Third Party Insurance Price In Ghana

Monday, March 11, 2024

Edit

Third Party Insurance Price In Ghana

The Benefits of Third-Party Insurance

Third-party insurance is a form of insurance that covers the insurance holder from the claims of other people. It is a form of risk management that is used to protect against the claims of third parties. This type of insurance is most commonly used in the motor vehicle industry, where it is required by law in many countries. It is also used in other areas, such as liability insurance for businesses and professional indemnity insurance for professionals.

The main benefit of third-party insurance is that it provides financial protection for the insured against the claims of another person. This means that if a person is injured or their property is damaged by the actions of the insured, they can make a claim against the insurance policy and receive compensation. This can be a great relief to those who have suffered an injury or had their property damaged, as they do not have to bear the financial burden of the costs associated with the claim.

Another benefit of third-party insurance is that it can help to reduce the costs associated with legal proceedings. If an individual has to go to court to fight a claim against them, they can be faced with expensive legal bills. However, if they have third-party insurance, they can be covered for the costs of the legal proceedings and can therefore avoid having to bear the financial burden of the claim.

Third-Party Insurance in Ghana

In Ghana, third-party insurance is a legal requirement for all motor vehicles. It is a form of liability insurance that covers the insured for any damages or injuries that they may cause to another person or property as a result of their actions. The insurance will cover the costs of legal proceedings and any compensation that is due to the other person or property.

