Importance Of Long Term Care Insurance

The Benefits of Long-Term Care Insurance

Long-term care insurance is a type of insurance policy that helps cover the costs of long-term care services such as home health care, adult daycare, and nursing home care. It can help protect your savings and provide you with peace of mind when it comes to your long-term care needs. Here are some of the benefits of having a long-term care insurance policy.

Financial Security

Long-term care insurance can help protect your financial security. It can help cover the costs of long-term care services that would otherwise be out of pocket. This can help ensure that you have enough money to pay for the care that you need without having to dip into your savings or retirement funds. This can help you maintain your financial independence and ensure that you have enough money to live comfortably in your later years.

Peace of Mind

Having a long-term care insurance policy can also provide you with peace of mind. Knowing that you have a policy in place that can help cover the costs of long-term care services can give you the confidence to enjoy your golden years without worrying about how you’re going to pay for care. This peace of mind can help you relax and enjoy life knowing that your future is taken care of.

Estate Planning

Long-term care insurance can also be beneficial when it comes to estate planning. Having a policy in place can help ensure that your assets are protected if you need long-term care services. This can help ensure that your estate is distributed according to your wishes and that your loved ones are taken care of financially if you need long-term care.

Tax Benefits

Long-term care insurance policies may also be eligible for tax benefits. Some policies may be eligible for a tax deduction, which can help reduce your taxable income. Additionally, some policies may be eligible for a tax credit, which can help reduce your overall tax bill. Be sure to consult with a financial advisor or tax professional to find out what tax benefits may be available to you.

Flexibility

Long-term care insurance policies can also offer you flexibility. Many policies allow you to customize your coverage to meet your individual needs and budget. You can choose the type of care you need, the amount of coverage you want, and the length of time you need the coverage. This allows you to tailor your policy to fit your individual needs and budget.

Long-term care insurance can be a valuable tool to help you protect your financial security, provide peace of mind, and help with estate planning. If you’re looking for a way to ensure that you have the coverage you need for your long-term care needs, then a long-term care insurance policy can be a great option. Be sure to consult with an insurance professional to find out what coverage is best for you.

Pin on Infographics

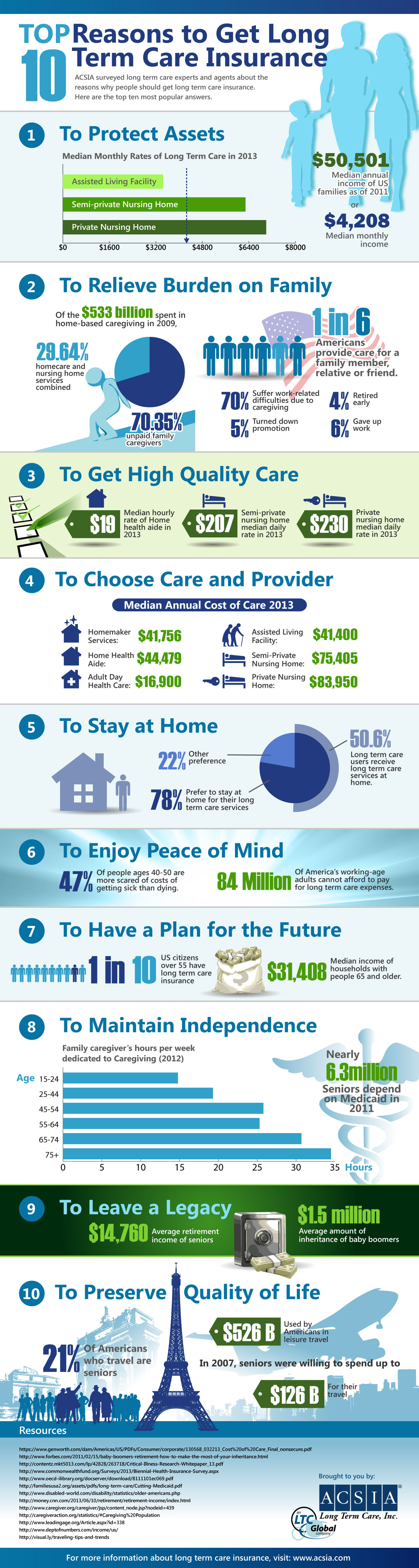

Infographic: Top 10 Reasons to Get Long Term Care Insurance | ACSIA

With Higher Rates, Is Long-Term Care Insurance Still a Viable Option?

It’s Long-Term Care Insurance Awareness Month. We know that Life

Top 10 Reasons To Get Long Term Care Insurance | Infographic Post