Texas State Minimum Car Insurance

Thursday, March 14, 2024

Edit

Texas State Minimum Car Insurance Requirements

What is Texas State Minimum Car Insurance?

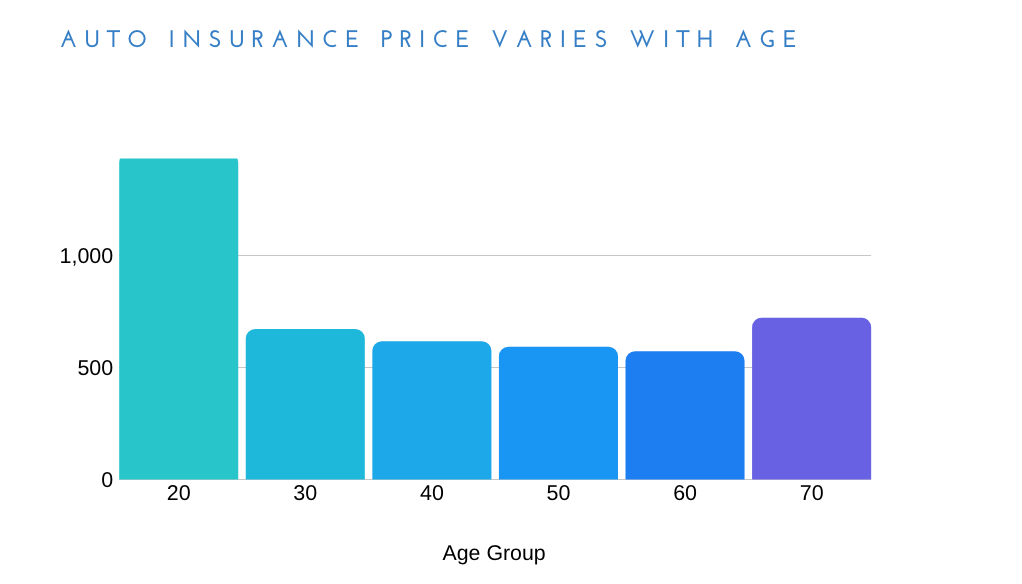

In Texas, you must have liability insurance to drive a car, truck, motorcycle, or other motor vehicle. Liability insurance pays for damage you may cause to others in an accident. It does not pay for damage to your own vehicle. The Texas Department of Insurance (TDI) regulates the minimum amount of liability insurance you must have. This is called the Texas State Minimum Insurance Requirement.

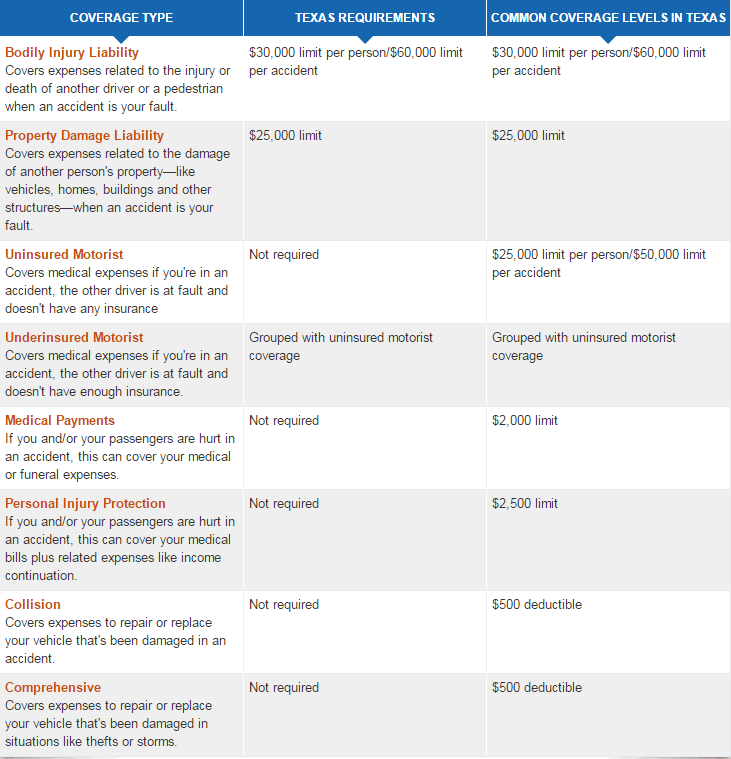

The Texas State Minimum Insurance Requirement includes two parts. The first part is Bodily Injury Liability (BIL). BIL pays for medical expenses, lost wages, pain and suffering, and other costs if you are legally responsible for an accident. The second part is Property Damage Liability (PDL). PDL pays for damage to another person's property if you are legally responsible for an accident.

What is the Texas State Minimum Insurance Requirement?

The Texas State Minimum Insurance Requirement is 30/60/25. This means you must have liability insurance with at least the following amounts: $30,000 for each injured person, up to a total of $60,000 per accident, and $25,000 for property damage.

In addition to the Texas State Minimum Insurance Requirement, you may also need to have Uninsured/Underinsured Motorist (UIM) coverage. UIM pays for medical expenses, lost wages, pain and suffering, and other costs if you are injured by an uninsured or underinsured driver.

Are There Other Types of Car Insurance?

Yes, there are other types of car insurance that you may want to consider. Collision coverage pays for damage to your own vehicle if you are in an accident. Comprehensive coverage pays for damage to your vehicle from fire, theft, vandalism, or other covered events. Personal Injury Protection (PIP) pays for medical expenses, lost wages, and other costs if you or your passengers are injured in an accident.

Do I Have to Carry the Texas State Minimum Insurance Requirement?

Yes, you must carry the Texas State Minimum Insurance Requirement to legally drive in Texas. If you are caught driving without the proper amount of insurance, you may be fined, your license may be suspended, and your vehicle may be impounded.

Where Can I Get Car Insurance?

You can get car insurance from a variety of sources. Most people get car insurance from an agent or a broker. You can also get car insurance directly from an insurance company. You can compare rates from different companies online to find the best deal.

Conclusion

If you are driving in Texas, you must have liability insurance with at least the Texas State Minimum Insurance Requirement. This includes Bodily Injury Liability and Property Damage Liability coverage. You may also want to consider Collision, Comprehensive, Uninsured/Underinsured Motorist, and Personal Injury Protection coverage. You can get car insurance from an agent, a broker, or directly from an insurance company. Be sure to compare rates to find the best deal.

Texas Minimum Car Insurance - Car Insurance For Texas Drivers : Minimum

Texas Auto Insurance Plan - Save Money On Your Auto Insurance Money

Texas Minimum Car Insurance Requirements 2019 : Cheapest Car Insurance

texas car insurance

Low Cost Liability Car Insurance Texas ~ npmdesigner