How Much Is Car Insurance Per Month On Average

How Much Is Car Insurance Per Month On Average?

Are you wondering how much is car insurance per month on average? You are not alone. Many people are trying to figure out how much they can expect to pay for their car insurance each month. The cost of car insurance varies greatly depending on a variety of factors, such as the type of car you drive, your driving record, and the insurance company you choose. Fortunately, there are a few ways to estimate how much you can expect to pay for car insurance on a monthly basis.

Factors That Affect Your Monthly Car Insurance Payment

There are several factors that can affect the monthly cost of your car insurance. The most important factor is the type of car you drive. Cars that are more expensive to repair and more likely to be stolen cost more to insure. If you drive an expensive car, you can expect your monthly car insurance bill to be higher than if you drive an inexpensive car. Additionally, cars with higher safety ratings tend to cost less to insure than cars with lower safety ratings.

Your driving record also plays a part in how much car insurance will cost you each month. If you have a clean driving record with no violations or accidents, you can expect to pay less than someone with a history of speeding tickets or DUIs. Insurance companies use your driving record to determine how likely you are to file a claim, and they set their rates accordingly.

Finally, the insurance company you choose can also have an impact on your monthly car insurance bill. Different insurance companies offer different rates, so it is worth shopping around to find the best deal. Additionally, some insurance companies offer discounts for certain groups of drivers, such as students or military personnel.

Average Cost of Car Insurance Per Month

According to the Insurance Information Institute (III), the average cost of car insurance in the United States is $139 per month. This figure, however, is just an estimate and the actual cost of car insurance will vary depending on the type of car you drive, your driving record, and the insurance company you choose. The best way to get an accurate estimate of your monthly car insurance bill is to compare quotes from multiple insurance companies.

Tips for Lowering Your Car Insurance Payment

If you are looking for ways to lower your monthly car insurance payment, there are several things you can do. First, consider raising your deductible. A higher deductible means you will pay more out-of-pocket if you need to file a claim, but it can also lower your monthly payment. You can also ask your insurance company about discounts for certain groups of drivers, such as students or military personnel.

Additionally, you can shop around for car insurance and compare rates from multiple insurance companies. Different companies offer different rates, so it is worth taking the time to compare quotes to find the best deal. Finally, you can consider switching to a different type of car that is cheaper to insure, such as a smaller, safer car.

Conclusion

The average cost of car insurance in the United States is $139 per month, but this figure can vary greatly depending on the type of car you drive, your driving record, and the insurance company you choose. To get an accurate estimate of your monthly car insurance bill, it is best to compare quotes from multiple insurance companies. Additionally, there are a few ways to lower your monthly car insurance payment, such as raising your deductible, asking about discounts, and shopping around for car insurance.

Average Cost Of Car Insurance For 19 Year Old Female - Car Retro

ALL You Need to Know About the Average Car Insurance Cost

Average Price Of Car Insurance Per Month - designby4d

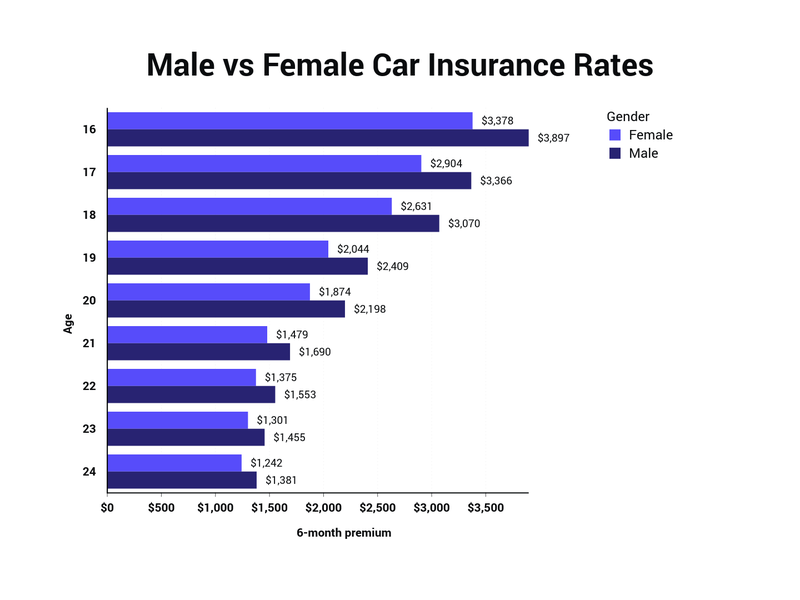

Average Car Insurance Rates by Age and Gender Per Month

32+ Teenage Car Insurance Average Cost Per Month Pics - Escanciador Sidra