Average Increase Of Price Of Insuring 2 Cars

Average Increase Of Price Of Insuring 2 Cars

How Much More You Have to Pay When Insuring Two Cars

When you own two cars, you may be considering combining them into one insurance policy. After all, it could be more convenient to have all your cars insured in one place. But, you may also be wondering if it is worth the extra cost to insure two cars. Unfortunately, you will usually pay more if you insure two cars under one policy.

The exact amount you will pay depends on the types of cars you have, the types of coverage you need, and the company you are insured with. Generally speaking, you can expect to pay an extra 10 to 25 percent more if you add a second car to your policy. For example, if you are currently paying $800 per year for one car, you may pay an extra $100 to $200 per year for the second car.

Factors That Influence the Cost of Insuring Two Cars

There are several factors that can influence the cost of insuring two cars. The first factor is the age and condition of the cars. Older cars often require more coverage due to their age, and more expensive cars may require more coverage in order to fully protect them. The type of coverage you need can also influence the cost of insuring two cars. For example, comprehensive coverage is generally more expensive than liability coverage.

The type of car you own can also influence the cost of insuring two cars. Sports cars and luxury cars often require more coverage due to their higher replacement cost. In addition, the type of car you own can affect your insurance rate. For example, if you own a car that is commonly stolen or has a high rate of accidents, your insurance rate will be higher.

Finally, the company you choose to insure your two cars can also affect the cost. Different companies offer different rates, so it is important to compare rates from several different companies. This will help you find the best rate for your situation.

Tips for Saving Money on Two Car Insurance

If you are looking for ways to save money on your two car insurance, there are a few tips you can follow. First, make sure you shop around for the best rate. Different companies offer different rates, so you should compare rates from several different companies to find the best deal.

You should also consider raising your deductible. A higher deductible can lower your premiums, but you should be sure you can afford to pay the deductible if you ever need to make a claim. You should also consider increasing your liability coverage. This will help protect you in the event of an accident.

Finally, consider bundling your two car insurance policies. Many companies offer discounts if you combine your policies, so this could help you save money in the long run. With a little bit of research and comparison shopping, you should be able to find a policy that is both affordable and provides the coverage you need.

