Does Credit Card Insurance Cover Turo

Does Credit Card Insurance Cover Turo?

What is Credit Card Insurance?

Credit card insurance is a type of insurance provided by credit card companies to protect cardholders in the event of certain losses or losses due to theft, damage, or accidents. Credit card insurance typically covers items purchased with the card, such as a laptop, jewelry, or electronics. It can also provide protection from fraudulent charges or lost items. Credit card insurance is an important safety net for consumers, as it can help to reduce losses and provide peace of mind.

Does Credit Card Insurance Cover Turo?

The answer to this question is yes and no. Credit card insurance generally does not cover damage to vehicles rented through a car-sharing service, such as Turo. However, some credit card companies may offer additional coverage for car rentals through such services. Be sure to check with your credit card provider to see if they offer such coverage. Additionally, Turo provides its own insurance coverage for rentals, so it is important to read the terms and conditions carefully before renting a vehicle.

What Does Turo Insurance Cover?

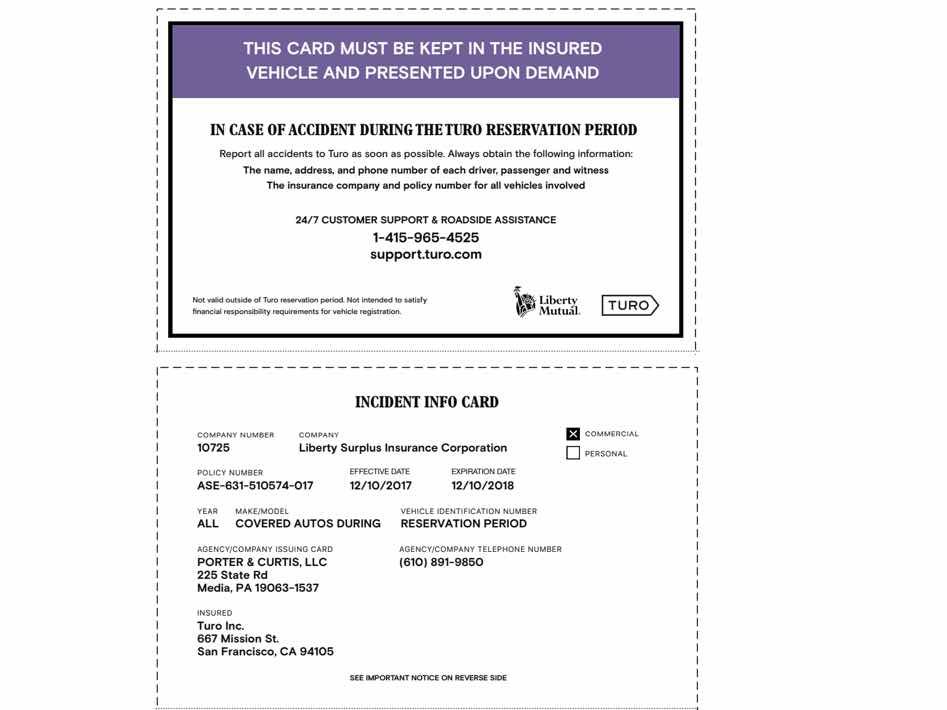

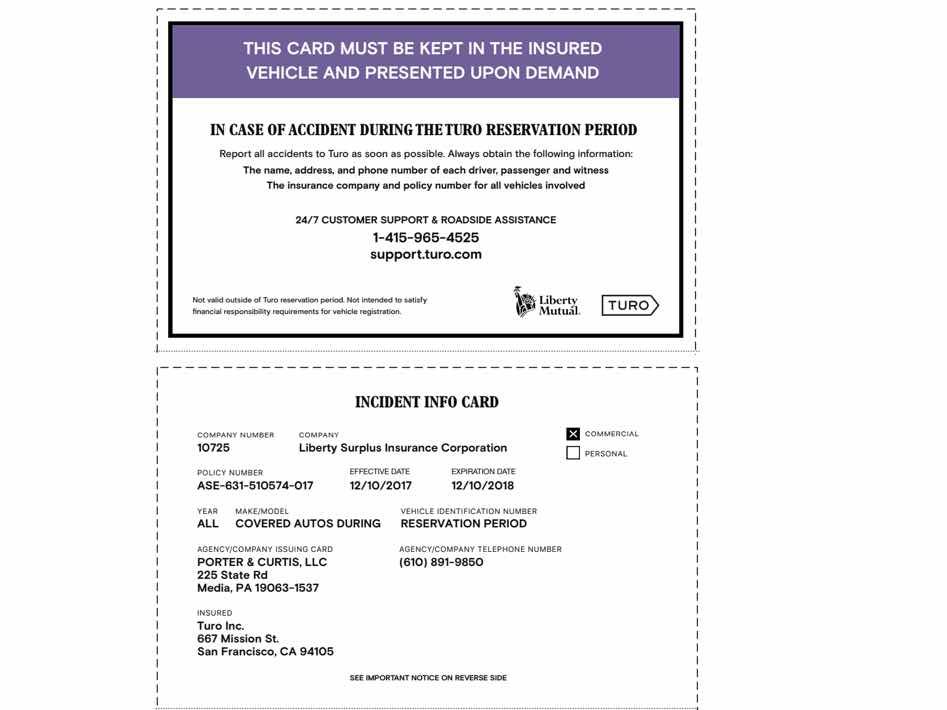

Turo provides insurance for its rentals that covers damage to the vehicle and liability. The liability coverage covers any damages you may cause to other people or property while driving the rental vehicle. The damage coverage covers any damage to the rental vehicle resulting from an accident, theft, or vandalism. Turo also covers some towing and roadside assistance costs. However, it’s important to note that the Turo insurance does not cover damage to personal property, such as your luggage, or medical expenses in the event of an accident.

What Steps Should I Take If I Need To Make a Claim?

If you need to make a claim on your credit card insurance or Turo insurance, it is important to be prepared. First, make sure you have all the necessary documents and information ready. This includes a copy of your rental agreement, photos of the damage, police report (if applicable), and any other relevant documents. Then, contact your credit card provider or Turo to begin the claim process. Be sure to provide all the necessary information and follow their instructions to the letter.

Conclusion

Credit card insurance does not typically cover damage to vehicles rented through car-sharing services, such as Turo. However, some credit card companies may offer additional coverage for such rentals. Additionally, Turo provides its own insurance coverage for rentals, so it is important to read the terms and conditions carefully before renting a vehicle. Finally, if you need to make a claim on your insurance, be sure to have all the necessary documents and information ready, and follow your provider’s instructions.

Pros and Cons of Turo Car Rental for Travellers – Sling Adventures

Turo, the 'Airbnb for cars,' could upend the car-rental industry

How Does Turo Insurance Work : Host Tips How Insurance Works On Turo

Does Amex Cover Turo?-(Credit Card Insurance, Coverage Through Turo+

Credit Card Keywords List - Credit card icon isolated - Download Free