 3rd Party Liability Insurance?

If you are looking for more information on 3rd party liability insurance in Switzerland, you can visit the website of the Swiss Federal Insurance Office. This website is a great resource for businesses looking for more information on this type of insurance, as it provides detailed information on the regulations and requirements for this type of policy. Additionally, you can contact a licensed insurance broker in Switzerland who can provide you with more information on 3rd party liability insurance.

How is a group insurance scheme effective? - MyAnmol Insurance

Third Party Property Car Insurance | iSelect

What Is Third-party Insurance?

What is Third Party Insurance | What is Third Party Insurance for Car

Compulsory Third Party Liability What You Need to Know | iChoose