Hdfc Ergo Car Insurance Policy

HDFC ERGO Car Insurance Policy: Get Maximum Benefits

A car is a prized possession for many and the idea of losing it due to any unforeseen circumstance is frightening. To prevent such losses, taking a car insurance policy is essential. HDFC ERGO car insurance policy is one of the most reliable and beneficial policies available in the market. It is designed by keeping in mind the needs of the customer. It offers both, third-party and comprehensive cover, so that customers can choose the one they need.

Advantages of HDFC ERGO Car Insurance Policy

HDFC ERGO car insurance policy provides many benefits to its customers, some of which are listed below:

- Cashless claim settlement at over 4500+ network garages across India

- 24/7 customer service

- No Claim Bonus (NCB) benefit

- Fast and hassle-free claim settlement process

- Discounts on the renewal of the policy

- Free roadside assistance

Third-party Cover

HDFC ERGO car insurance policy provides third-party cover, which is mandatory by the Indian Motor Tariff. This cover provides financial protection to the policyholder against any third-party liabilities arising out of an accident. It covers damages caused to any third-party property, as well as any bodily injury or death caused to the third-party due to the accident. This cover is provided up to a sum insured of Rs 7.5 lakh.

Comprehensive Cover

Apart from the third-party cover, HDFC ERGO car insurance policy also offers comprehensive cover. This cover provides financial protection against any damages caused to the insured vehicle due to an accident, theft, fire, explosion, self-ignition, lightning, and any other natural or man-made calamities. It also covers the costs of third-party liabilities arising out of an accident. In addition, the policy also covers personal accident cover for the owner-driver, up to a sum of Rs 15 lakh.

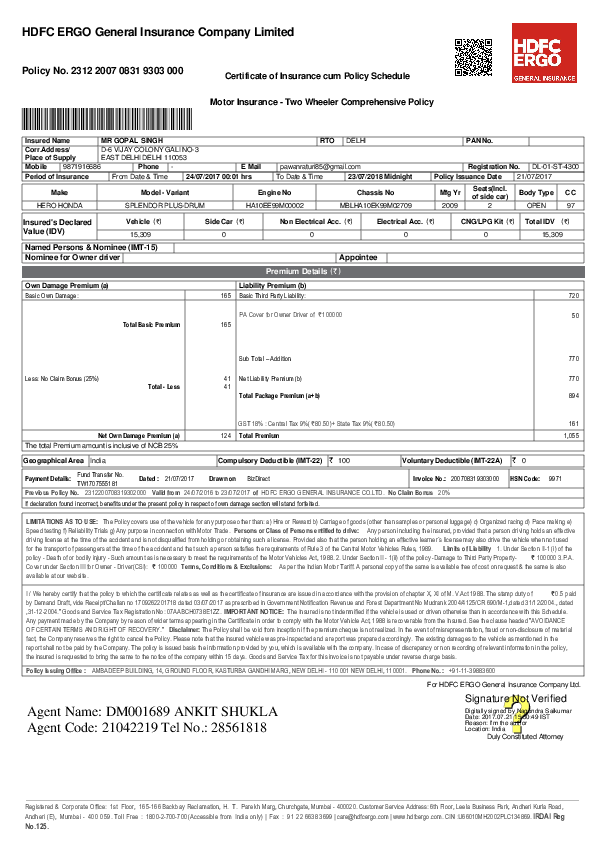

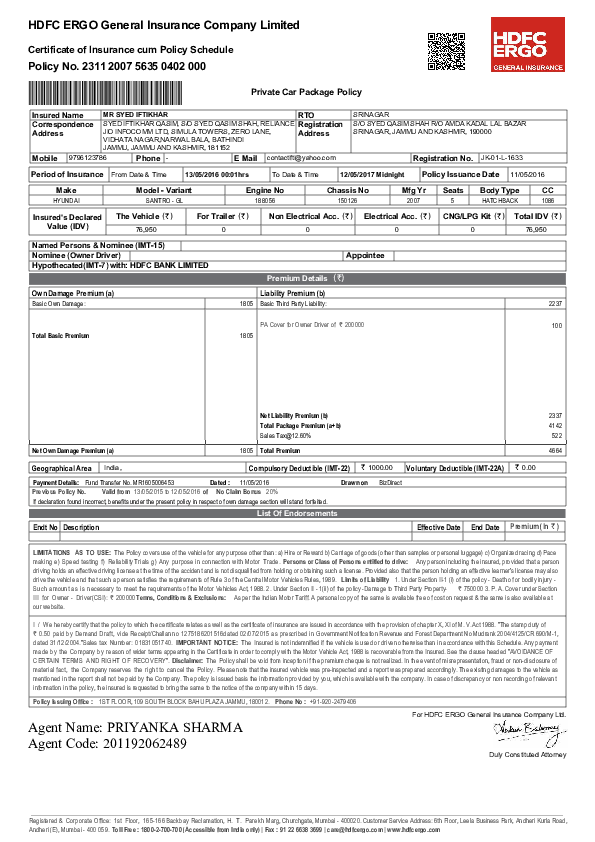

Insured Declared Value (IDV)

The Insured Declared Value (IDV) is the maximum amount that HDFC ERGO will pay in case the vehicle is declared a total loss or unrecovered. The IDV is calculated on the basis of the current market value of the vehicle, and it is revised every year at the time of renewal. The IDV is an important factor in determining the premium for the policy.

Additional Covers

Apart from the basic covers, HDFC ERGO car insurance policy also provides many optional covers that the customer can choose from. These covers include zero depreciation cover, engine and gearbox cover, consumables cover, and roadside assistance cover. The cost of these optional covers is included in the total premium of the policy.

Conclusion

HDFC ERGO car insurance policy is one of the best policies available in the market. It provides comprehensive coverage and a wide range of additional covers to its customers. The policy also offers 24/7 customer service and cashless claim settlement at over 4500+ network garages across India. So, if you are looking for a reliable and beneficial car insurance policy, then HDFC ERGO car insurance policy is the right choice for you.

Buy hdfc ergo car insurance

[PDF] HDFC ERGO Motor Car Insurance Form PDF Download in English – InstaPDF

![Hdfc Ergo Car Insurance Policy [PDF] HDFC ERGO Motor Car Insurance Form PDF Download in English – InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/hdfc-ergo-motor-car-insurance-form-1361.jpg)

Hdfc Insurance Claim Form Pdf

Hdfc Ergo Car Insurance Renewal Online India : Car Insurance Renewal