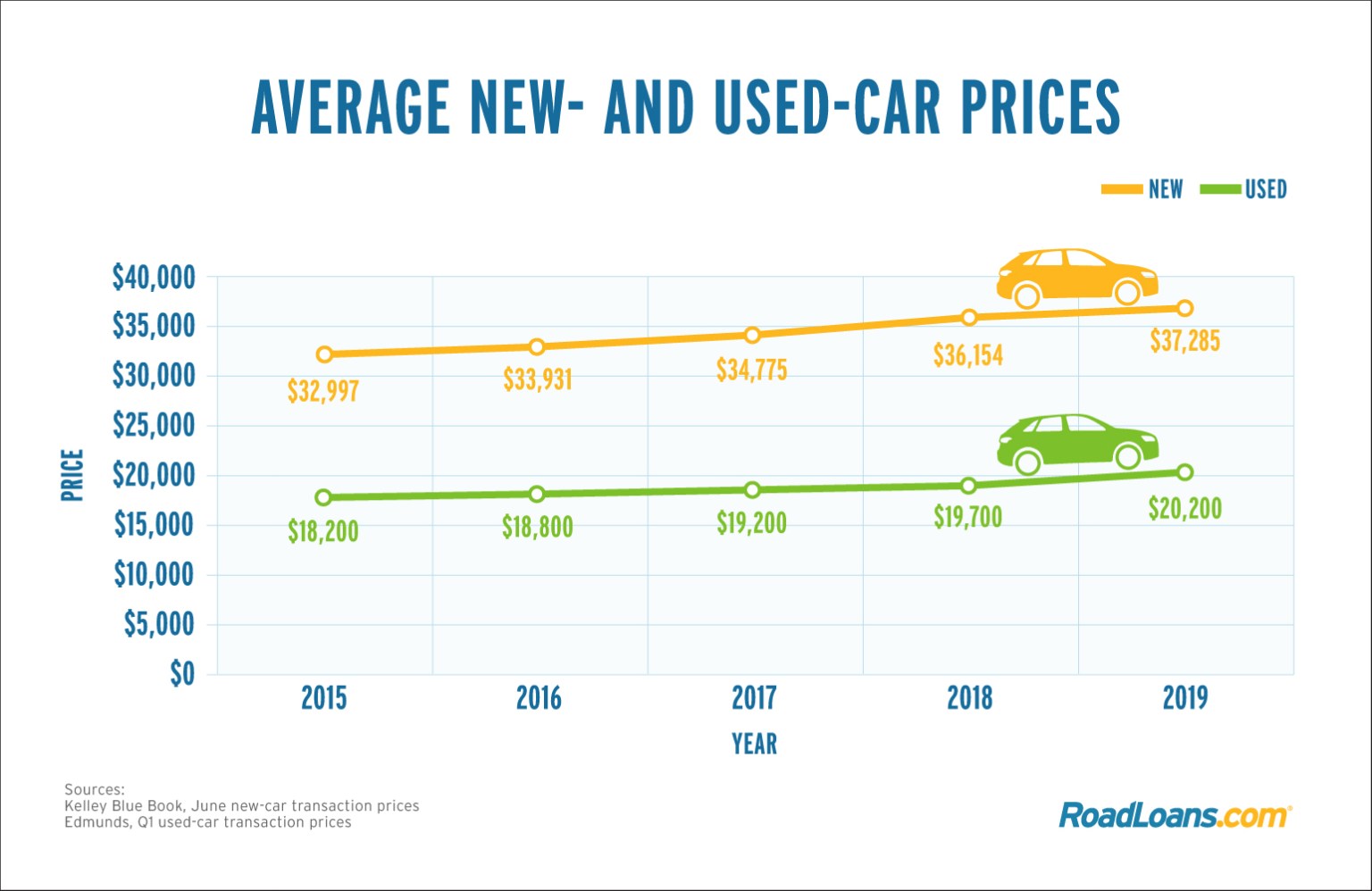

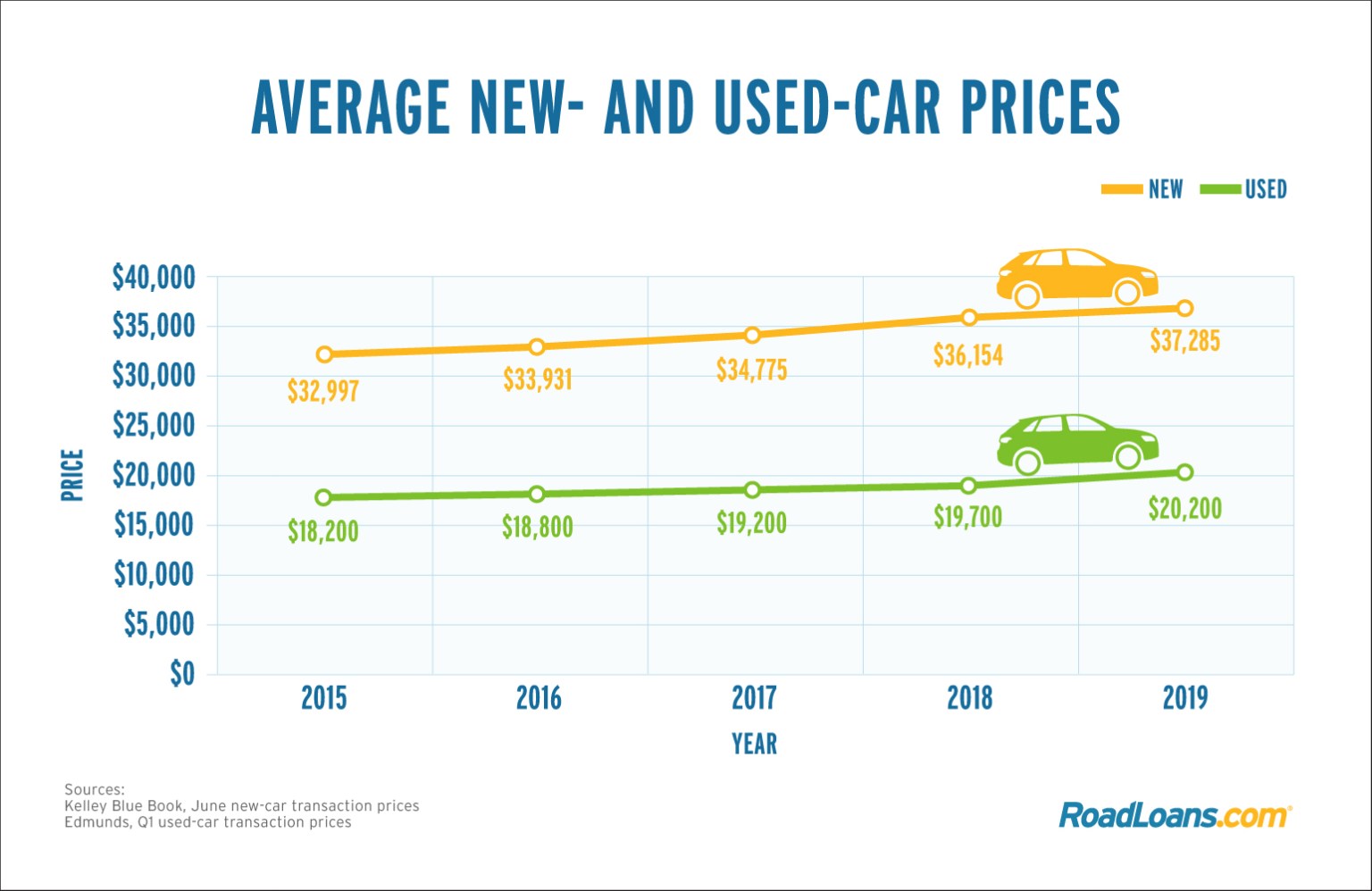

Why used cars offer ‘compelling alternative’ to new as average prices

