Cheap Full Coverage Car Insurance Ohio

Thursday, March 7, 2024

Edit

Cheap Full Coverage Car Insurance Ohio

Finding an Affordable Plan in Ohio

When it comes to finding affordable full-coverage car insurance in Ohio, it can be quite a challenge. With so many different providers offering different plans and prices, it can be difficult to compare and find the most cost-effective policy. Fortunately, there are a few tips and tricks that will help you find the right plan for your budget and needs.

First, it’s important to shop around and compare multiple car insurance policies. Different companies offer different coverage levels, deductibles, and rates, so it’s important to compare and find the plan that best suits your needs. Additionally, you should look for any discounts that you may qualify for, such as good driver discounts, multi-car discounts, and more.

Factors That Impact Your Premiums

There are several factors that can influence how much you pay for car insurance in Ohio. Your age, driving record, and location are all taken into consideration when calculating your premiums. Additionally, the type of car you drive can also affect your rates. Generally, more expensive cars are more costly to insure.

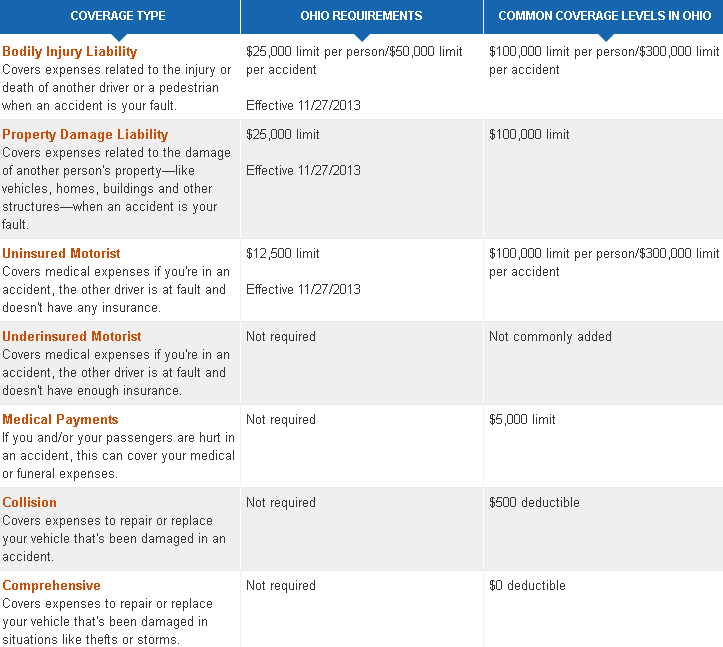

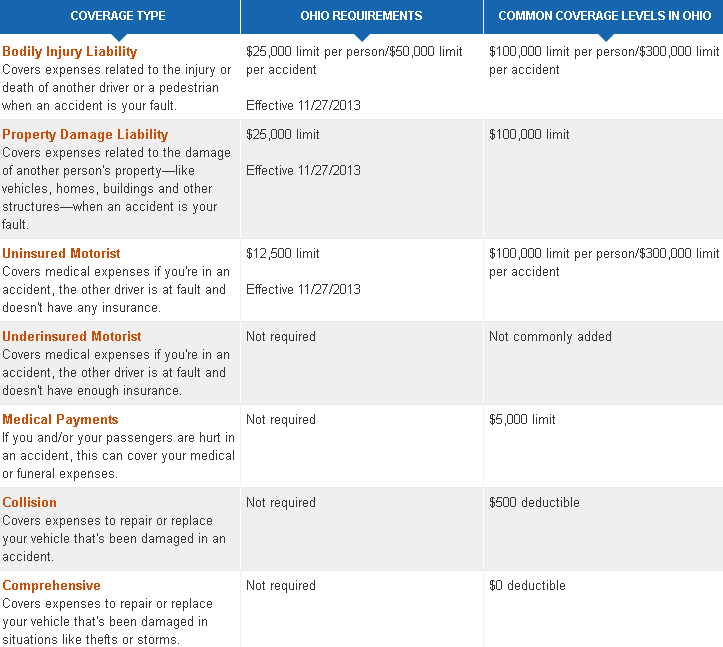

It’s also important to understand that higher coverage levels will generally result in higher premiums. In order to find the most cost-effective policy, you should look for the coverage levels that you need without overpaying.

The Benefits of Full Coverage Insurance

Having full coverage car insurance in Ohio offers a number of benefits. Not only does full coverage provide you with protection against collisions, but it also offers protection against theft, vandalism, and other damages. Additionally, full coverage can also provide you with legal protection in the event of an accident.

It’s important to note, however, that full coverage may not be the right choice for everyone. Depending on your budget and needs, you may be able to get away with only having the minimum required coverage.

Tips for Keeping Your Rates Low

There are a few ways that you can keep your full coverage car insurance rates low in Ohio. One way is to keep your driving record clean. Your driving record is a major factor in determining your rates, so it’s important to stay safe on the road and avoid moving violations. Additionally, you should consider enrolling in a defensive driving course, which can qualify you for discounts.

You should also consider raising your deductible. A higher deductible can significantly reduce your premiums, though it’s important to remember that you will be responsible for covering the cost of the deductible in the event of an accident.

Conclusion

Finding an affordable full coverage car insurance plan in Ohio can be a challenge. However, by following the tips and tricks outlined above, you should be able to find a policy that fits your budget and needs. It’s important to shop around, compare policies, and look for discounts in order to get the best deal. With a little bit of research, you should be able to find a great rate on your car insurance in Ohio.

car insurance - cheap car insurance in ohio - Top 10 best insurance

Ohio SR22 Insurance: Getting cheap coverage (Updated 2016) – Select

Factors Influencing the Cost of Car Insurance in Cleveland, OH

Cheap Full Coverage Auto Insurance With No Down Payment - YouTube

Cheapest Full Coverage Car Insurance (November 2022)