Usaa Auto Insurance Vs Met Life

Comparing USAA Auto Insurance and MetLife Insurance

Introduction

When it comes to choosing auto insurance, there are a lot of options out there. One of the most popular choices is USAA auto insurance, which is known for its great customer service, competitive rates, and wide range of coverage options. On the other hand, MetLife auto insurance is also a well-known and reliable company. This article will compare USAA and MetLife auto insurance, looking at their coverages, discounts, and customer service. Hopefully, at the end of this article, you will have a better idea of which of these two companies is the best choice for you.

Coverage Options

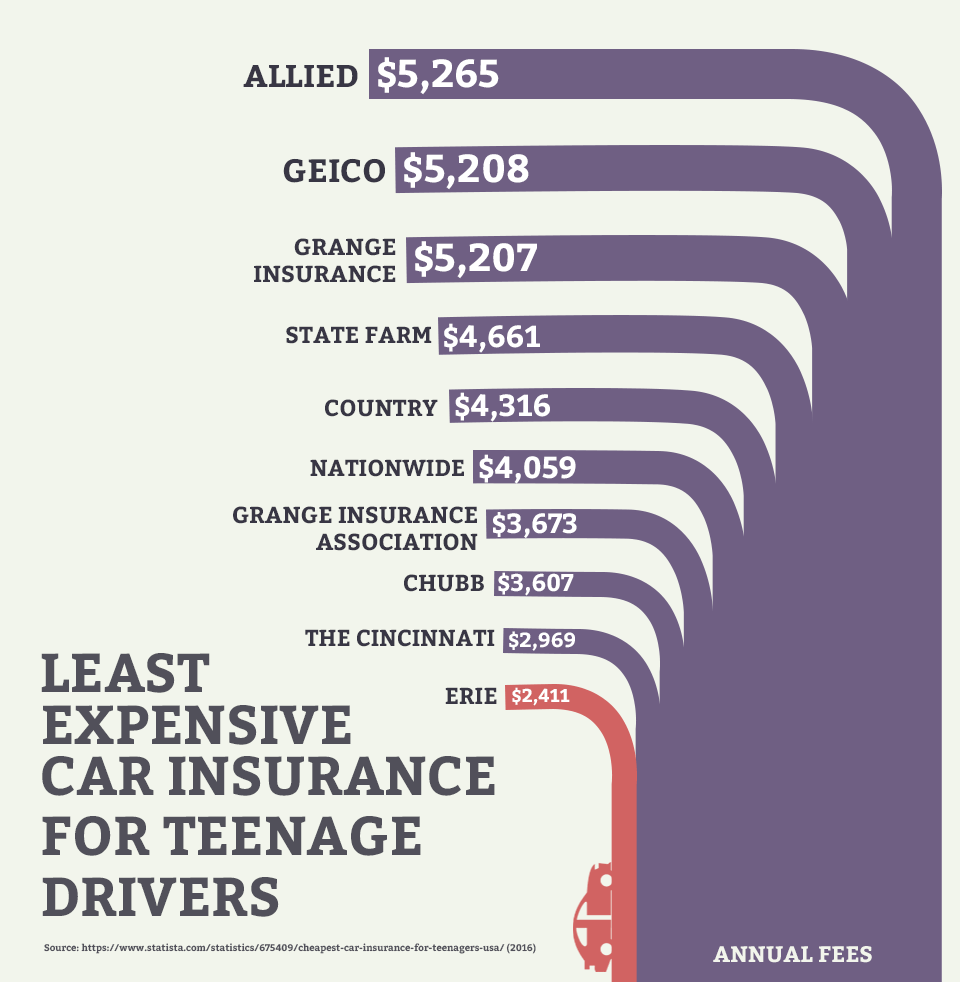

USAA auto insurance offers a wide range of coverage options, including liability coverage, collision coverage, comprehensive coverage, uninsured motorist coverage, and more. USAA also offers a variety of discounts, such as multi-car discounts, good student discounts, and military discounts. MetLife offers a similar range of coverage options, including liability coverage, collision coverage, comprehensive coverage, and uninsured motorist coverage. MetLife also offers discounts, such as multi-car discounts, good driver discounts, and military discounts. However, the discounts offered by MetLife are not as generous as those offered by USAA.

Customer Service

USAA is known for its excellent customer service, which is available 24/7. USAA's customer service reps are friendly and helpful, and they are always willing to answer any questions you may have. MetLife also has a good customer service record, and its reps are knowledgeable and helpful. However, MetLife does not offer 24/7 customer service, so if you have an emergency, you may not be able to get help right away.