Average Cost of Car Insurance UK 2020 | NimbleFins

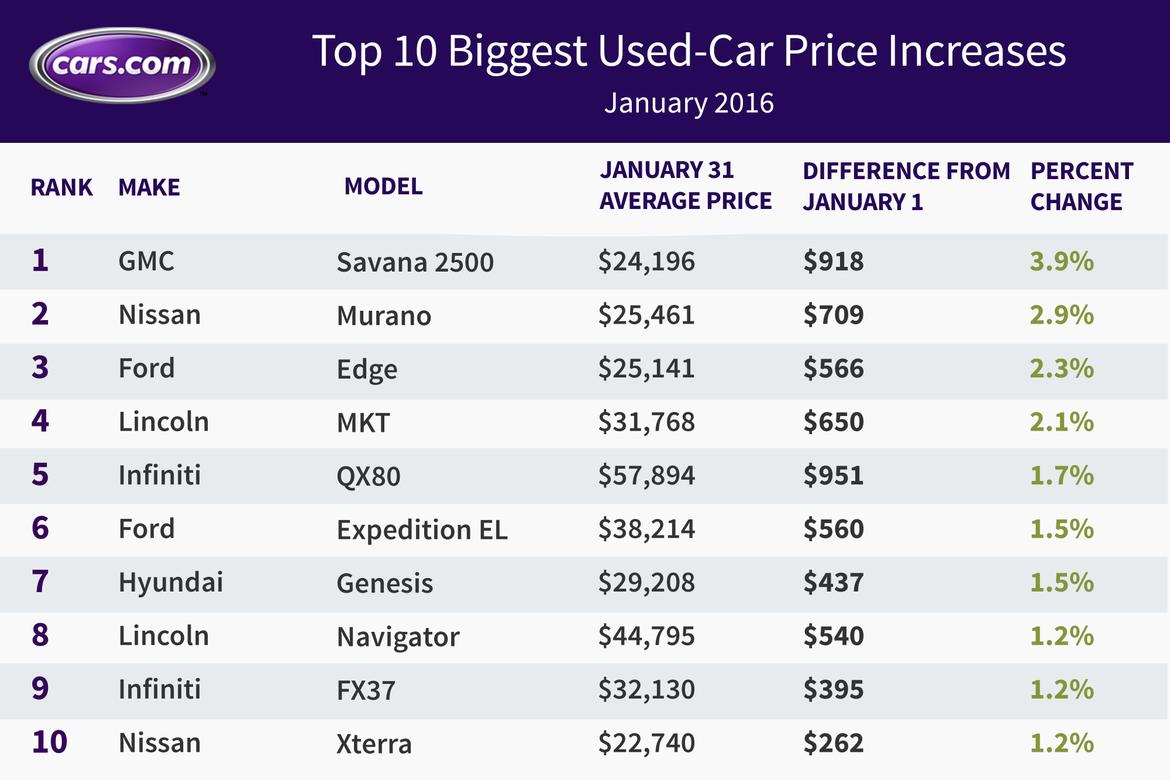

Used Luxury-Car Prices Fall, SUV Values Rise in January | News | Cars.com

