Is Louisiana A No Fault State For Auto Insurance

Saturday, February 24, 2024

Edit

Is Louisiana a No Fault State for Auto Insurance?

What Is No Fault Car Insurance?

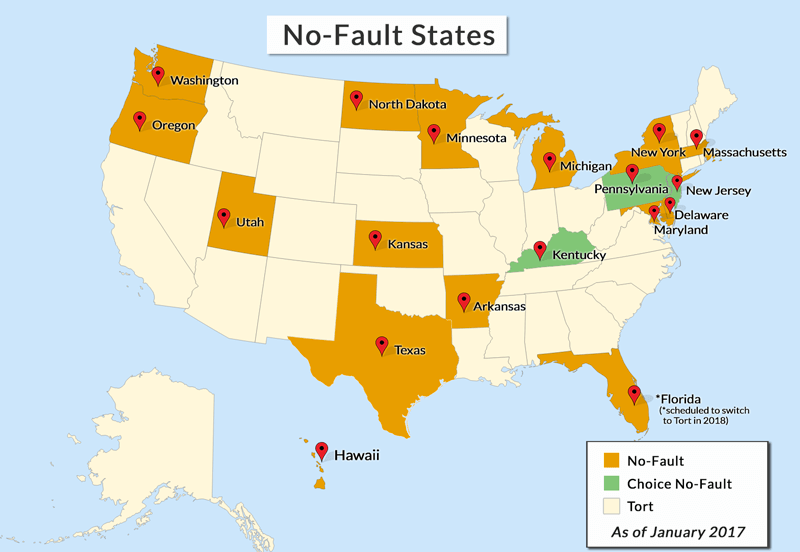

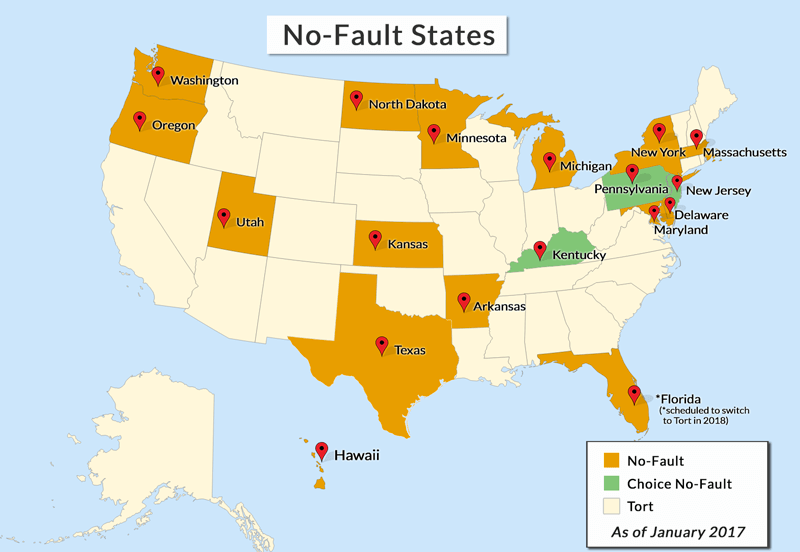

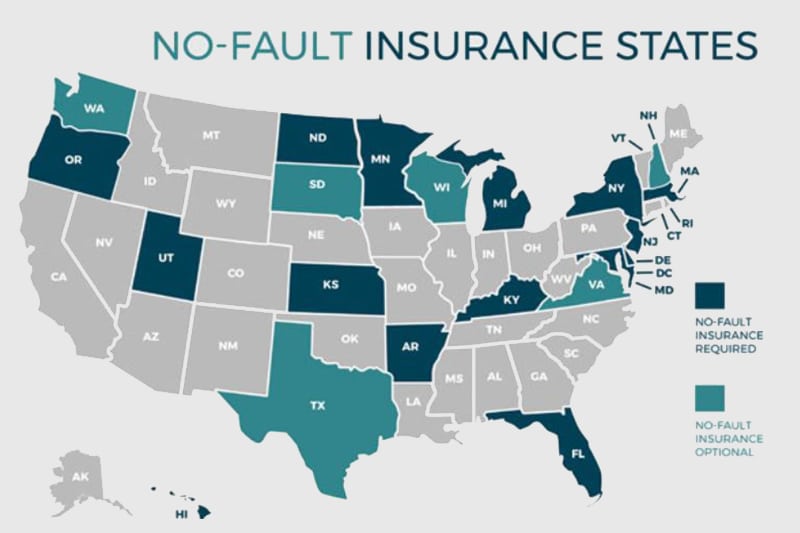

No fault car insurance is a type of insurance that covers your medical expenses after an accident, regardless of who caused the accident. This type of insurance is most common in states that have no fault insurance laws. It is important to understand the difference between no fault insurance and liability insurance. Liability insurance covers the costs of injuries and damage to other people that you cause in an accident. No fault insurance only covers your own medical expenses.

No Fault Insurance in Louisiana

Louisiana is not a no fault state for auto insurance. In this state, drivers must carry liability insurance in order to legally drive. Liability insurance covers the costs of injuries and damage to other people that you cause in an accident. This means that if you are at fault for an accident, your insurance will cover the costs of the other person’s medical bills and car repairs. Louisiana also requires drivers to carry uninsured motorist coverage, which covers you if you are in an accident with an uninsured driver.

Benefits of No Fault Insurance

No fault insurance is beneficial for drivers in no fault states because it helps to reduce the amount of time and money spent on litigation. When two drivers are injured in an accident, they can both file a claim with their own insurance companies instead of having to go to court to determine who was at fault. This helps to reduce the time and money spent on litigation and keeps premiums low.

Drawbacks of No Fault Insurance

No fault insurance can also have drawbacks. Since no fault insurance only covers your own medical expenses, you may not be able to get compensation for lost wages, pain and suffering, or other expenses related to the accident. Additionally, no fault insurance does not protect you from being sued by the other driver in an accident. This means that if you are at fault for an accident, you may be held liable for the other person’s medical bills and car repairs.

Conclusion

Louisiana is not a no fault state for auto insurance. In this state, drivers must carry liability insurance in order to legally drive. Liability insurance covers the costs of injuries and damage to other people that you cause in an accident. No fault insurance is beneficial for drivers in no fault states because it helps to reduce the amount of time and money spent on litigation. However, no fault insurance does not protect you from being sued by the other driver in an accident and may not cover all of your expenses related to the accident.

Ultimate Guide to No-Fault Auto Insurance

Did Your Car Accident Happen in a No-Fault State? - Dailey Law Firm

No Fault Insurance | Best rates in Your State | Ogletree Financial

No-Fault vs. Fault-Based Insurance States - Heninger Garrison Davis

Michigan No-Fault Insurance Law Overview | Michigan Auto Law