Sr22 Insurance California Average Cost

Understanding the Cost of SR22 Insurance in California

What is SR22 Insurance?

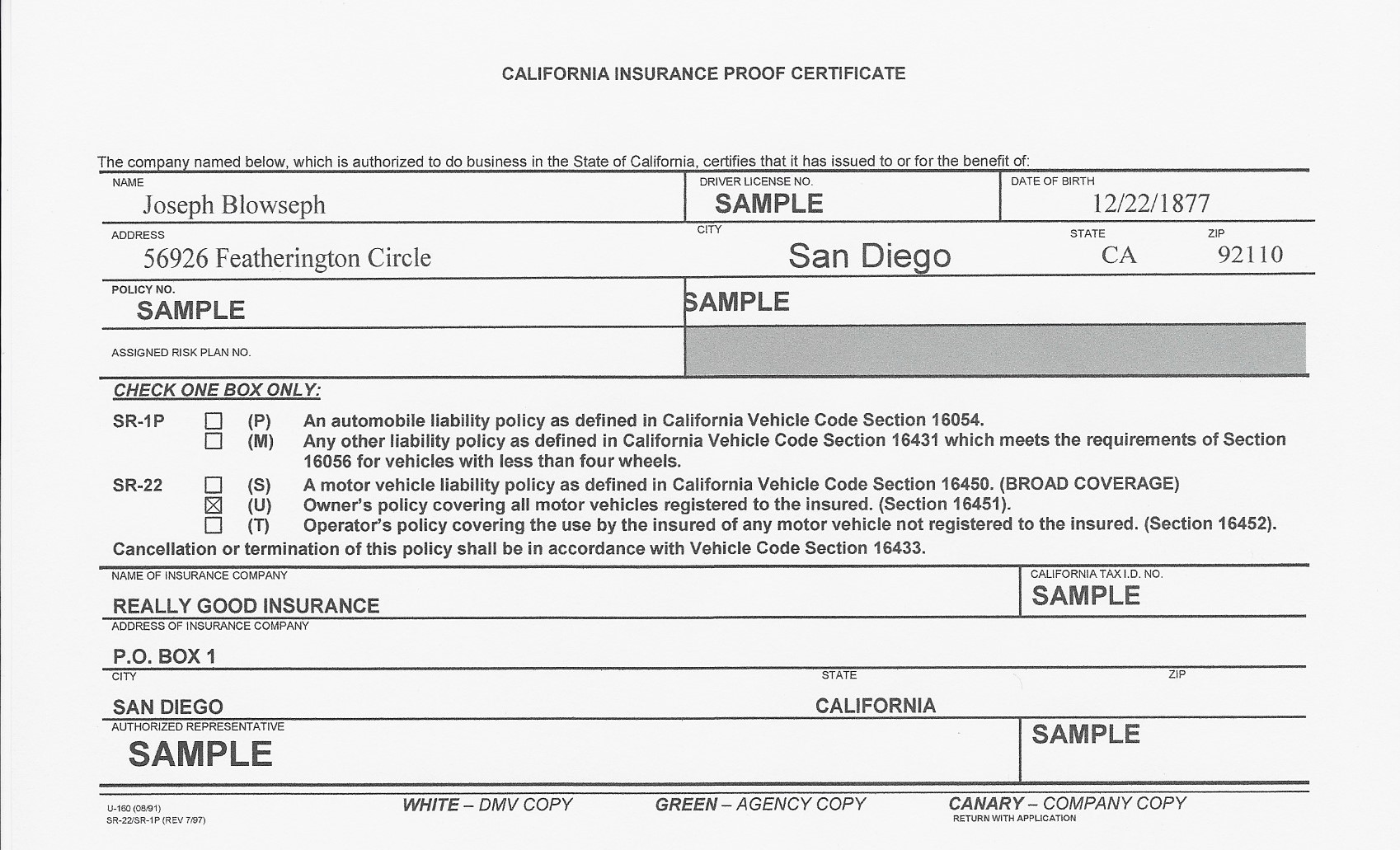

SR22 insurance, also known as a Certificate of Financial Responsibility, is a type of auto insurance that is required by the state of California for certain drivers. SR22 insurance is required for drivers whose license have been suspended due to a DUI, reckless driving or other serious offense. It is also sometimes required for drivers with multiple traffic violations or accidents. SR22 insurance is typically more expensive than regular auto insurance, and the cost can vary significantly depending on the insurance company and the driver's driving record.

What is the Average Cost of SR22 Insurance in California?

The average cost of SR22 insurance in California can vary significantly depending on the insurance company and the driver's driving record. Generally speaking, the average cost for SR22 insurance in California is between $25 and $50 per month. However, this cost can increase depending on the company and the driver's record. For instance, drivers with multiple DUIs or other serious offenses may be required to pay more for SR22 insurance. Additionally, drivers with multiple traffic violations may be required to pay more for SR22 insurance than those with a clean driving record.

What Factors Affect the Cost of SR22 Insurance in California?

The cost of SR22 insurance in California is affected by several factors, including the driver's age, driving record, and the type of vehicle they drive. Generally speaking, younger drivers tend to pay more for SR22 insurance than older drivers. Additionally, drivers with multiple DUIs, reckless driving offenses, or other serious offenses will pay more for SR22 insurance than those with a clean driving record. Lastly, the type of vehicle a driver drives can affect the cost of SR22 insurance. Drivers who drive luxury vehicles or sports cars will typically pay more for SR22 insurance than those who drive economy cars.

How Can Drivers in California Reduce the Cost of SR22 Insurance?

There are several ways that drivers in California can reduce the cost of SR22 insurance. One of the most effective ways to reduce the cost of SR22 insurance is to compare rates from several different insurance companies. This will allow drivers to find the best rate and the coverage that is right for them. Additionally, drivers can reduce the cost of SR22 insurance by taking a defensive driving course, maintaining a clean driving record, and avoiding traffic violations. Lastly, drivers can reduce the cost of SR22 insurance by increasing their deductible and reducing the amount of coverage they purchase.

Conclusion

SR22 insurance is a type of auto insurance that is required by the state of California for certain drivers. The cost of SR22 insurance in California can vary significantly depending on the insurance company and the driver's driving record. Drivers can reduce the cost of SR22 insurance by comparing rates from several different insurance companies, taking a defensive driving course, and increasing their deductible. It is important for drivers to compare rates and understand the cost of SR22 insurance before purchasing a policy.

How a California DUI Affects Car Insurance Costs, Premiums & Coverage

The CHEAPEST, non Owner SR22 Insurance! Only $15 | maricehatmaker's Blog

What is an SR22? 6 CA SR22 Filing FAQs | McCormick Insurance

How Much Is Health Insurance A Month? | Period Furniture Hardware

How Much Does SR22 Cost in Illinois