Price

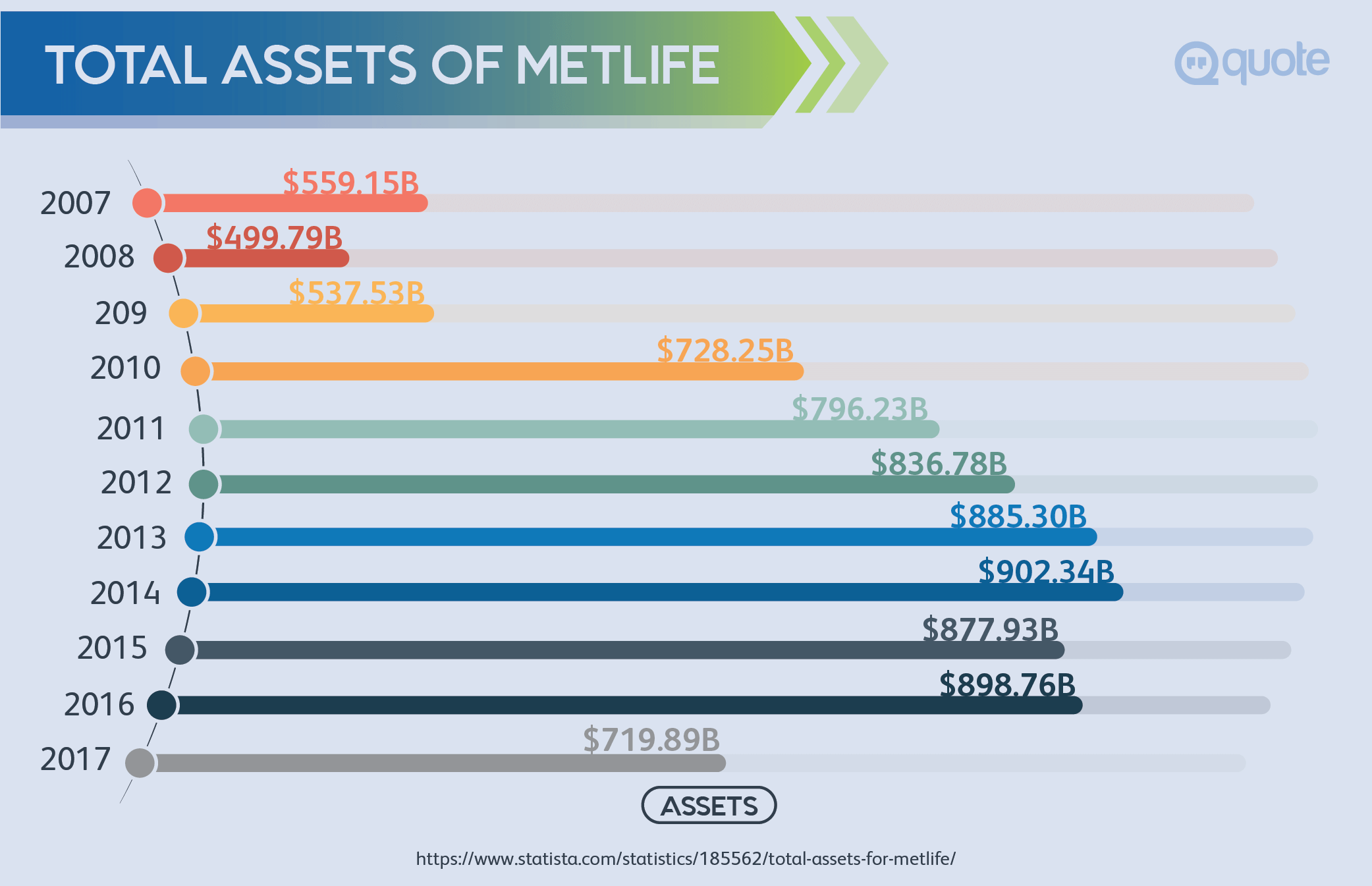

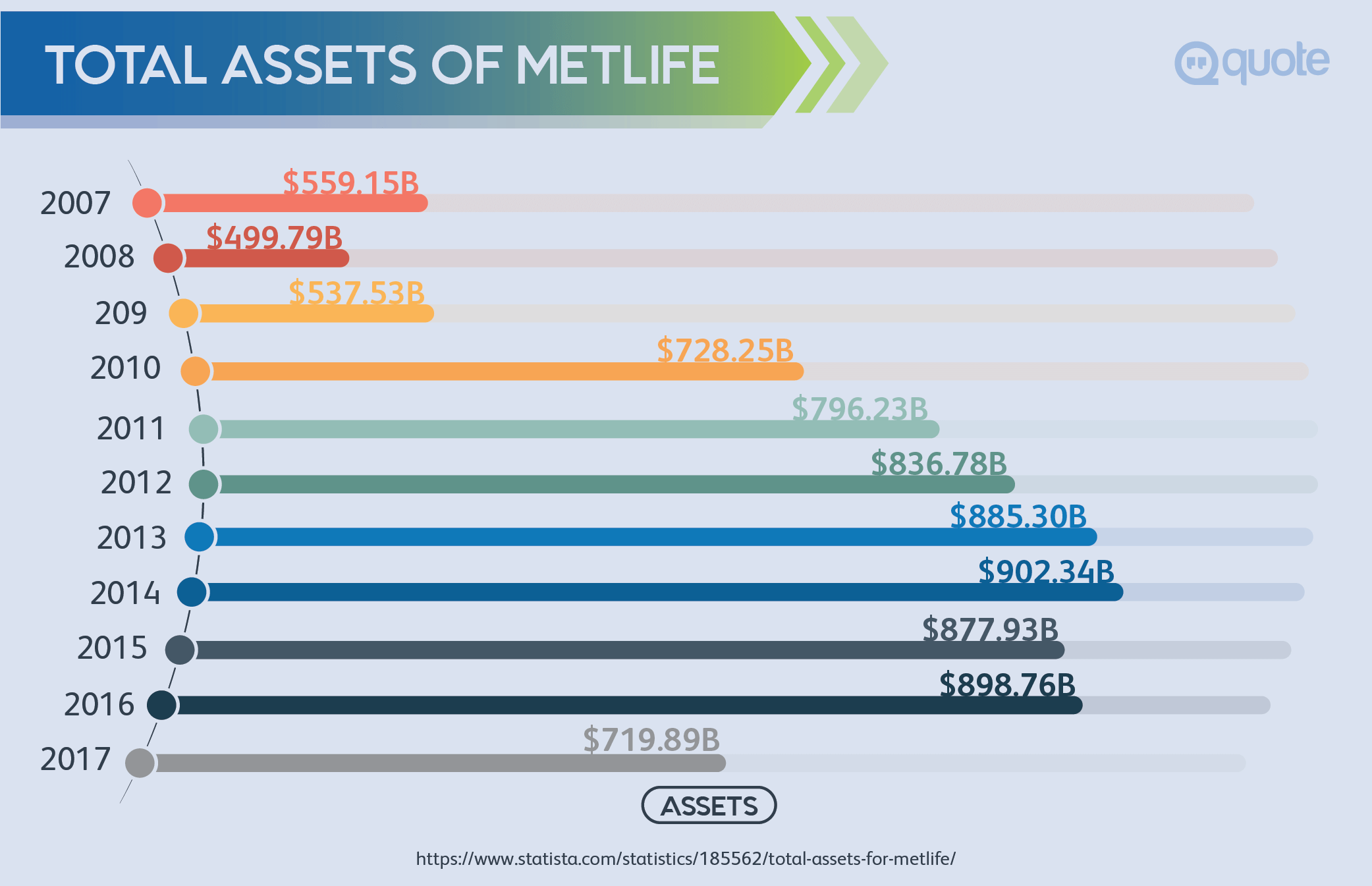

USAA auto insurance is generally more expensive than MetLife auto insurance. USAA's rates are competitive, but they may not be the cheapest option available. MetLife, on the other hand, is known for its competitive rates, and it may be the more affordable option for some customers. It is important to compare the rates of both companies before making a decision.

Discounts

USAA offers a variety of discounts, including multi-car discounts, good student discounts, and military discounts. MetLife also offers discounts, such as multi-car discounts, good driver discounts, and military discounts. However, the discounts offered by MetLife are not as generous as those offered by USAA.

Conclusion

Both USAA auto insurance and MetLife auto insurance are reliable companies that offer great coverage options and discounts. USAA is known for its excellent customer service and competitive rates, while MetLife is known for its competitive rates and discounts. Ultimately, it is up to you to decide which company is the best choice for you, based on your budget and coverage needs.

Metlife Auto Insurance Quote / Learn more about metlife, one of america

Metlife Auto Insurance Quote / Learn more about metlife, one of america

MetLife Auto Insurance Review: Features, Pros & Cons, and Costs

USAA Auto Insurance Login and Make a Payment Information - DP Tech Group

Metlife Auto Insurance Quote / How important is a Florida auto