State Farm Full Coverage Insurance Price

Thursday, April 25, 2024

Edit

State Farm Full Coverage Insurance Price

What is Full Coverage Insurance?

Full coverage insurance is a term that is commonly used to describe a combination of coverage options that may include liability, comprehensive, and collision coverage. To be considered full coverage, a policy must typically include liability protection, which helps cover the cost of damages if you cause an accident that results in injury or property damage to someone else. It also includes comprehensive and collision coverage, which protect your vehicle from damage or theft.

How Much Does State Farm Full Coverage Insurance Cost?

The cost of State Farm full coverage insurance depends on a variety of factors, such as the type of vehicle you drive, your age, driving record, and more. Generally, the average cost of State Farm full coverage insurance is around $1,200 per year. However, this can vary depending on the factors mentioned above. Additionally, you may be eligible for discounts, such as safe driver or multi-car discounts, which can help reduce your premium.

What Does State Farm Full Coverage Insurance Include?

State Farm full coverage insurance typically includes liability protection, comprehensive coverage and collision coverage. Liability coverage helps cover the costs of damages and injuries that you cause in an accident. Comprehensive coverage helps protect your car from damage caused by events such as theft, vandalism and natural disasters. Collision coverage helps cover the cost of repairing or replacing your car if it is damaged in an accident.

What Are the Benefits of State Farm Full Coverage Insurance?

State Farm full coverage insurance provides a variety of benefits, including peace of mind knowing that you are protected in the event of an accident. It also helps protect you from financial loss if you cause an accident that results in injury or property damage to someone else. Additionally, it can help cover the cost of repairs or replacement of your vehicle if it is damaged in an accident.

How Can I Get a Quote for State Farm Full Coverage Insurance?

Getting a quote for State Farm full coverage insurance is easy. You can contact your local State Farm agent or visit the State Farm website to get an online quote. When you get a quote, make sure to provide the most accurate information so that you can get an accurate quote. Additionally, you may be eligible for discounts, such as safe driver or multi-car discounts, which can help reduce your premium.

Conclusion

State Farm full coverage insurance is a great way to make sure that you are protected in the event of an accident. It includes liability protection, comprehensive coverage and collision coverage, and can help protect you from financial loss if you cause an accident that results in injury or property damage to someone else. If you are looking for full coverage insurance, contact your local State Farm agent or visit the State Farm website to get a quote.

Should you get car insurance through your credit union?

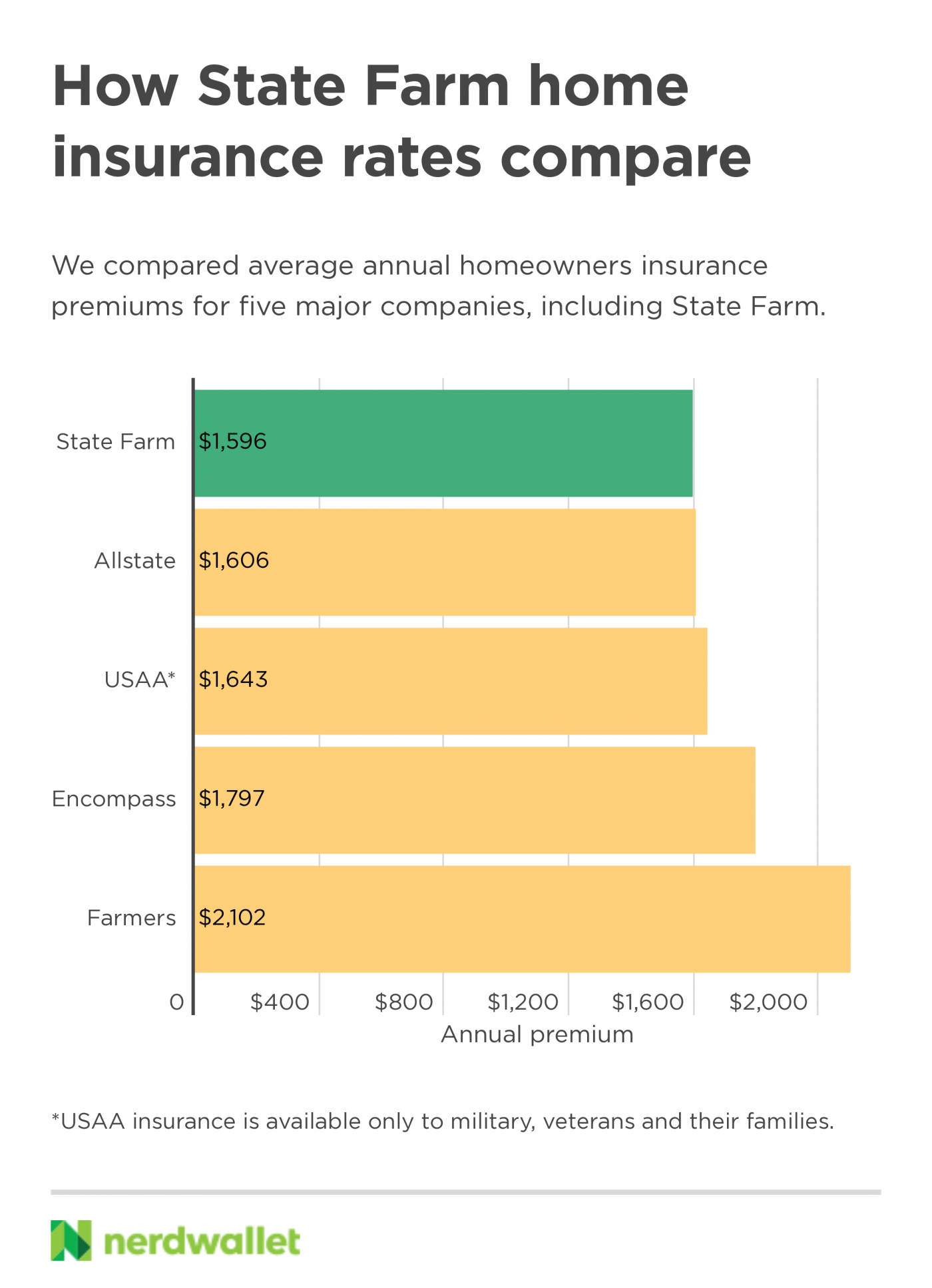

State Farm Home Insurance Review 2021 - NerdWallet

State Farm Stays Profitable Despite Higher Losses, Lower Premiums | WGLT

Top 177 Reviews and Complaints about State Farm Life Insurance

State Farm Insurance - Opening Hours - 547 Bay St, Midland, ON