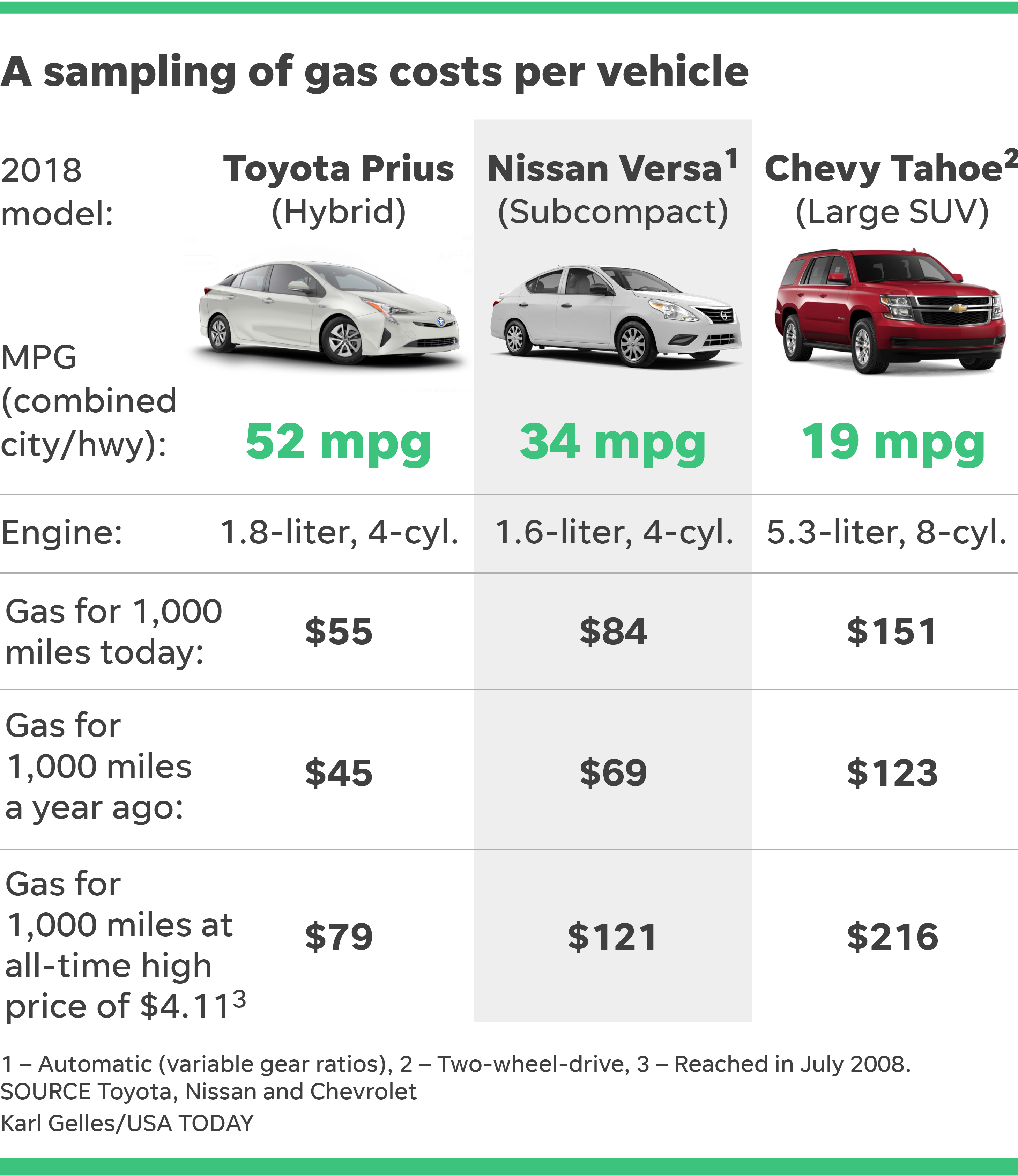

With gas prices going up, what's it cost to fill up your car?

The prices of used cars are rising as demand exceeds supply