What Does The Average Person Pay For Car Insurance

What Does The Average Person Pay For Car Insurance?

How Much Does Car Insurance Cost?

When it comes to car insurance, there is no one-size-fits-all answer to what the average person pays for car insurance. Rates vary from person to person and are based on a variety of factors such as age, driving record, type of vehicle, and even the area in which you live. Generally, however, the national average for car insurance is about $1,500 per year.

Factors That Affect Car Insurance Rates

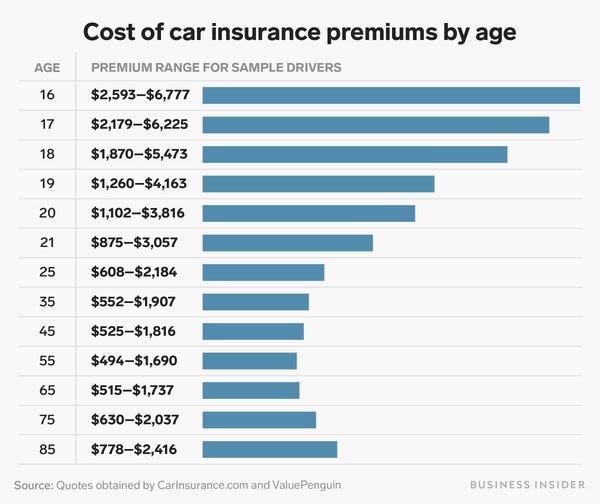

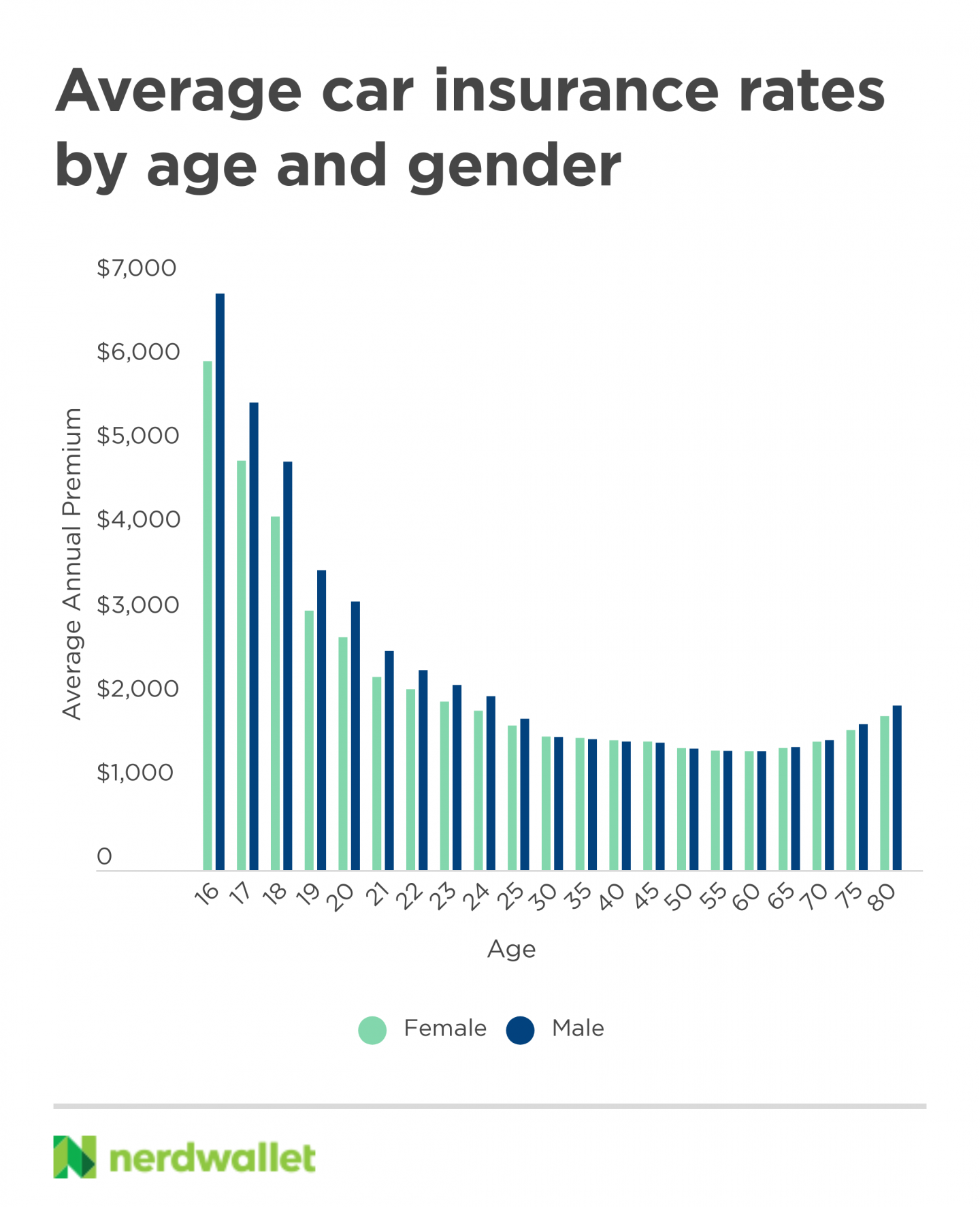

Age is one of the primary factors that influence car insurance rates. Drivers under the age of 25 are considered to be high-risk drivers, and will usually pay higher rates than more experienced drivers. Another factor that affects car insurance rates is the type of vehicle you drive. Cars with a higher value, such as luxury vehicles, often have higher car insurance rates. Additionally, the area in which you live can also affect your car insurance rates, as some states and cities have higher rates of theft and accidents.

Discounts That Lower Your Car Insurance Rates

There are several discounts that you may be eligible for that can help lower your car insurance rates. For instance, many insurance companies offer discounts for students who maintain good grades, as well as for drivers who take safety courses. Additionally, some insurance companies offer discounts for drivers who have not had any accidents or moving violations in the past three years. It is important to ask your insurance company about any discounts that may be available.

How to Get the Best Car Insurance Rates

If you are looking to get the best car insurance rates, it is important to shop around. It is a good idea to get quotes from several different insurance companies in order to compare rates. It is also important to consider factors such as the coverage limits, deductibles, and the cost of additional coverage such as roadside assistance or rental car coverage. Additionally, you may be able to save money by bundling your car insurance with other types of insurance, such as home or life insurance.

Conclusion

The average person pays about $1,500 per year for car insurance, though this number can vary depending on several factors such as age, driving record, type of vehicle, and area of residence. Additionally, there are a variety of discounts available that can help lower your car insurance rates. To get the best car insurance rates, it is important to shop around and compare rates from different companies. It is also important to consider factors such as coverage limits, deductibles, and the cost of additional coverage when choosing a car insurance policy.

Monthly Car Insurance Payment - Insurance Reference

Average Price Of Car Insurance Per Month - designby4d

Common Automobile Insurance coverage Charges by Age and Gender

How Much Is Car Insurance In California ~ news word

Car Insurance Rates Across Canada: Who's Paying the Most and Why