Auto Insurance That Charges By The Mile

Friday, April 5, 2024

Edit

Auto Insurance That Charges By The Mile

An Overview Of Mileage-Based Insurance

Mileage-based insurance is a type of auto insurance that charges customers based on the number of miles they drive in a year. This type of insurance is becoming increasingly popular as more and more people are opting for rideshares and car sharing services, and for those who don’t drive very often, it can provide substantial savings. This type of insurance is also beneficial for those who drive a lot, as it rewards them for their safe driving habits.

Mileage-based insurance works by tracking the number of miles the insured driver has driven in a particular period of time. The insurance company then sets a rate based on the number of miles driven and typically provides a discount for drivers who drive fewer miles. This type of insurance is also beneficial for those who drive a lot, as it rewards them for their safe driving habits. Additionally, mileage-based insurance can be tailored to the individual’s needs, so that the driver is only paying for the coverage they need.

Benefits Of Mileage-Based Insurance

Mileage-based insurance has a number of benefits, both for the insured driver and the insurer. Insurance companies can save money by reducing their risk exposure, as they are only providing coverage for the miles that are actually driven. The insured driver also benefits, as they are able to save money on their insurance premiums.

For those who don’t drive very often, such as retirees or those who use rideshares or car sharing services, mileage-based insurance can provide significant savings. This type of insurance rewards drivers for their safe driving habits, as those who drive fewer miles will pay less in premiums. Additionally, mileage-based insurance can be tailored to the individual’s needs, so that the driver is only paying for the coverage they need.

Drawbacks Of Mileage-Based Insurance

Mileage-based insurance does have some drawbacks as well. The primary drawback is that it can be difficult to accurately track the number of miles driven, as the insured driver must manually enter the information into the insurer’s system. Additionally, some insurance companies may not offer mileage-based insurance in all states, so it’s important to check with your insurer to see if it is available in your state.

Mileage-based insurance can also be difficult for those who travel frequently, as the insurance company may not be able to accurately track the number of miles driven in other states. Additionally, those who drive a lot may not benefit from this type of insurance, as they may end up paying more in premiums than they would with a traditional insurance policy.

Choosing The Right Mileage-Based Insurance

When choosing a mileage-based insurance policy, it’s important to compare different policies to find the one that best meets your needs. It’s also important to consider the type of vehicle you drive and how much you drive, as this will affect the amount you pay in premiums. Additionally, it’s important to consider the coverage offered by the policy, as some policies may provide more coverage than others.

It’s also important to read the fine print of the policy to make sure you understand the coverage offered and any restrictions that may apply. Additionally, it’s important to check with your insurer to make sure they offer mileage-based insurance in your state.

Conclusion

Mileage-based insurance can be a great option for those who don’t drive often, as it can provide significant savings. However, it’s important to do your research and compare different policies to make sure you are getting the coverage you need at the best price. Additionally, it’s important to read the fine print of the policy to make sure you understand the coverage offered and any restrictions that may apply.

Sardilli Says: A Family Insurance Agency: Pay-Per-Mile Auto Insurance

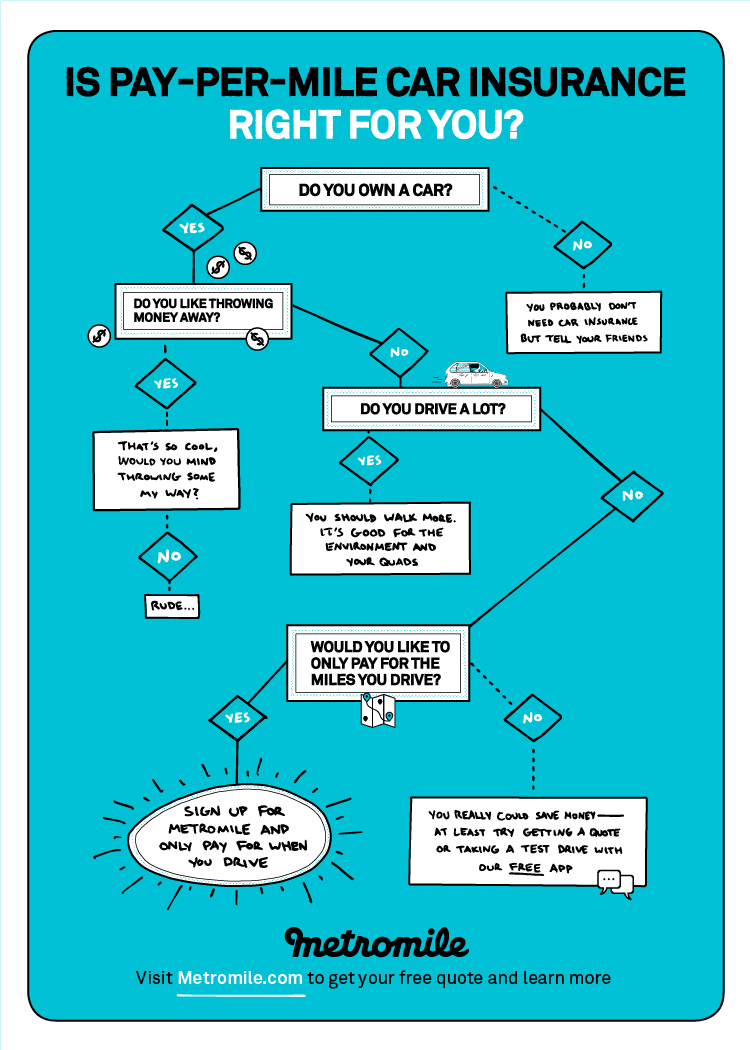

Quiz: Is Pay-per-mile Car Insurance Right for You?

Car Insurance Costs by State | Money

Average Price Of Car Insurance Per Month - designby4d

Auto insurance quote california - insurance