What Is Liability Insurance Coverage

What Is Liability Insurance Coverage?

Liability insurance coverage is a type of policy that helps protect individuals, businesses, or organizations from the financial costs of being found legally responsible for causing injury or damage to another's property. It covers the insured party for any legal costs, court costs, and/or settlement costs that they may be liable for. Liability insurance can also provide coverage for medical expenses related to an injury caused by the insured party. Liability insurance can be purchased from an insurance company or through an independent agent. The cost of the coverage depends on the type of policy and the amount of coverage purchased.

Types of Liability Insurance Coverage

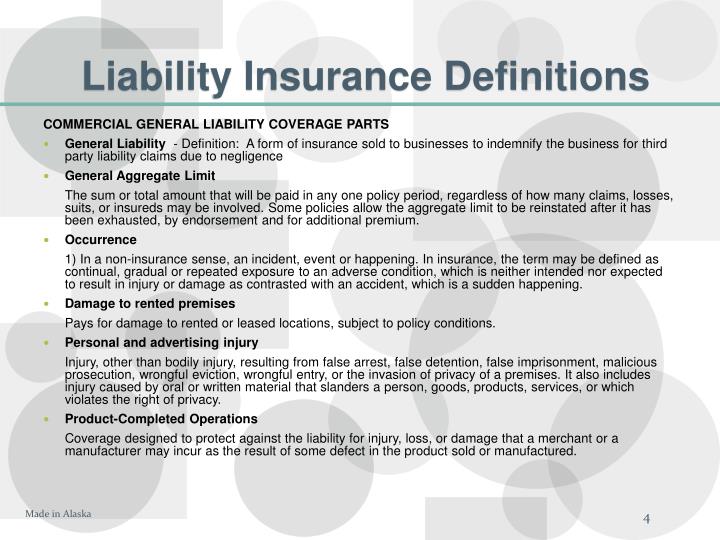

Liability insurance coverage can be divided into two main types: general liability and professional liability. General liability insurance covers the insured party for any damage or injury caused to another person or their property. Professional liability insurance provides coverage for claims of negligence or malpractice. This type of coverage is essential for professionals such as doctors, lawyers, and accountants. Additionally, there are specific types of liability insurance, such as product liability insurance, employer’s liability insurance, and premises liability insurance.

Benefits of Liability Insurance Coverage

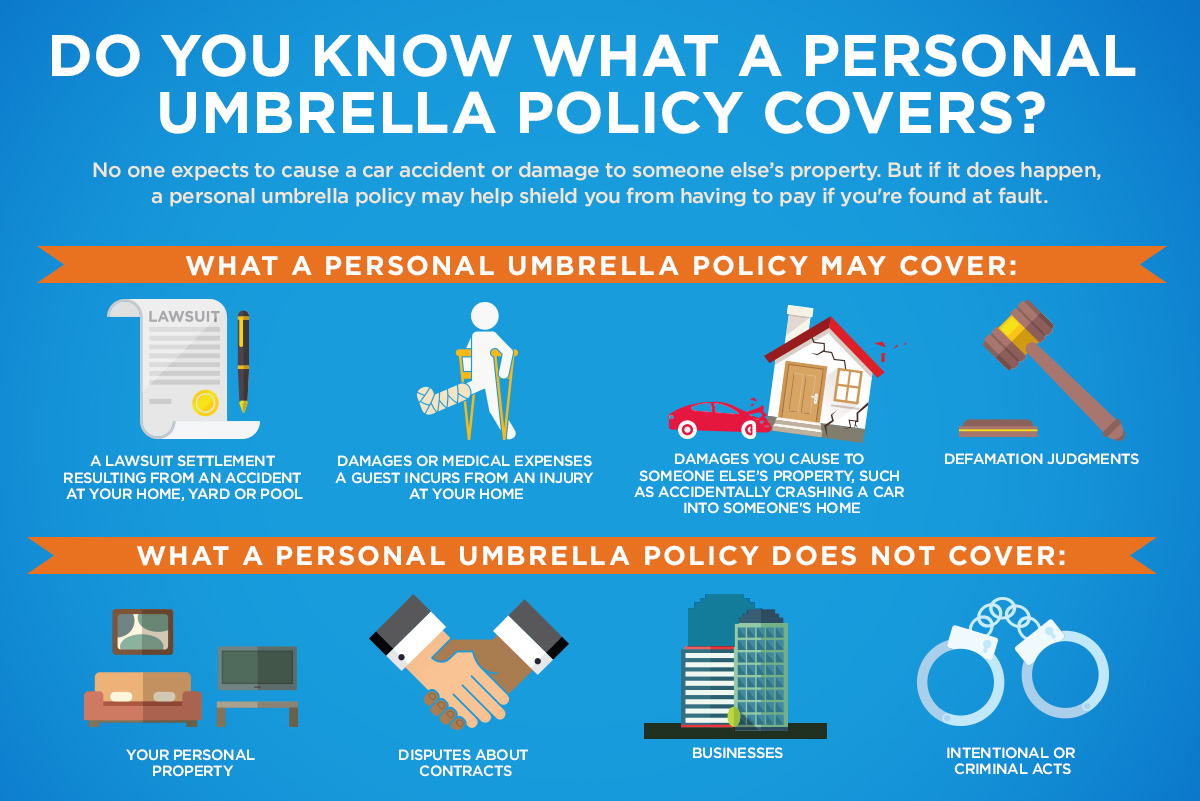

Liability insurance coverage provides the insured party with peace of mind and financial protection in the event of a legal claim. It can help protect an individual, business, or organization from the costs associated with a legal claim, including court costs and settlements. Liability insurance can also provide coverage for medical expenses related to an injury caused by the insured party. Additionally, liability insurance can provide coverage for damages to third-party property.

Cost of Liability Insurance Coverage

The cost of liability insurance coverage varies depending on the type of policy and the amount of coverage purchased. Generally, the higher the limit of coverage, the more expensive the policy will be. The cost of the policy will also depend on the type of business, the number of employees, and the amount of risk associated with the business. Additionally, factors such as the claims history of the business and the financial stability of the insurer can also affect the cost of the policy.

How to Choose the Right Liability Insurance Coverage

When choosing liability insurance coverage, it is important to consider the type of business, the amount of risk associated with the business, and the size of the business. Additionally, it is important to consider the financial stability of the insurer and the claims history of the business. It is important to compare different policies and compare quotes from different insurers to ensure that the best coverage is obtained at the best price.

Conclusion

Liability insurance coverage is a type of policy that helps protect individuals, businesses, or organizations from the financial costs of being found legally responsible for causing injury or damage to another's property. It covers the insured party for any legal costs, court costs, and/or settlement costs that they may be liable for. Liability insurance can be purchased from an insurance company or through an independent agent. The cost of the coverage depends on the type of policy and the amount of coverage purchased. When choosing liability insurance coverage, it is important to consider the type of business, the amount of risk associated with the business, and the size of the business. Additionally, it is important to consider the financial stability of the insurer and the claims history of the business.

Learn the Different Types of Car Insurance Policies

What Is Liability Insurance? | Allstate

How Much Does Professional Liability Insurance Cost?

PPT - Insurance For Small Business PowerPoint Presentation - ID:6555847

Understanding Umbrella Liability Insurance | Absolute Insurance Brokers