What Does Auto Collision Insurance Cover

What Does Auto Collision Insurance Cover?

An Overview of Collision Insurance

Auto collision insurance is one of the most important types of auto insurance coverage. It pays for the cost of repairing or replacing your vehicle if it is damaged or destroyed in a collision. Collision coverage is usually required by lenders if you have an auto loan, and it can be a wise investment even if you don’t. It will pay for repairs or replacement of your vehicle, no matter who is at fault, and can help you avoid financial hardship if you are involved in an accident.

What Does Collision Insurance Cover?

Collision insurance is designed to cover the cost of repairs or replacement of your vehicle if it is damaged or destroyed in an accident. This includes damage caused by collisions with other vehicles, objects, or animals, and is generally applicable regardless of who is at fault in the accident. Collision coverage will also pay for legal fees if you are sued as a result of an accident. The amount of coverage you have will depend on the specific policy you choose, but most policies cover damages up to the current value of your vehicle.

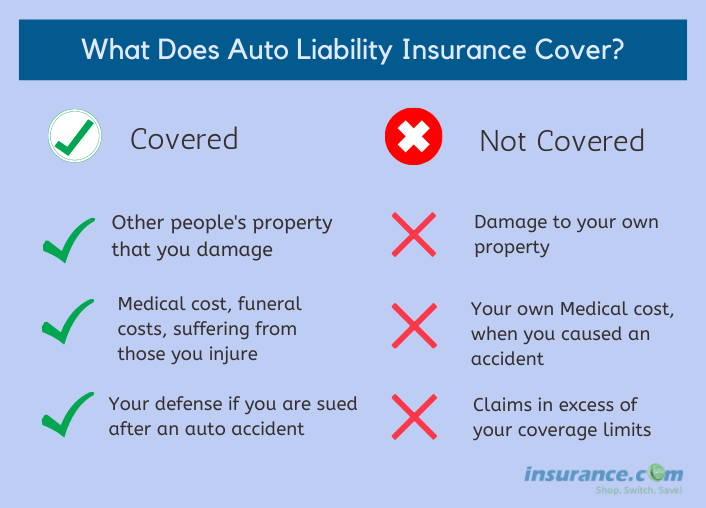

What is Not Covered by Collision Insurance?

Collision insurance does not generally cover damages caused by “acts of God,” such as floods, earthquakes, and other natural disasters. It also does not generally cover damages resulting from theft or vandalism. Comprehensive coverage is usually necessary to cover these types of damages. In addition, collision insurance will not pay for medical expenses, or for damage to any other vehicle or property. Those types of damages are usually covered by liability insurance.

How Much Does Collision Insurance Cost?

The cost of collision insurance can vary widely depending on factors such as the type and age of your vehicle, your driving history, and the amount of coverage you choose. In general, collision insurance premiums are higher for drivers that are deemed to be higher-risk, such as those with poor driving records. The cost of collision insurance is also typically higher for newer vehicles, as they are typically more expensive to repair.

Is Collision Insurance Required?

Collision insurance is usually required if you have an auto loan, as lenders typically require that their collateral is insured. Even if you don’t have a loan, collision insurance can be a wise investment. It can help protect you from financial hardship if you are involved in an accident, and can even help you avoid a potential lawsuit. While the cost of collision insurance can be high, it is usually worth the peace of mind it provides.

Conclusion

Auto collision insurance is an important type of auto insurance coverage. It pays for the cost of repairing or replacing your vehicle if it is damaged or destroyed in an accident. It is usually required if you have an auto loan, but can be a wise investment even if you don’t. The cost of collision insurance will depend on factors such as the type and age of your vehicle, your driving history, and the amount of coverage you choose. Ultimately, collision insurance can provide peace of mind and protect you from financial hardship if you are involved in an accident.

what-does-collision-cover-infographic-desktop.jpg (767×1646) | Car

Some Known Questions About Collision Coverage – What Is It And Do I

Collision Coverage Definition | Examples and Forms

Hippo Video - Collision Coverage - First Touch

Auto Liability Insurance - What It Is and How to Buy