Icici Lombard Motor Insurance Claim Process

A Comprehensive Guide to Icici Lombard Motor Insurance Claim Process

What Is Motor Insurance?

Motor insurance, also known as vehicle insurance or auto insurance, is a type of insurance that provides financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could arise from incidents in a vehicle. It covers the cost of all reasonable medical treatment for injured people and damage to the vehicle in an accident. It is mandatory in India to have motor insurance before you can legally drive a vehicle.

How Does Icici Lombard Motor Insurance Work?

Icici Lombard motor insurance offers comprehensive coverage for all types of vehicles, including cars, motorcycles, scooters, and commercial vehicles. Depending on the type of policy you choose, it will provide coverage for loss or damage to your vehicle, third-party liability, personal accident cover, and more. The policies also cover various add-on benefits like engine protection cover, zero depreciation cover, and roadside assistance. The premium for your motor insurance policy will depend on factors like the type of vehicle, the age of the vehicle, the IDV or Insured Declared Value, and the place of registration.

Steps To Follow When Making a Motor Insurance Claim with Icici Lombard

When you need to make a claim on your motor insurance policy with Icici Lombard, the steps to follow are quite straightforward. Here is a quick guide to help you with the process:

Step 1: Intimate Your Insurer

The first thing you need to do is to contact your insurer and inform them about the incident. You can do this by calling their customer care number or by sending them an email. Make sure you provide as much information as possible about the incident, including the date, time, and place of the accident.

Step 2: File a First Information Report (FIR)

If the incident was a theft or a third-party liability claim, then you will need to file an FIR with the police. Make sure you get a copy of the FIR as it will be needed when filing the insurance claim.

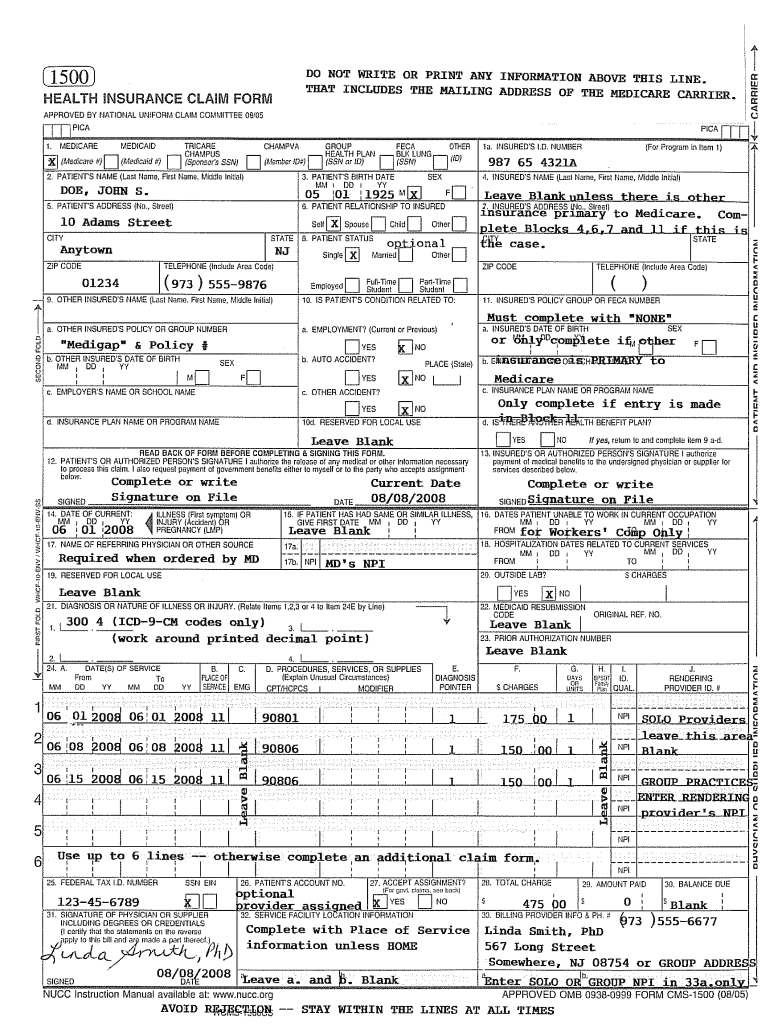

Step 3: Submit the Claim Form

Once you have intimated your insurer, they will send you a claim form. Fill out the form with all the relevant details and submit it to the insurer along with the required documents. These documents usually include the registration certificate, policy documents, FIR, repair estimate, and other relevant documents.

