Add Second Driver To Car Insurance

Adding a Second Driver to Your Car Insurance Policy

Adding a second driver to your car insurance policy is a great way to save on premiums. Car insurance companies often offer discounts if you insure multiple cars and/or drivers, and having a second driver on your policy can also reduce the risk of an accident or damage. But before you add a second driver to your policy, there are a few things you should keep in mind.

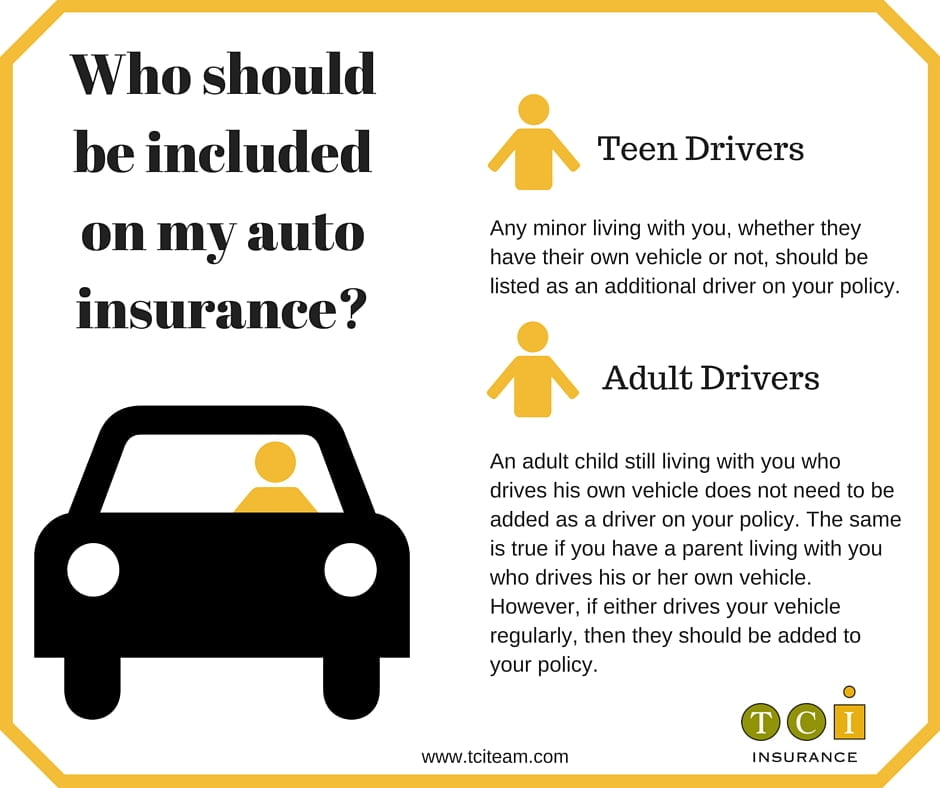

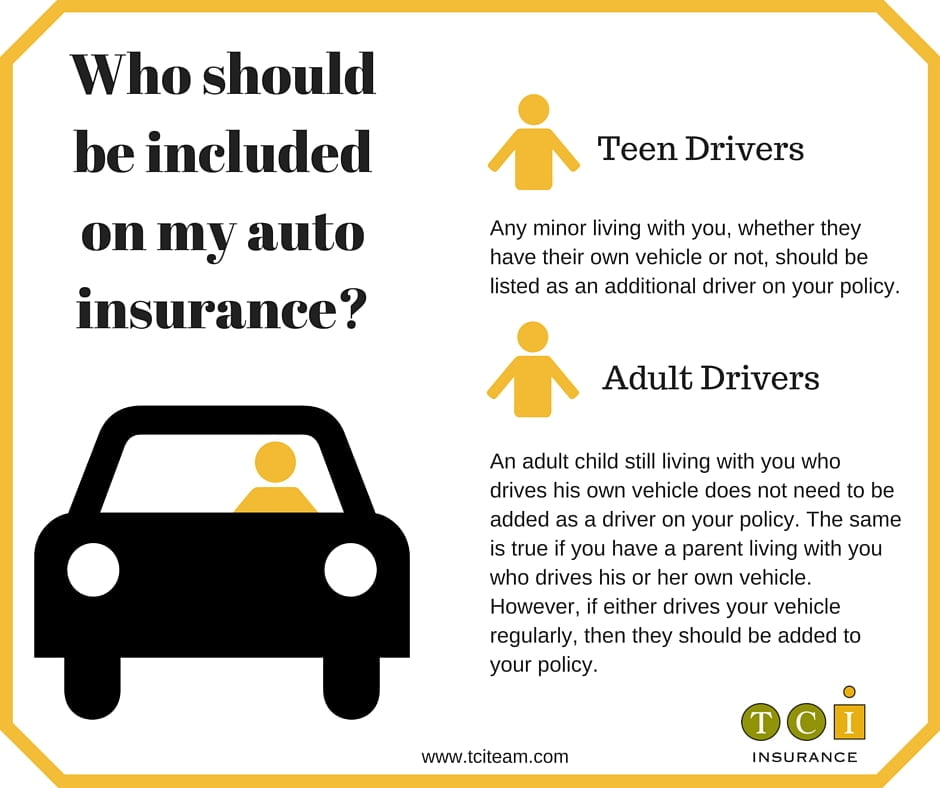

Who Can You Add?

The first thing you need to consider is who you can add to your policy. Generally, you can add any individual over the age of 18 who is a family member or a person who lives in your household. You may also be able to add a close friend or a business partner, but this varies from insurer to insurer. It’s important to remember that the driver you add must have a valid driver’s license and must be legally allowed to drive the car you are insuring.

What Factors Are Considered?

When you add a second driver to your policy, the insurance company will consider a variety of factors to determine your new premium. These factors include the age of the second driver, their driving history, the type of car you’re insuring, and where the car will be driven. Additionally, the insurance company will take into account the amount of time the second driver will be driving the car and the distance they will be driving it.

Will Adding a Second Driver Affect My Rate?

In most cases, adding a second driver to your policy will result in a lower premium. This is because having a second driver on your policy decreases the risk of an accident or damage, since the car isn’t being driven as often. However, it’s important to remember that the second driver’s age, driving history, and other factors can also affect your rate. So it’s a good idea to get a few quotes before you decide to add a second driver to your policy.

What Are the Benefits of Adding a Second Driver?

In addition to potentially saving on your premiums, adding a second driver to your policy can also provide other benefits. For example, in the event of an accident or a breakdown, the second driver can take over and drive the car. This can save you time and money, since you won’t have to wait for a tow truck or a rental car. Additionally, having two drivers on the same policy can make it easier to keep track of your coverage and any changes that may need to be made.

Conclusion

Adding a second driver to your car insurance policy can be a great way to save money and reduce the risk of an accident or damage. But before you add a second driver, it’s important to keep in mind who you can add, what factors will be considered, and what the benefits are. By understanding these things, you can make an informed decision and get the best deal on your car insurance.

Adding Drivers - TCI Insurance

Second and Occasional Driver Insurance Rules in Ontario

Be Covered Adequately with Car Insurance Add on Covers - InstaBima

Car Insurance Policy - All You Need to Know About It ~ General

60 Second Driver - Backing In - YouTube