Email Hastings Direct Car Insurance

A Comprehensive Guide to Hastings Direct Car Insurance

What is Hastings Direct Car Insurance?

Hastings Direct Car Insurance is a leading insurance company that provides motor insurance for a range of car types. It offers comprehensive car insurance that can be tailored to suit the needs of the policyholder. It has been providing car insurance for over 30 years, and its policies are designed to provide coverage for most types of cars, including vans, trucks, and motorbikes.

Hastings Direct Car Insurance offers a range of different policies that are designed to suit a variety of budgets and needs. It has a range of policies that can be tailored to provide coverage for any type of car, and its policies are designed to be both flexible and affordable. It also offers special discounts for certain types of drivers, such as those who are over 50 or have a good driving record.

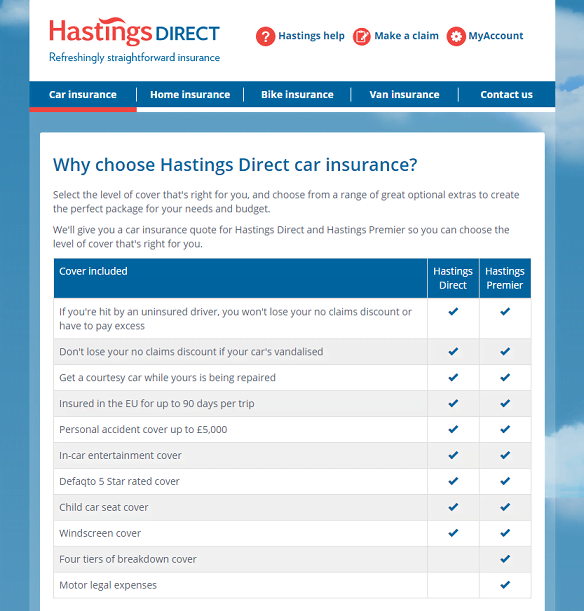

What Does Hastings Direct Car Insurance Cover?

Hastings Direct Car Insurance provides a range of cover for the policyholder, including liability and personal injury protection. It also offers a number of optional extras that can be added to the policy to provide additional cover. These extras include breakdown cover, windscreen cover, and legal protection.

The liability cover provided by Hastings Direct Car Insurance covers any damage caused by the policyholder's car to another person, vehicle, or property. The personal injury protection covers medical expenses, loss of earnings, and other expenses related to any injuries suffered by the policyholder.

Hastings Direct Car Insurance also provides additional cover for any damage caused to the policyholder's car, such as theft or vandalism. It also provides cover for any legal costs incurred in defending the policyholder against a claim for damages.

What Are the Benefits of Hastings Direct Car Insurance?

Hastings Direct Car Insurance offers a number of benefits to its customers, including competitive premiums and a range of discounts. It also provides a range of additional services, such as breakdown cover and legal protection.

The company also offers a range of discounts for certain types of drivers, such as those who are over 50 or have a good driving record. It also offers discounts for customers who have more than one car insured with them.

In addition, Hastings Direct Car Insurance offers a range of other services, such as a 24-hour claims helpline and online tools to help manage the policy. It also offers a range of discounts for customers who pay their premiums in full or by direct debit. These discounts can help to make the policy more affordable.

How Do I Get A Quote for Hastings Direct Car Insurance?

To get a quote for Hastings Direct Car Insurance, customers can either call the company directly or visit their website. On the website, customers can enter their details to receive a quote for car insurance.

When getting a quote, it is important to provide accurate and up-to-date information. This will help the company to provide an accurate quote.

When customers receive a quote, they can compare it with other quotes from other insurers to ensure they are getting the best deal.

What Else Should I Know About Hastings Direct Car Insurance?

Hastings Direct Car Insurance is committed to providing excellent customer service and strives to provide its customers with the best possible experience. The company is also committed to providing competitive prices and a range of discounts to help customers save money on their car insurance.

Hastings Direct Car Insurance is part of the Hastings Group, which has been providing car insurance for over 30 years. The company is financially secure and is regulated by the Financial Conduct Authority.

The company is also accredited by the British Insurance Brokers Association, which is a professional body that ensures companies meet high standards of service and professionalism.

Conclusion

Hastings Direct Car Insurance is a leading provider of car insurance in the UK. It offers a range of policies that can be tailored to suit the needs of the policyholder. It also provides a range of additional services, such as breakdown cover and legal protection, that can help to make the policy more affordable.

The company is committed to providing excellent customer service and providing competitive prices and a range of discounts. It is also regulated by the Financial Conduct Authority and is accredited by the British Insurance Brokers Association.

Car MyAccount | Manage Your Policy Online | Hastings Direct

New Drivers Insurance - Car Insurance - Hastings Direct SmartMiles

Hastings Direct Car Insurance January Discount Offers & Cashback Deals

Hastings Direct Car Insurance Contact Details / Hastings car insurance

Hastings Direct Car Insurance cashback, discount codes and deals