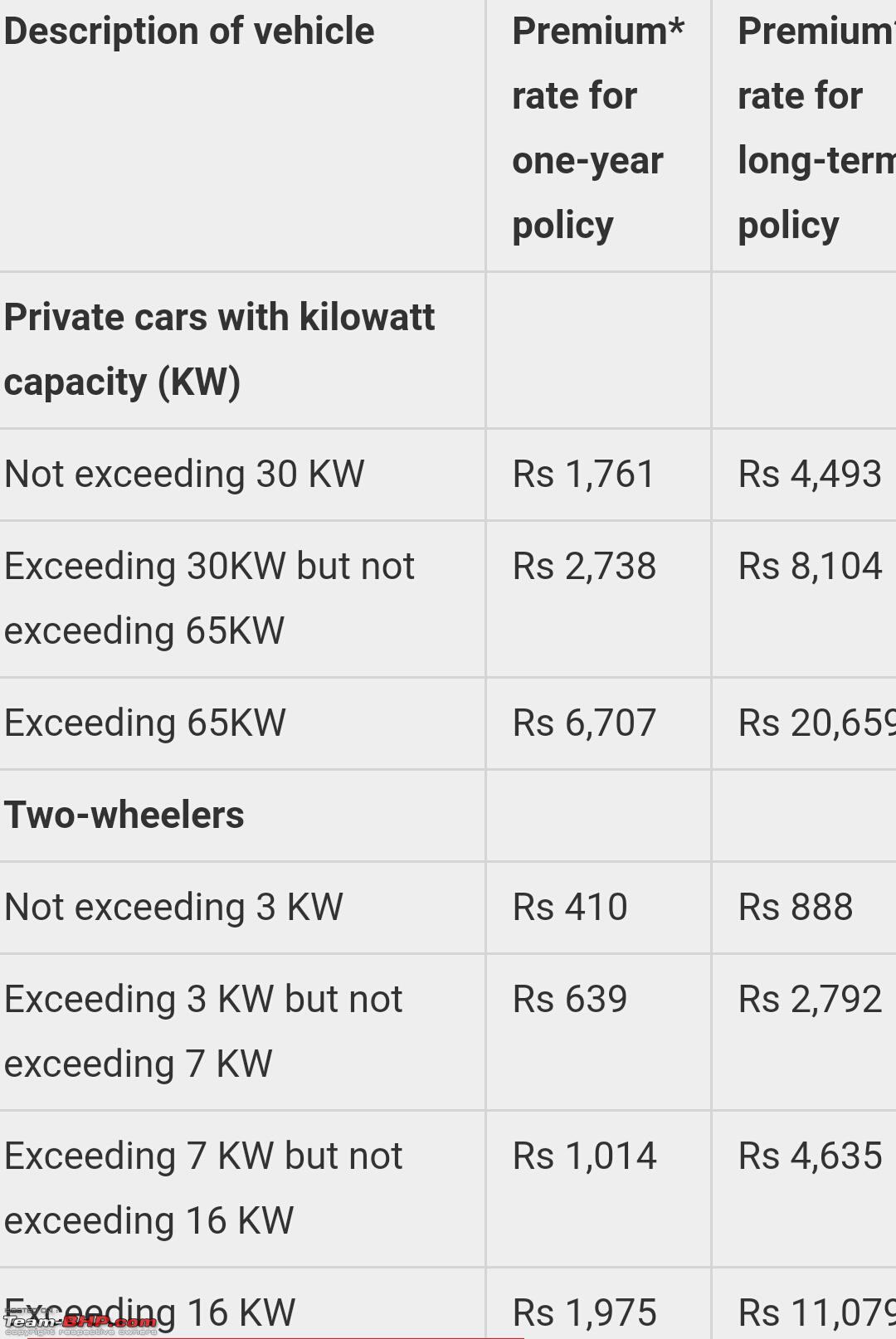

The cost of third-party insurance in Ghana varies depending on the type of vehicle that is being covered, as well as the age and value of the vehicle. Generally, the cost of third-party insurance is lower in Ghana than in other countries. This is because the risk of claims is lower in Ghana due to the lower levels of traffic and the fewer number of cars on the roads.

In Ghana, third-party insurance can be purchased from a variety of different providers. These include insurance companies, brokers, and online providers. In order to get the best deal on third-party insurance, it is important to compare the prices and coverage offered by different providers. It is also important to make sure that the policy covers the type of vehicle that is being insured, as well as any additional features that may be required.

The Cost of Third-Party Insurance

The cost of third-party insurance in Ghana can vary greatly depending on the type of vehicle that is being insured, as well as the age and value of the vehicle. Generally, the cost of third-party insurance is lower in Ghana than in other countries. This is because the risk of claims is lower in Ghana due to the lower levels of traffic and the fewer number of cars on the roads.

The cost of third-party insurance can also depend on the type of coverage that is being purchased. For example, some policies may only provide coverage for liability, while others may offer a more comprehensive coverage. It is important to read the policy carefully in order to understand what is covered.

In addition to the cost of the policy, there may also be additional costs associated with third-party insurance. These can include the cost of any legal fees or court costs that may be incurred if a claim is made against the policy. It is important to factor these costs into the overall cost of the policy when making a decision about which policy to purchase.

How To Save Money On Third-Party Insurance

There are a number of ways to save money on third-party insurance in Ghana. One of the best ways to save money is to shop around and compare the prices and coverage offered by different providers. By doing this, it is possible to get the best deal on third-party insurance.

It is also important to consider the type of coverage that is being purchased. Some policies may only provide coverage for liability, while others may offer a more comprehensive coverage. It is important to read the policy carefully in order to understand what is covered.

Finally, it is important to consider any additional costs that may be associated with the policy. These can include the cost of any legal fees or court costs that may be incurred if a claim is made against the policy. It is important to factor these costs into the overall cost of the policy when making a decision about which policy to purchase.

Conclusion

Third-party insurance is an important form of insurance that is required by law for motor vehicles in Ghana. It provides financial protection for the insured against the claims of another person. The cost of third-party insurance in Ghana can vary depending on the type of vehicle that is being covered, as well as the age and value of the vehicle. It is important to shop around and compare the prices and coverage offered by different providers in order to get the best deal on third-party insurance. In addition, it is important to consider any additional costs that may be associated with the policy. By doing this, it is possible to get the best deal on third-party insurance and save money.

Third Party Insurance | क्या है थर्ड पार्टी INSURANCE - YouTube

Third Party Property Car Insurance | iSelect

3rd-party insurance prices hiked for the nth time (June 2019) - Team-BHP

Third Party Insurance Premium to go up W.e.f 1st April 2013 - Team-BHP

4 Important Things to Know About Third-Party Insurance