Provisional Driver Insurance Uk Application

Provisional Driver Insurance UK Application: What You Need to Know

What is Provisional Driver Insurance?

Provisional driver insurance is the insurance coverage that you must have if you are a learner driver in the UK and you are learning to drive on a public road. It is a type of short-term insurance which covers the new driver from any risks that may occur while they are practicing driving and gaining the necessary experience and knowledge to become a safe and responsible driver. This type of insurance is often referred to as learner driver insurance.

How Does Provisional Driver Insurance Work?

The way provisional driver insurance works is that you need to apply for it before you can begin to practice and drive on the roads. The insurance covers you for the duration of your learning period and it gives you the freedom to practice driving on the roads. The insurance covers you for any accidents or incidents that may occur while you are learning to drive, so that you are not left with any financial burden.

How Much Does Provisional Driver Insurance Cost?

The cost of provisional driver insurance will vary depending on your circumstances and the type of coverage you are looking for. Generally, a basic level of coverage will start at around £30 per month, however, you may need to pay more depending on the level of coverage you require. It is important to shop around and compare different levels of coverage to make sure you get the best deal.

How Can I Apply for Provisional Driver Insurance?

Applying for provisional driver insurance is a straightforward process. You will need to provide some basic information when applying, such as your name, address, date of birth, and any driving history you may have. You will also need to provide details of the car you will be driving, such as the make, model, and registration number. Once you have provided this information, you can submit your application and the insurer will assess your application and provide a quote.

What are the Benefits of Provisional Driver Insurance?

One of the main benefits of provisional driver insurance is that it gives new drivers the freedom to practice driving on the roads without having to worry about the financial repercussions of any accidents or incidents. It also provides peace of mind to parents and guardians of learners, as they can rest assured that their learner driver is covered while they are on the roads. Finally, provisional driver insurance can help to reduce the cost of car insurance for young drivers once they have passed their driving test, as they will have a better understanding of the roads and driving in general.

Where Can I Find More Information on Provisional Driver Insurance?

If you are looking for more information on provisional driver insurance, then the best place to start is with your insurance provider. Your insurance provider will be able to provide you with more detailed information on the cover they provide, as well as any discounts or special offers they have available. You can also find further information online, including on comparison websites which allow you to compare different levels of cover from different insurers.

Insurance Companies That Insure Provisional Drivers - noclutter.cloud

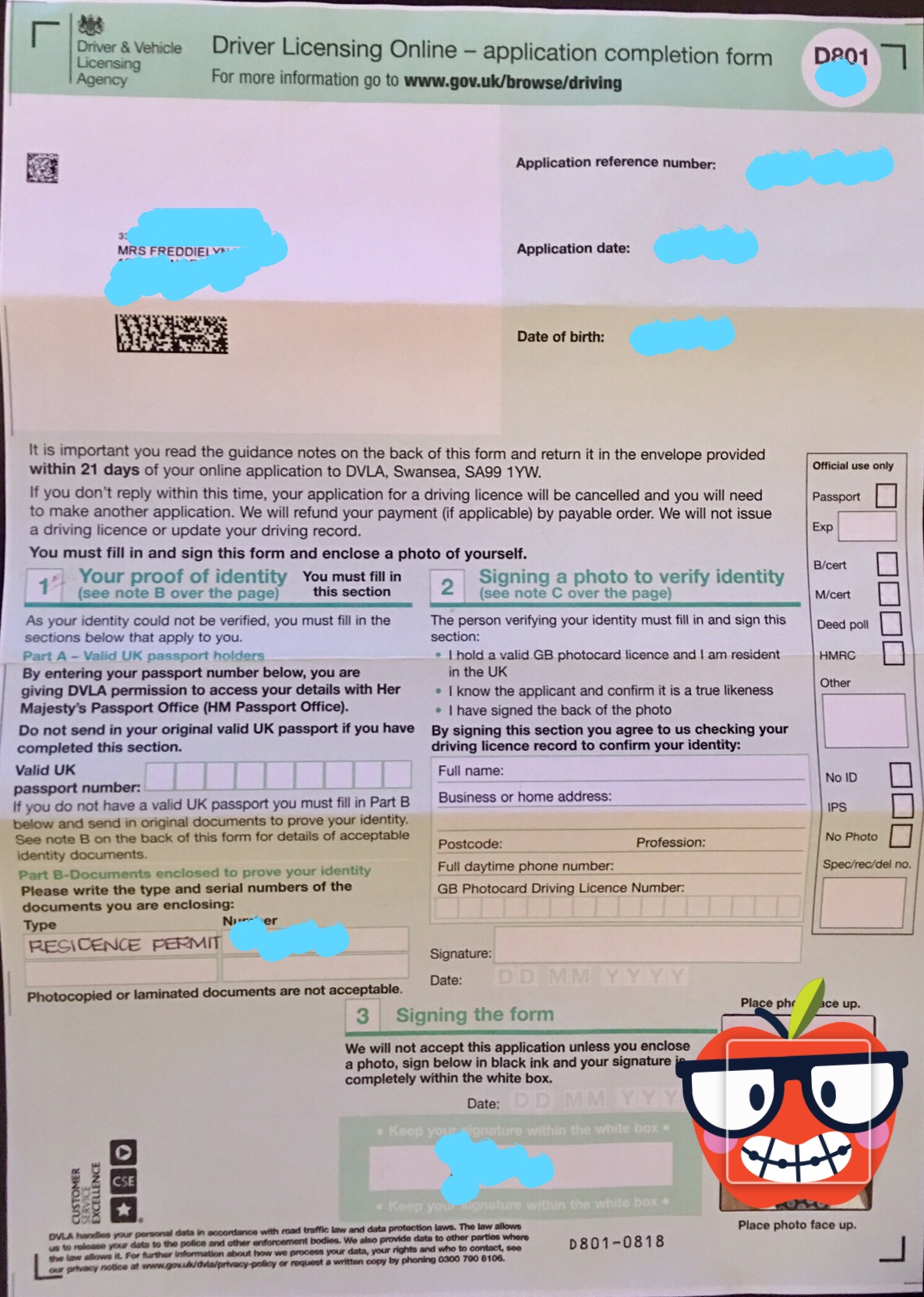

Provisional Driving Licence Application – Freddy's Musings

Dvla D1 Application Form Download - goodsitezero

visas | ¿Puedo utilizar mi permiso de conducir provisional

Provisional Driving Licence - What It Is For - Cuisine Europe