Step 4: Survey and Settlement

After the insurer receives the claim form, they will appoint an authorized surveyor to assess the damages and prepare a report. The insurer will then use this report to decide whether to settle or reject the claim. If the claim is settled, then the insurer will pay the amount to the repair shop or to you, depending on the policy terms.

Conclusion

Making an insurance claim with Icici Lombard is a simple process. All you need to do is intimate your insurer, file an FIR if necessary, submit the claim form along with the required documents, and wait for the surveyor’s report. Once the claim is settled, you will receive the amount to cover your losses.

ICICI Lombard Claim Status- How to check your claim status

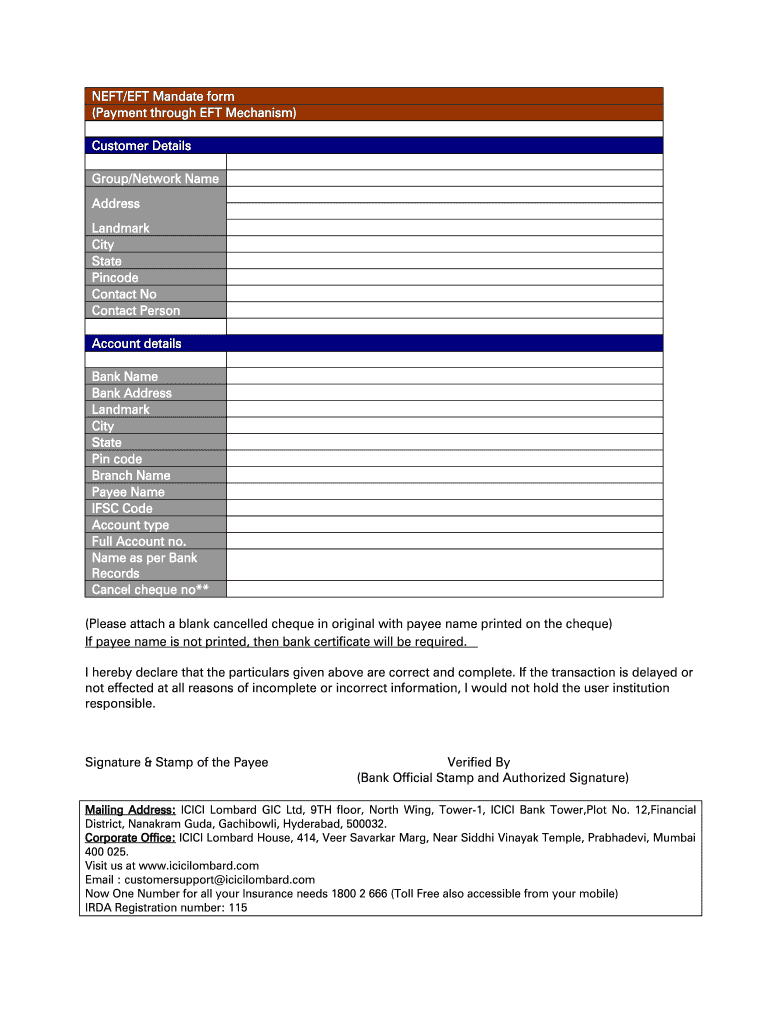

Icici Lombard Claim Form - Fill Online, Printable, Fillable, Blank

Icici Lombard Claim Form - Fill Out and Sign Printable PDF Template

[PDF] ICICI Lombard : Hospitalization Health Care Claim Form – Govtempdiary

![Icici Lombard Motor Insurance Claim Process [PDF] ICICI Lombard : Hospitalization Health Care Claim Form – Govtempdiary](https://govtempdiary.com/wp-content/uploads/2021/05/ICICI-Lombard-Hospitalization-Health-Care-Claim-Form.jpg)

Vehicle Insurance for 3 years in 15 minutes - ICICI LOMBARD AUTO